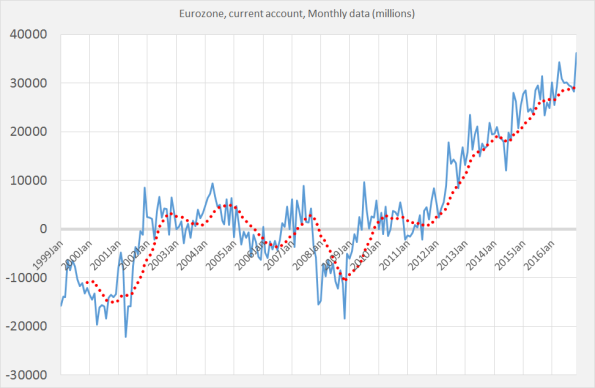

Update: after writing this post I discovered that today Matthew Klein wrote a much longer and much more in depth article about the same subject here. Same conclusion. Should we start a trade war? Let’s, before doing this, take a closer look at current accounts: higher current account surpluses or smaller deficits are not necessarily associated with higher employment. To the contrary. Two examples: between 2009 and 2016 the monthly Eurozone Current Account changed from about minus 10 billion to +30 billion or, expressed as a % of GDP, from minus 1 to + 3% of GDP (3,1% to be precise). In the same period, Britain’s trade deficit with other European Union countries increased to about 8 billion a month. Not because these other countries were exporting more – but because they were importing less. This decline in EU imports was not caused by improvements in competitivety but by austerity. A decline in domestic spending leads, as goods and services purchased always and everywhere have some imported components, quite mechanically to a decrease in imports. And it was caused by lower oil prices. In both cases, the increase of the surplus was not associated with an increase in employment. It was at least up to about 2014 in fact caused by a decrease of employment and the associated decrease of expenditure (compared with the UK).

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Update: after writing this post I discovered that today Matthew Klein wrote a much longer and much more in depth article about the same subject here. Same conclusion.

Should we start a trade war? Let’s, before doing this, take a closer look at current accounts: higher current account surpluses or smaller deficits are not necessarily associated with higher employment. To the contrary. Two examples: between 2009 and 2016 the monthly Eurozone Current Account changed from about minus 10 billion to +30 billion or, expressed as a % of GDP, from minus 1 to + 3% of GDP (3,1% to be precise). In the same period, Britain’s trade deficit with other European Union countries increased to about 8 billion a month. Not because these other countries were exporting more – but because they were importing less. This decline in EU imports was not caused by improvements in competitivety but by austerity. A decline in domestic spending leads, as goods and services purchased always and everywhere have some imported components, quite mechanically to a decrease in imports. And it was caused by lower oil prices. In both cases, the increase of the surplus was not associated with an increase in employment. It was at least up to about 2014 in fact caused by a decrease of employment and the associated decrease of expenditure (compared with the UK). Which serves to illustrate the point that the relation between current account deficits and employment is slightly more complicated than sometimes assumed. Another case in point: in only four months (this bears repeating: in only four months!), the period between October 2008 and February 2009, the USA trade deficit halved from 60 billion (or about 6% of GDP) to less than 30 billion (or about 3% of GDP) per month, largely because of a decline in oil prices but also because of a lower volume of imports which was not matched by a comparable decline in exports. Can economists agree that this decrease of the USA deficit was not associated with higher USA employment? Let’s ramp up spending (we can use several hundreds of millions of additional solar cells in the EU) – that will solve the UK as well as the Eurozone problem.