From C.P. Chandrasekhar and Jayati Ghosh For several decades, the US economy functioned as the principal agent of global demand, sucking in vast amounts of imports from the rest of the world as it built up vast current account deficits. Of course, it was easily able to finance these deficits with capital inflows, benefiting from its status as the holder of the only viable global reserve currency. But just as the US was able to make the rest of the world in effect pay for its own domestic economic expansion, this expansion had positive effects on growth in the rest of the global economy. The US functioned as the primary source of demand for major exporting nations, thereby pulling much of the rest of the world economy along with it in the intermittent periods of boom. In the 1990s and

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from C.P. Chandrasekhar and Jayati Ghosh

For several decades, the US economy functioned as the principal agent of global demand, sucking in vast amounts of imports from the rest of the world as it built up vast current account deficits. Of course, it was easily able to finance these deficits with capital inflows, benefiting from its status as the holder of the only viable global reserve currency. But just as the US was able to make the rest of the world in effect pay for its own domestic economic expansion, this expansion had positive effects on growth in the rest of the global economy.

The US functioned as the primary source of demand for major exporting nations, thereby pulling much of the rest of the world economy along with it in the intermittent periods of boom. In the 1990s and again in the 2000s, there were prolonged periods during which the current account deficits of the US grew and then remained at very high levels, generating demand for others in the world economy. While major exporting nations like Germany, China and to a lesser extent Japan, were obviously the chief beneficiaries of this, the expansion trickled down to other countries and regions.

This was clearly not the ideal mode of global expansion, since it created imbalances that were bound at some point to become unsustainable, and possibly erupt in crises, as they indeed did in 2001 and again more severely in 2008-09. The problem was that countriestried to export their way to growth and therefore relied on an external stimulus for demand expansion, which had to be at the expense of others. A better and morepreferable route to global growth would be to enable and allow domestic expansion within countries – but that requiresinternational co-ordination.

Such co-ordination has been lacking in the recent past. This is unfortunate, because since the Global Financial Crises, in which the US economy was the epicentre, the US economy’s net stimulus to the rest of the world has been on a declining trajectory. And the absence of other demand stimuli condemns the global economy to its low “new normal”.

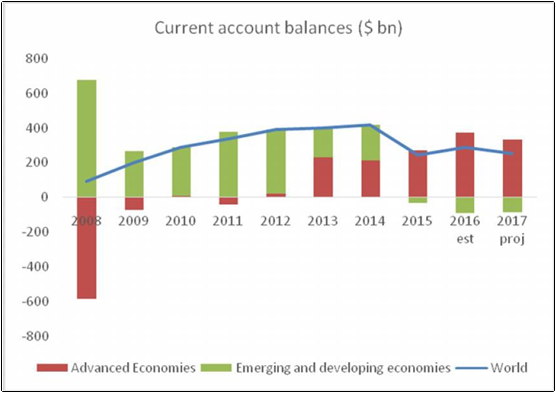

Consider the net current account deficits (in US $ billion) of the major regions and economies, shown below using the latest data from the IMF online database. As Chart 1 shows, in 2008 the advanced economies as a group ran a huge current account deficit of more than $580 billion in 2008. This shrank dramatically the following year, and thereafter, especially since 2013, advanced economies have shown growing current account surpluses, implying that they as a group no longer provide a net demand stimulus to the world economy.

Chart 1: Advanced economies no longer provide a net stimulus

Meanwhile the group of developing, emerging and transition economies ran surpluses until 2014, which turned to deficits thereafter. However, these deficits were much smaller in absolute size and so nowhere near enough to counteract the impact of the declining net demand from the advanced economies.

As the chart shows, the world economy as a whole has shown significant current account surpluses over this entire period, essentially implying an increase in aggregate reserve accumulation, as well as the impact of “errors and omissions”. This aggregate global current account surplus (which effectively amounts to a global excess of ex ante savings over investment, and therefore levels of output well below potential full capacity output) increased sharply between 2008 and 2014. While it has fallen a little since then, the IMF’s projections for 2017 are still nearly three times the level of 2008.

