From David Ruccio Like many liberal economic nationalists, who are concerned about both inequality and economic growth, Michael Lind attempts to make a distinction between “takers” and “makers.” As against conservative economic nationalists, who blame immigrants and the welfare-dependent poor, Lind focuses his attention on the “rent-extracting, unproductive rich” for undermining the dynamism and fairness of contemporary capitalism. The term “rent” in this context refers to more than payments to your landlords. . . “Profits” from the sale of goods or services in a free market are different from “rents” extracted from the public by monopolists in various kinds. Unlike profits, rents tend to be based on recurrent fees rather than sales to ever-changing consumers. While productive capitalists — “industrialists,” to use the old-fashioned term — need to be active and entrepreneurial in order to keep ahead of the competition, “rentiers” (the term for people whose income comes from rents, rather than profits) can enjoy a perpetual stream of income even if they are completely passive. This is a familiar trope within economic discourse. As I’ve explained before (e.g., here and here), it relies on a distinction between productive and unproductive economic activities, which is then overlain with other dichotomies: active vs. passive, doing vs. owning, and so on.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Like many liberal economic nationalists, who are concerned about both inequality and economic growth, Michael Lind attempts to make a distinction between “takers” and “makers.”

As against conservative economic nationalists, who blame immigrants and the welfare-dependent poor, Lind focuses his attention on the “rent-extracting, unproductive rich” for undermining the dynamism and fairness of contemporary capitalism.

The term “rent” in this context refers to more than payments to your landlords. . . “Profits” from the sale of goods or services in a free market are different from “rents” extracted from the public by monopolists in various kinds. Unlike profits, rents tend to be based on recurrent fees rather than sales to ever-changing consumers. While productive capitalists — “industrialists,” to use the old-fashioned term — need to be active and entrepreneurial in order to keep ahead of the competition, “rentiers” (the term for people whose income comes from rents, rather than profits) can enjoy a perpetual stream of income even if they are completely passive.

This is a familiar trope within economic discourse. As I’ve explained before (e.g., here and here), it relies on a distinction between productive and unproductive economic activities, which is then overlain with other dichotomies: active vs. passive, doing vs. owning, and so on. The idea is that one group—the passive, owning, recipients of rent—increasingly serve as a drag on the other group—the active, doing, recipients of profits.

If one or more of the sectors providing inputs or infrastructure to productive industry charges excessive rents, then industry can be strangled. Industry cannot flourish if too much rent is paid to landlords, if credit is too expensive, if excessive copyright protections stifle the diffusion of technology. . .

All of this suggests that, if we want a technology-driven, highly productive economy, we should encourage profit-making productive enterprises while cracking down on rent-extracting monopolies, whether they are natural products of geography and geology (real estate and energy and energy and mineral deposits) or artificial (chartered banks, professional licensing associations, labor unions, patents and copyrights). This is a valid distinction between “makers” and “takers.”

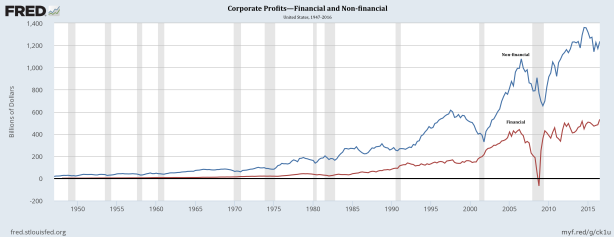

Basically, Lind is privileging the profits that are received by productive capitalists from their supposed doing activities (the blue line in the chart above) and calling into question the profits that are received through the rent-seeking activities of financial capitalists (the red line in the chart above).

It’s a powerful idea, and one that—after the spectacular crash of 2007-08, the subsequent bailout of Wall Street, and the uneven recovery since then—stands to garner a great deal of attention and sympathy.

There are, however, two fundamental problems with Lind’s distinction between profit-oriented makers and rent-seeking takers.

First, Lind presumes that industrial capitalists would do more—more investing, and thus more job creating, more growth, and so on—if they had to pay lower rents to others, including rent-taking financial capitalists. While it is certainly the case that “industrialists” would have higher retained earnings if they distributed less of their profits in the form of rents (not only financial charges but also, as Lind explains, taxes, union wages, oil rents, healthcare premia, and so on), there’s no guarantee they would actually invest or accumulate more capital with those profits.

That is precisely the specter that is created when, as I explained the other day, the capitalist machine is broken. In recent decades, investment has increased much less than profits, thus calling into question the pact with the devil that historically has stood at the center of capitalism. Lind may be an economic nationalist but the industrialists he champions are not, and never have been.

The second problem is that Lind never offers an adequate explanation of where the profits of those industrial capitalists come from. He merely presumes they are the fair return to entrepreneurial, making activities.

But who is doing all that making—and who are the ones getting the profits? Non-financial corporate profits represent the extra value workers create during the course of producing commodities (both goods and services). The workers receive wages (more or less equal to the value of their labor power) and their employers receive the extra or surplus value those workers create (above and beyond the value of labor power). In other words, the profits of industrial capitalists stem from the exploitation of productive workers.

The surplus appropriated by the boards of directors of industrial capitalist enterprises is, in turn, distributed. One portion remains within those enterprises (in the form of retained earnings, executive and supervisory salaries, expenditures on new equipment and software, the hiring of additional workers, and so on), while another portion is distributed outside them (to shareholders, finance capitalists, merchants, the government, and so on). All of those payments—some of which Lind characterizes as profits, others as rents—represent distributions of the surplus.

In the end, then, there is no valid distinction between makers and takers. The appropriators of the surplus make nothing—and everyone who gets a cut of the surplus, in both industrial and financial enterprises, is a taker.

They are all, in Lind’s language, rich moochers who hurt America.