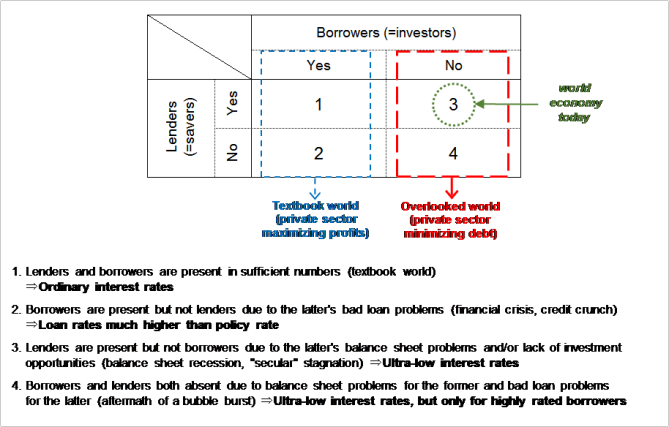

. . . an economy is always in one of four possible states depending on the presence or absence of lenders (savers) and borrowers (investors). They are as follows: (1) both lenders and borrowers are present in sufficient numbers, (2) there are borrowers but not enough lenders even at high interest rates, (3) there are lenders but not enough borrowers even at low interest rates, and (4) both lenders and borrowers are absent. These four states are illustrated in Exhibit 2. Of the four, only Cases 1 and 2 are discussed in traditional economics, which implicitly assumes there are always borrowers as long as real interest rates can be brought low enough. And of these two, only Case 1 requires a minimum of policy intervention – such as slight adjustments to interest rates – to keep the economy going. The causes of Case 2 (insufficient lenders) may be found in both financial and non-financial factors. Non-financial factors might include a culture that does not encourage saving or a country that is simply too poor and underdeveloped to save. A restrictive monetary policy may also qualify as a non-financial factor that weighs on savers’ ability to lend. (If the paradox of thrift leaves a country too poor to save, this would be classified as Case 3 or 4 because it is actually due to a lack of borrowers.

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

. . . an economy is always in one of four possible states depending on the presence or absence of lenders (savers) and borrowers (investors). They are as follows: (1) both lenders and borrowers are present in sufficient numbers, (2) there are borrowers but not enough lenders even at high interest rates, (3) there are lenders but not enough borrowers even at low interest rates, and (4) both lenders and borrowers are absent. These four states are illustrated in Exhibit 2.

Of the four, only Cases 1 and 2 are discussed in traditional economics, which implicitly assumes there are always borrowers as long as real interest rates can be brought low enough. And of these two, only Case 1 requires a minimum of policy intervention – such as slight adjustments to interest rates – to keep the economy going.

The causes of Case 2 (insufficient lenders) may be found in both financial and non-financial factors. Non-financial factors might include a culture that does not encourage saving or a country that is simply too poor and underdeveloped to save. A restrictive monetary policy may also qualify as a non-financial factor that weighs on savers’ ability to lend. (If the paradox of thrift leaves a country too poor to save, this would be classified as Case 3 or 4 because it is actually due to a lack of borrowers.)

Financial factors weighing on lenders might include an excess of many non-performing loans (NPLs), which depresses banks’ capital ratios and prevents them from lending. This is what is typically called a credit crunch.

When many banks encounter NPL problems at the same time, mutual distrust among lenders may lead to a dysfunctional interbank market, a state of affairs typically known as a financial crisis. Over-regulation of financial institutions by the authorities can lead to a credit crunch as well. An underdeveloped financial system may also be a factor.

Cultural norms discouraging savings, as well as income (and productivity) levels that are simply too low for people to save, are developmental phenomena typically found in pre-industrialized societies. These issues can take many years to address.

Exhibit 2. Borrowers and lenders: four possible states

Non-developmental causes of a shortage of lenders, however, all have well-known remedies in the literature. For example, the government can inject capital into the banks to restore their ability to lend, or it can relax regulations preventing financial institutions from performing their role as financial intermediaries. In the case of a dysfunctional interbank market, the central bank can act as lender of last resort to ensure the clearing system continues to operate. It can also relax monetary policy.

The conventional emphasis on monetary policy and concerns over the crowding-out effect of fiscal policy are justified in Cases 1 and 2, where there are borrowers but (for a variety of reasons in Case 2) not enough lenders.