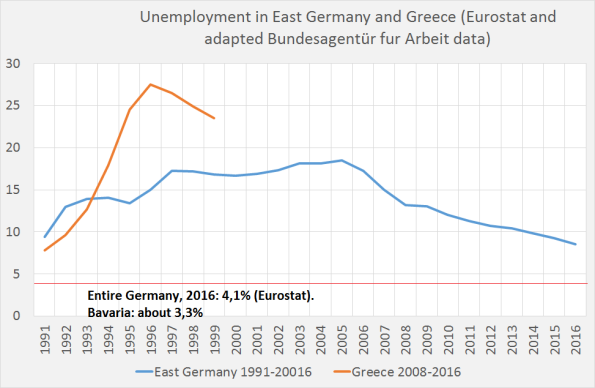

From: Merijn Knibbe Brexit should not have happened. But, understandably, it did. Brussels bears a large part of the blame: they could and should have known. The title of this blog is an allusion to the 1992 Wayne Godley article ‘Maastricht and all that’ in which he predicted the present day troubles of the Eurozone. People (in Brussels) should have listened. People (in Brussels) should still listen. If a country does not have its own money it is not really sovereign – unless it has democratic power on a higher level. If that’s not the case it might be treated as a kind of colony. Think Ireland. Think Greece. The EU should not be like that. But it was. And is. And people voted for Brexit. But that’s not all to there is to Brexit. it’s not just about Brussels and power and politics. It is about policies, too. It is enlightening to compare unemployment in Greece with unemployment in East Germany (graph 1). In graph 1 East German unemployment data from the ‘Bundesagentür für Arbeit’ have (based upon a comparison for total Germany) been cut with 10% to make them compatible with the Eurostat unemployment data. The graph clearly shows that even within a democratic country which, at that time, had monetary sovereignty, ‘Greek’ levels of region unemployment were accepted for decades.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from: Merijn Knibbe

Brexit should not have happened. But, understandably, it did. Brussels bears a large part of the blame: they could and should have known. The title of this blog is an allusion to the 1992 Wayne Godley article ‘Maastricht and all that’ in which he predicted the present day troubles of the Eurozone. People (in Brussels) should have listened. People (in Brussels) should still listen. If a country does not have its own money it is not really sovereign – unless it has democratic power on a higher level. If that’s not the case it might be treated as a kind of colony. Think Ireland. Think Greece. The EU should not be like that. But it was. And is. And people voted for Brexit.

But that’s not all to there is to Brexit. it’s not just about Brussels and power and politics. It is about policies, too. It is enlightening to compare unemployment in Greece with unemployment in East Germany (graph 1). In graph 1 East German unemployment data from the ‘Bundesagentür für Arbeit’ have (based upon a comparison for total Germany) been cut with 10% to make them compatible with the Eurostat unemployment data. The graph clearly shows that even within a democratic country which, at that time, had monetary sovereignty, ‘Greek’ levels of region unemployment were accepted for decades. While it also shows that even in a benign situation (same rules and quality of government as in West-Germany; totally free movement of people, shared language and, to an extent, culture; massive government transfers and the transfer of the government to Berlin) über-unemployment can last for decades. Compare this with the German ‘Wirtschaftwunder’ of the fifties when, despite mass immigration and post war dislocation, German unemployment directly started to come down and kept coming down! Aside – events during the boom years 2007 and 2008, when unemployment did decline with 2% a year, show that supply side rigidities did not prevent such a decline! In their book ‘Shifting sands. Full employment abandoned:

shifting sands and policy failures’ Joan Muysken and Bill Mitchell argue (based on pre-Great Financial Crisis data) that such events are not due to market failures but, consistent with the Godley argument, NEOLIBERAL policy failures (here the book, here an extended summary by the authors, here an extension of their argument by me, based on an extended set of countries, times series which are extended to the post 2008 period and including data on broad unemployment). Small wonder that people choose to abandon a federation which pursues such policies, especially when part of the redundant labor force is forced, by policies which accepts such rates of unemployment, to seek for labor in your country. I back the EU free labor ideal – but only if it is not meant to be a panacea for economic problems caused by deregulation of capital markets (and deregulated capital markets do lead to economic fragility, as argued in this recent Voxeu piece by Aida Caldera, Alain de Serres, Filippo Gori, Oliver Röhn while undercapitalization of banks does not lead to a higher incidence of financial crises but does lead to much longer and deeper downturns after such crises, as convincingly argued by Òscar Jordà, Björn Richter, Moritz Schularick, and Alan M. Taylor in the NBER report Bank Capital Redux: Solvency, Liquidity, and Crisis. We really do have to push for higher capital of banks. But these are policies oriented to mitigating future crises. To solve the present crisis, we will have to pursue a more aggressive policy towards resolving bad debts (as Richard Werner argues: financed by the central bank and of course for creditors and debtors alike). We can’t make up for lost time. We might try to mitigate the problem of lost generations. To do this, we need another EU.