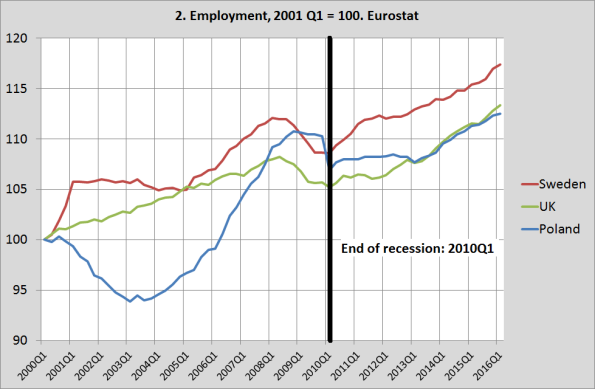

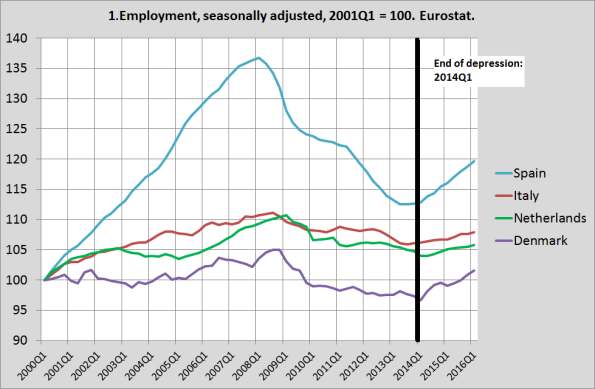

Why did the crisis last so long in Italy, the Netherlands, Spain and Denmark (graph 1) and much shorter (four years!) in the UK, Poland and Sweden (graph 2, at the end)? Lack of Aggregate Demand in the former countries? Not according to Scott Sumner. This post will however show, point by point, some counterexamples to the ideas of Scott Sumner about what he calls ‘AD voodoo‘- and especially his claim that “there is almost no theoretical or empirical support for the new voodoo claims, and lots of evidence against“. Let’s quote Scott: “Old hydraulic Keynesianism from the 1960s was already a pretty implausible model. But what’s happened since 2009 involves not just one, but at least five new types of voodoo: 1. The claim that artificial attempts to force wages higher will boost employment, by boosting AD. 2. The claim that extended unemployment benefits—paying people not to work—will lead to more employment, by boosting AD. 3. The claim that more government spending can actually reduce the budget deficit, by boosting AD and growth. Note that in the simple Keynesian model, even with no crowding out, monetary offset, etc., this is impossible. 4. More aggregate demand will lead to higher productivity. In the old Keynesian model, more AD boosted growth by increasing employment, not productivity. 5. Fiscal stimulus can boost AD when not at the zero bound, because . . .

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Why did the crisis last so long in Italy, the Netherlands, Spain and Denmark (graph 1) and much shorter (four years!) in the UK, Poland and Sweden (graph 2, at the end)? Lack of Aggregate Demand in the former countries? Not according to Scott Sumner. This post will however show, point by point, some counterexamples to the ideas of Scott Sumner about what he calls ‘AD voodoo‘- and especially his claim that “there is almost no theoretical or empirical support for the new voodoo claims, and lots of evidence against“. Let’s quote Scott:

Why did the crisis last so long in Italy, the Netherlands, Spain and Denmark (graph 1) and much shorter (four years!) in the UK, Poland and Sweden (graph 2, at the end)? Lack of Aggregate Demand in the former countries? Not according to Scott Sumner. This post will however show, point by point, some counterexamples to the ideas of Scott Sumner about what he calls ‘AD voodoo‘- and especially his claim that “there is almost no theoretical or empirical support for the new voodoo claims, and lots of evidence against“. Let’s quote Scott:

“Old hydraulic Keynesianism from the 1960s was already a pretty implausible model. But what’s happened since 2009 involves not just one, but at least five new types of voodoo:

1. The claim that artificial attempts to force wages higher will boost employment, by boosting AD.

2. The claim that extended unemployment benefits—paying people not to work—will lead to more employment, by boosting AD.

3. The claim that more government spending can actually reduce the budget deficit, by boosting AD and growth. Note that in the simple Keynesian model, even with no crowding out, monetary offset, etc., this is impossible.

4. More aggregate demand will lead to higher productivity. In the old Keynesian model, more AD boosted growth by increasing employment, not productivity.

