From Cherrie Bucknor and Dean Baker The 4.9 percent unemployment rate is getting close to most economists’ estimates of full employment. In fact, it is below many estimates from recent years and some current ones. Many policy types, including some at the Federal Reserve Board, take this as evidence that it’s necessary to raise interest rates in order to keep the unemployment rate from falling too low and triggering a round of spiraling inflation. The argument on the other side is first and foremost there is zero evidence that inflation is about to start spiraling upward. The Fed’s key measure, the core personal consumption expenditure deflator, remains well below the Fed’s target and shows no evidence of acceleration. The same is true of most wage growth measures. But there is also good reason for skepticism on the current unemployment rate as a useful measure of labor market tightness. Other measures of labor market tightness, such as the percentage of workers employed part-time for economic reasons and the share of unemploymentdue to voluntary quits, remain close to recession levels. Most importantly, there has been a sharp drop in labor force participation rates. As a result, in spite of the relatively low unemployment rate, the employment rate is still close to 3.0 percentage points below its pre-recession level.

Topics:

Dean Baker considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Cherrie Bucknor and Dean Baker

The 4.9 percent unemployment rate is getting close to most economists’ estimates of full employment. In fact, it is below many estimates from recent years and some current ones. Many policy types, including some at the Federal Reserve Board, take this as evidence that it’s necessary to raise interest rates in order to keep the unemployment rate from falling too low and triggering a round of spiraling inflation.

The argument on the other side is first and foremost there is zero evidence that inflation is about to start spiraling upward. The Fed’s key measure, the core personal consumption expenditure deflator, remains well below the Fed’s target and shows no evidence of acceleration. The same is true of most wage growth measures.

But there is also good reason for skepticism on the current unemployment rate as a useful measure of labor market tightness. Other measures of labor market tightness, such as the percentage of workers employed part-time for economic reasons and the share of unemploymentdue to voluntary quits, remain close to recession levels.

Most importantly, there has been a sharp drop in labor force participation rates. As a result, in spite of the relatively low unemployment rate, the employment rate is still close to 3.0 percentage points below its pre-recession level. This story holds up even if we restrict ourselves to looking at prime-age workers (between the ages of 25–54), with an EPOP that is close to 2.0 percentage points below pre-recession levels and almost 4.0 percentage points below 2000 peaks.[1]

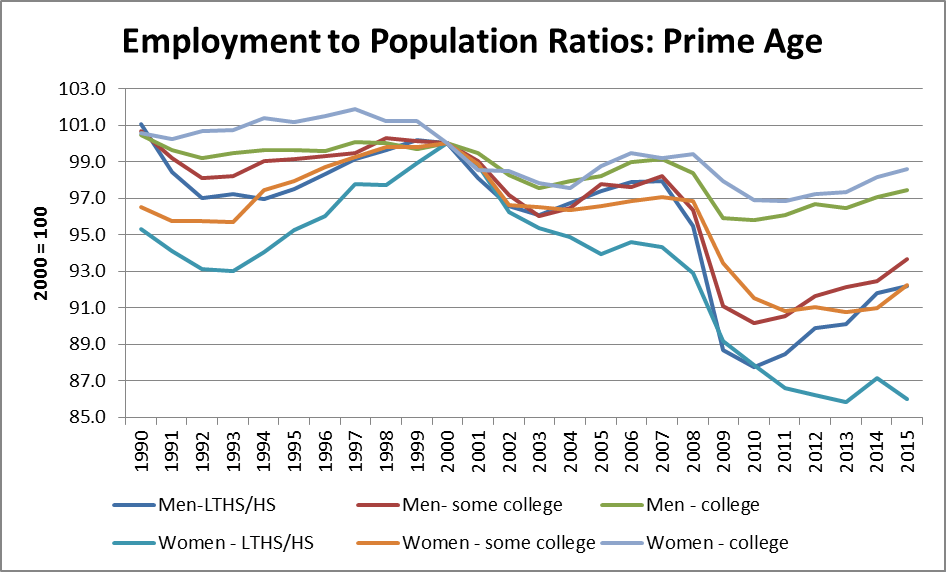

The response of the proponents of higher interest rates has been to attribute this drop to a problem with prime-age men rather than a lack of demand in the economy. For example, Tyler Cowen argued that less educated men were watching Internet porn and playing video games rather than working. The problem with this explanation is that the decline in EPOPs is comparable for non-college educated men and women. There is also a decline in EPOPs since 2000 for both college educated men and women, albeit a smaller one than for their less-educated counterparts.

Since there is a drop in prime-age EPOPs for all groups, this would seem to suggest that the main problem is a lack of demand and not some new difficulty that some relatively narrow group of workers has in dealing with the labor market. Before going through these trends, it is worth making an additional point; this decline in EPOPs was not expected before it happened.

For example, the Congressional Budget Office (CBO) in 2001 projected that EPOPs would continue to rise from their 2000 peaks. It projected that the potential labor force would grow at an average annual rate of 1.1 percent over the next decade, implying that it would be 11.6 percent larger in 2010 than in 2000 (Table 2). This growth was driven in part by population growth, but also by the expectation that the trend of rising EPOPs for women would continue.

In fact, the labor force in 2010 was just 7.9 percent larger than in 2000. This 3.7 percentage point difference corresponds to a labor force that was 5 million smaller in 2010 than CBO had projected for that year in 2001. (It is worth noting that the CBO projections were not an outlier. CBO tries to ensure that its projections lie close to the middle of the pack for economic forecasters.)

If the argument that structural factors have led to a permanent lowering of prime-age EPOPs is right, as opposed to just weakness in demand reducing employment, then the 2001 projections for the growth of the potential labor force were clearly wrong. Of course official projections have often proven wrong, but this should give us caution about our ability to accurately assess the structural determinants of employment rates. After all, it’s not obvious that our knowledge of the economy is very much better in 2016 than it was in 2001.

The figure below shows the employment to population ratios for prime-age workers by gender and education levels.

Source: Authors’ analysis of data from the Current Population Survey.

The ratios for 2000 are set at 100 to allow for a clear view of the drop off from this peak. As noted, all groups see some drop from this peak, with the smallest drop for college-educated women, followed by college-educated men. The drop for prime-age workers with some college is considerably sharper, with the drop for women being somewhat larger than the drop for men. The drop for workers with a high school degree or less is even greater, but here also the drop is larger for women than for men. The decline in EPOPs for prime-age men with a high school degree or less is 7.8 percent, while the drop for women is 14.0 percent. Given the much sharper drop in EPOPs for less-educated women, it is difficult to understand why the policy debate has focused on men leaving the labor force.

The more fundamental issue is that it is difficult to explain a drop in EPOPS for all workers, regardless of education levels, as being a problem of workers lacking skills or a desire to work. This looks pretty clearly like a story of weak demand. In other words, the problem is not them; it is us, where “us” is the people who make economic policy.

[1] This discussion focuses on EPOPs rather than labor force participation rates (LFPR) because the latter has likely been affected by the tightening of rules for getting unemployment insurance. It is widely recognized that many unemployed workers drop out of the labor force when they are no longer eligible for unemployment benefits. With many states having instituted stricter rules on benefits over this period, we would have expected a decline in LFPR even with no changes in the workforce or the economy.