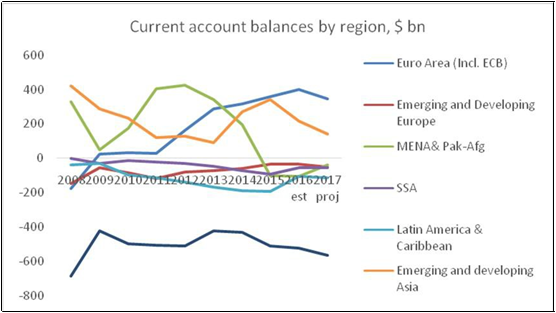

Chart 2 provides the regional division of these current account balances over this period. Several significant features emerge: a rise and then equally sharp decline in the surpluses of the Middle East and North Africa region, largely driven by oil prices; a decline, increase and then decline again for emerging and developing Asia; a decline in the North American deficit followed by only a marginal increase after 2014; and most strikingly of all, a very significant increase in the surpluses of the eurozone.

Chart 2: Regional balances have changed very dramatically

While these regional aggregates are instructive, it is clear that they are driven by a few large countries, and in the contemporary global economy there are no prizes for guessing which these are. Chart 3 provides data on the three most significant players: the United States, Germany and China. The US deficit fell after 2008 and since then the net stimulus coming from that economy has been stagnant or falling. The Chinese current account surpluses are well known and much talked of, but they have been much more variable and recently on a clearly declining path.

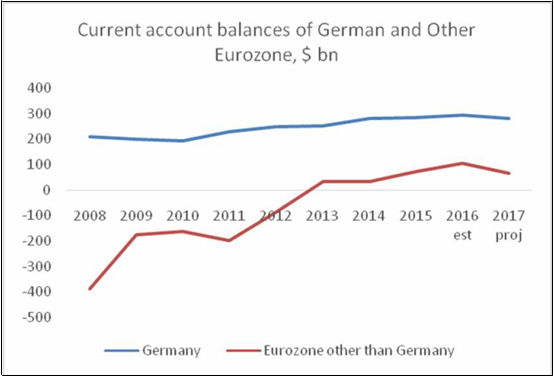

But the big news is about Germany, which since 2010 has been running the largest surpluses of any economy in the world – and furthermore, these surpluses have been increasing recently. This mercantilist approach of Germany imparts a severely negative impulse to global demand. As a large rich economy, its persistence on internal wage and demand suppression, relying fundamentally on external demand for its own expansion, deprives other economies of potential economic activity.

But the adverse German influence may extend even further, as Chart 4 demonstrates. It has also been actively trying to remake the rest of the eurozone in its own image at least with respect to this feature, by forcing austerity policies upon the peripheral economies and squeezing current account surpluses out of devastated economies in decline. The strategy is evidently to export the eurozone’s deflation and unemployment to the rest of the world. This is why, as Chart 4 shows, even the eurozone outside Germany has generated growing current account surpluses since 2013. These have not led to faster growth with more employment, since they have been based on wage suppression within these economies. (Interestingly, other countries in the “Teutonic bloc” like Austria and the Netherlands, have behaved similarly.)

Chart 3: The three big players

Chart 4: The Eurozone

The German role in the global economy thus currently appears to be doubly pernicious. Unlike the Chinese expansion, which during the boom created more growth in a range of other developing countries by drawing them into the value chain for export to the advanced countries, the German expansion has not had similar positive effects for most developing countries. And now, by imposing macroeconomically repressive and mercantilist policies upon the rest of the eurozone, it is further adding to the negative stimulus imparted to the global economy.

Talk of technology or trade as the villains simply distracts from the obvious point: unless significant and sustainable efforts are made to revive global demand through wage growth in a co-ordinated way, the global economy will be condemned to stagnation or worse.

This article was originally published in the Business Line on May 22, 2017.