5. Fiscal stimulus can boost AD when not at the zero bound, because . . . ?

In all five cases there is almost no theoretical or empirical support for the new voodoo claims, and lots of evidence against. There were 5 attempts to push wages higher in the 1930s, and all 5 failed to spur recovery. Job creation sped up when the extended UI benefits ended at the beginning of 2014, contrary to the prediction of Keynesians. The austerity of 2013 failed to slow growth, contrary to the predictions of Keynesians. Britain had perhaps the biggest budget deficits of any major economy during the Great Recession, job growth has been robust, and yet productivity is now actually lower than in the 4th quarter of 2007.”

Ad 1). About a year and a half ago Germany introduced a pretty high national minimum wage of 8,50. (Euro, of course) which replaced an amalgam of voluntary sectoral minimum wages which however did not cover all sectors. Lo and behold: job growth immediately increased to a, for Germany, pretty high level of about 1,3%. I’m not stating that the minimum wage caused this but it also did not prevent this; it’s at least a shred of evidence (but maybe a national minimum wage is, considering that humans are what they are, not that much of an artificial thing). I recall another shred of evidence: double-digit wage declines (a total of minus 20% or so) in Greece did not speed up job creation. I’ll return to that.

Ad 2) Returning to Greece: 90% of the unemployed does not get any kind of benefits. It still has the highest unemployment of the entire EU. Might I consider this a shred of evidence that unemployment is not just about collecting benefits?

Ad 3) There is of course the Summer/DeLong ‘self defeating austerity’ model. Here a Voxeudiscussion of such ideas. But it might be good to go to Scott Sumners home turf: nominal GDP. There have been consistent efforts to drive down wages and therewith price level in countries like Greece, Spain, Italy, Portugal and Ireland. Which, in combination with austerity, led to a virtual stagnation of the price level (total domestic demand) and in some cases (Greece!) even to a decline. Price levels are of course riddled with problems of composition and quality – which however does not mean that we can’t take a shot at them. And we do. And there is a very marked difference in development before and after 2008. To the extent that austerity (including artificial attempts to lower wage levels) contributed to this the possibility of self-defeating austerity, which was already considerable, increased. Greece is, again, the best (worst?) example.

4) Around 1960 high wages caused a large problem in Dutch agriculture. Agricultural wages were ‘equalized’ with (much higher) levels in manufacturing. But around 1955 possibilities to mechanize Dutch agriculture were limited. Oops.Ten years later, in 1965, Dutch agriculture had changed beyond recognition, the most visible aspect of this being the virtual disappearance of agricultural horses. ‘Induced technological change’ (using already existing ‘meta technologies’) had led to an explosion of labour-saving machinery which (in combination with increases in scale of farms and a wholesale re-engineering of the agricultural landscape) enabled mechanized harvesting of sugar beet and potatoes and whatever. The point: the idea of ‘induced technological change‘ is not exactly new. And it happens. But we of course have to add that in those days unemployment was about 2%. In this case, I think that Sumner is right that more demand does not necessarily lead to higher wages – as long as unemployment is high. We both seem to be Harrod-Domar guys! Aside from this there appear to be some ‘thresholds’ – unemployment seems to have to undershoot the rate at which wages ‘should’ start to increase to open the wedged box of a fully functional labour market. And we should take into account that the UK productivity data are influenced by the fact that in two large high productivity sectors (oil and finance) productivity as well as production declined and declines. Which causes a decline of average productivity. Aggregate demand exists. Aggregate average productivity is a (useful) construct. To understand this (again: useful) construct we do have to know how it is constructed.

Ad 5) Please, read this blogpost about, alas, Germany in the thirties (as compared with the goldbug Netherlands).

Ad 6) Shocks matter. After 2008 devaluating countries like the UK, Poland and Sweden did much better than the rest of the EU (metric: employment), except for Germany. Though Austria and Belgium (which did not practice too much austerity until recently) did reasonably well, too. Until recently. The point: exchange rate soon went back to normal levels. Despite this, these countries did not experience the 2010-2013 recession of the Euro area (while Denmark, with its pegged currency, did). An in fact very short period of devaluation enabled these countries somehow, I have no idea what exactly happened, to prevent a ‘bad equilibrium’. The point: more AD would have helped to get countries out of the bad equilibrium; the European Commission however tried to crush all kinds of AD (even investment) except for exports. Higher wages (less wage mitigation) could have helped.

Technical note about graph 2: the Polish jobs decline in 2010Q1 is supposedly caused by a change in the data as it does not show in a sudden increase in Polish unemployment.