From David Ruccio On Tuesday, I began a series on the unhealthy state of the U.S. healthcare system—starting with the fact that the United States spends far more on health than any other country, yet the life expectancy of the American population is actually shorter than in other countries that spend far less. Today, I want to look at what U.S. workers are forced to pay to get access to the healthcare system.According to the Kaiser Family Foundation, about half of the non-elderly population—147 million people in total—are covered by employer-sponsored insurance programs.* The average annual single coverage premium in 2015 was ,251 and the average family coverage premium was ,545. Each rose 4 percent over the 2014 average premiums. During the same period, workers’ wages increased only 1.9 percent while prices declined by 0.2 percent. But the gap is even larger when looked at over the long run. Between 1999 and 2015, workers’ contributions to premiums increased by a whopping 221 percent, even more than the growth in health insurance premiums (203 percent), and far outpacing both inflation (42 percent) and workers’ earnings (56 percent). Most covered workers face additional out-of-pocket costs when they use health care services.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

On Tuesday, I began a series on the unhealthy state of the U.S. healthcare system—starting with the fact that the United States spends far more on health than any other country, yet the life expectancy of the American population is actually shorter than in other countries that spend far less.

Today, I want to look at what U.S. workers are forced to pay to get access to the healthcare system.

According to the Kaiser Family Foundation, about half of the non-elderly population—147 million people in total—are covered by employer-sponsored insurance programs.* The average annual single coverage premium in 2015 was $6,251 and the average family coverage premium was $17,545. Each rose 4 percent over the 2014 average premiums. During the same period, workers’ wages increased only 1.9 percent while prices declined by 0.2 percent.

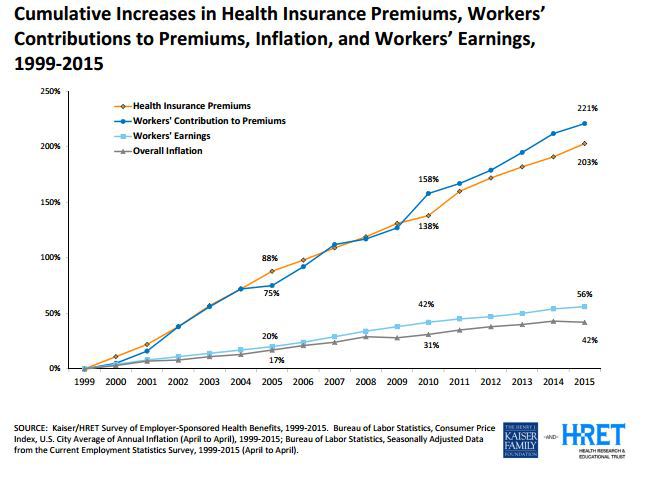

But the gap is even larger when looked at over the long run. Between 1999 and 2015, workers’ contributions to premiums increased by a whopping 221 percent, even more than the growth in health insurance premiums (203 percent), and far outpacing both inflation (42 percent) and workers’ earnings (56 percent).

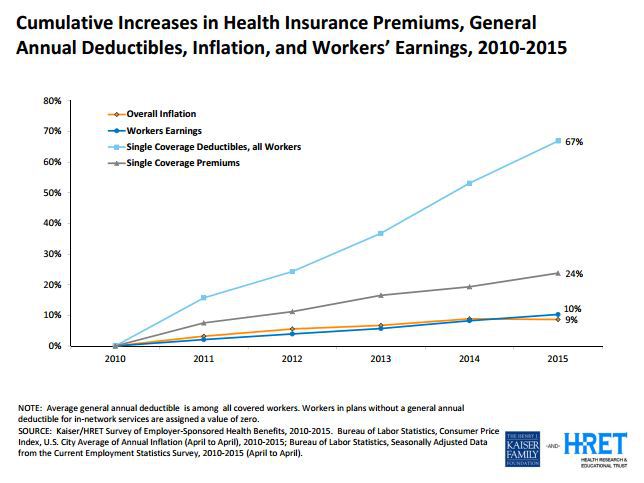

Most covered workers face additional out-of-pocket costs when they use health care services. Eighty-one percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan.** Since 2010, there has also been a sharp increase in both the percentage of workers on health plans with deductibles—which require members to pay a certain amount toward their care before the plan starts paying—and the size of those deductibles. The result has been a 67-percent rise in deductibles (for single coverage) since 2010, far outpacing not only the 24-percent growth in premiums, but also the 10-percent growth in workers’ wages and 9-percent rise in inflation.

In recent years, the increase in U..S. health costs has in fact slowed down. But the slowdown has been invisible to American workers, who have been forced to pay much higher premiums and deductibles in order to get access to healthcare for themselves and their families.

*Fifty-seven percent of firms offer health benefits to at least some of their employees, covering about 63 percent workers at those firms.

**Even workers without a general annual deductible often face other types of cost sharing when they use services, such as copayments or coinsurance for office visits and hospitalizations, and when they purchase prescription drugs.