From David Ruccio The total income reported on the top 400 individual tax returns rose 20 percent in 2014, according to Internal Revenue Service (pdf) data released last Thursday. The figures reveal the concentration of earnings at the summit of the income distribution, in a club that required 6.8 million of adjusted gross income to enter. That tiny group, out of nearly 150 million tax returns in 2014, took home 5.5 million on average (that’s in 1990 dollars) and 1.3 percent of total U.S. adjusted gross income. President-elect Donald Trump and the Republicans who control Congress have promised to lower the taxes on this group. First, they plan to repeal Obamacare and its taxes, which would bring the long-term capital gains rate down to 20 percent. A potentially even bigger benefit for the top 400 will come from Trump’s proposal to slash the tax on corporate income from 35 percent to 15 percent. That rate would also apply to at least some of the “passthrough” income from S Corporations and partnerships that is reported directly on individual income tax returns and is now taxed at a top rate of 39.6 percent. A lower rate for passthrough income would disproportionately benefit the über rich, just as the lower rate on capital gains does. In 2014, the top 400 earners reported 1.3 percent of all adjusted gross income in the U.S., but 2.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

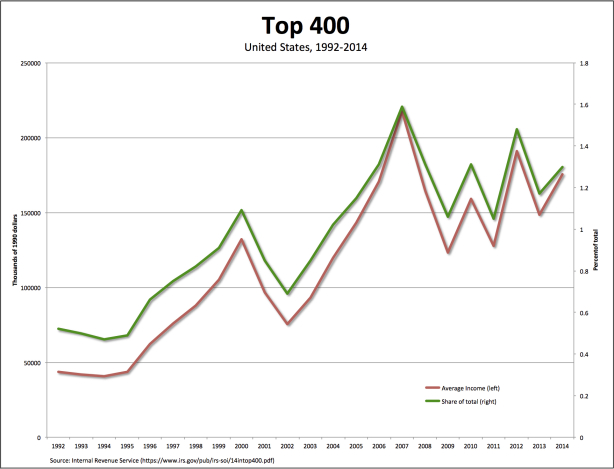

The total income reported on the top 400 individual tax returns rose 20 percent in 2014, according to Internal Revenue Service (pdf) data released last Thursday.

The figures reveal the concentration of earnings at the summit of the income distribution, in a club that required $126.8 million of adjusted gross income to enter. That tiny group, out of nearly 150 million tax returns in 2014, took home $175.5 million on average (that’s in 1990 dollars) and 1.3 percent of total U.S. adjusted gross income.

President-elect Donald Trump and the Republicans who control Congress have promised to lower the taxes on this group. First, they plan to repeal Obamacare and its taxes, which would bring the long-term capital gains rate down to 20 percent. A potentially even bigger benefit for the top 400 will come from Trump’s proposal to slash the tax on corporate income from 35 percent to 15 percent. That rate would also apply to at least some of the “passthrough” income from S Corporations and partnerships that is reported directly on individual income tax returns and is now taxed at a top rate of 39.6 percent.

A lower rate for passthrough income would disproportionately benefit the über rich, just as the lower rate on capital gains does. In 2014, the top 400 earners reported 1.3 percent of all adjusted gross income in the U.S., but 2.94 percent of all partnership and S corp net income, and 10 percent of capital gains taxed at a lower rate.

We know the top 400 will benefit enormously from those tax changes. But we won’t be able to measure it, since the IRS also announced it would no longer release data on the top 400, which it has compiled going back to 1992. Instead, future reports will focus on the top 0.001 percent, which included 1,396 households for 2014.