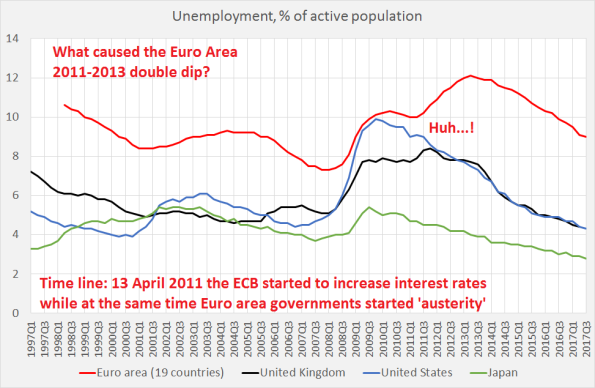

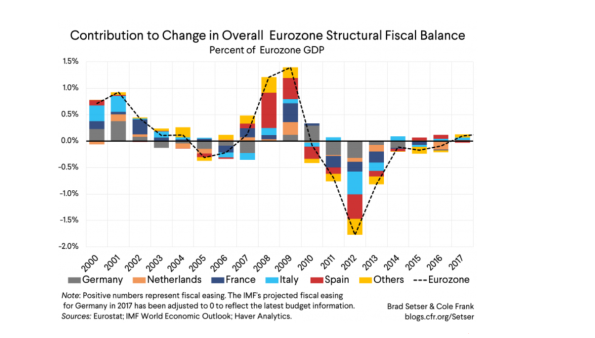

What was the cause of the infamous Euro Area 2011-2013 double dip? Answer: a grave policy mistake. Already high ECB interest rates were increased (13 April 2011 13 July 2011) at the same time when fiscal policy was tightened (‘austerity’), unemployment was at record levels (graph 1) and use of capacity was still lowish (less important, core inflation was low, too). As a consequence, Euro Area unemployment started to increase at a time when Japanese and USA unemployment continued to decrease while UK unemployment started to decrease, despite the Eurozone dip. Brad Seltser has written a very good post about the demand side of this (second graph). Readers of this blog won’t be surprised by his data but he gives a more detailed and systematic overview than I’ve seen up to now. Aside – his

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

What was the cause of the infamous Euro Area 2011-2013 double dip? Answer: a grave policy mistake. Already high ECB interest rates were increased (13 April 2011 13 July 2011) at the same time when fiscal policy was tightened (‘austerity’), unemployment was at record levels (graph 1) and use of capacity was still lowish (less important, core inflation was low, too). As a consequence, Euro Area unemployment started to increase at a time when Japanese and USA unemployment continued to decrease while UK unemployment started to decrease, despite the Eurozone dip. Brad Seltser has written a very good post about the demand side of this (second graph).

What was the cause of the infamous Euro Area 2011-2013 double dip? Answer: a grave policy mistake. Already high ECB interest rates were increased (13 April 2011 13 July 2011) at the same time when fiscal policy was tightened (‘austerity’), unemployment was at record levels (graph 1) and use of capacity was still lowish (less important, core inflation was low, too). As a consequence, Euro Area unemployment started to increase at a time when Japanese and USA unemployment continued to decrease while UK unemployment started to decrease, despite the Eurozone dip. Brad Seltser has written a very good post about the demand side of this (second graph).

Readers of this blog won’t be surprised by his data but he gives a more detailed and systematic overview than I’ve seen up to now. Aside – his post and verdict is totally based on the much despised but, as his post show, invaluable national accounts: austerity pulled the Euro Area into the double dip and higher net exports pulled it out of it – but this ‘beggar your neighbour’ strategy has run its course. It did not have to be this way – but it was and we will have to live with the consequences for years to come.

Some theoretical musings about this (the reader is advised to read instead the Seltser post): I agree with one conclusion of ‘New-Keynesian’models (or, as @Noahpinion more accurately states: ‘New-Friedmanian’ models): when the economy is in the doldrums (or worse) it is daft to increase interest rates and tighten fiscal policy at the same time. Simon Wren Lewis often wrote about this. Do I also agree with his analysis? During severe depressions (like the one starting in 2008) I do: interest rates have to be really, really low and fiscal policies have to be really, really contra-cyclical (i.e. additional government spending has to compensate the aggregate of declining household consumption, declining investments and declining gross (!) exports at least to a considerable extent and for quite a period). But is does not necessarily have to be the government – in the UK and the Netherlands the trillions owned by (members of) pension funds could (guided, but not paid by the government) have been used to shore up private (re-)construction of badly needed modern, sustainable apartments. Hey, the thing which sets pension funds apart from banks is their ability to provide 30, 40 or 50 year loans to private parties as they have extremely long-term funding – so, let’s do it.

There are however differences between the ‘New Keynesian’ view and my ideas. I do not believe that a system of interconnected markets moves toward something called ‘general equilibrium’. Markets consist of supply, demand and institutions like the ‘the law’, the ‘social contrivance’ of money or mortgage rules. These markets change all the time, AirBnB anyone? And because markets change all the time I do not understand the concept of the ‘natural interest rate’, or the interest rate which in a static world is supposed to equate demand and supply at a fictional ‘natural rate of unemployment’ (more modern: ‘NAIRU’ or Non Accelerating Inflation Rate of Unemployment, ughhh…). Let alone the fact that in the real world, markets already change because of the very fact of lending and borrowing (this is the idea behind the concept of ‘balance sheet recessions’, above I write about interest rates which were too hihg – woith this I mean that high interest rates disabled cheap refinancing for households and companies). Mortgages, anyone? Modern economies do have the tendency to grow – but this growth (and decline) is essentially sectoral (tourism, at the moment). Now, these sectors are connected but not by the interest rate but by lending and borrowing and balance sheets and the business cycle. And sometimes, the aggregate of sectoral growth and decline will lead to an increase in additional aggregate output and a decline in unemployment. But that won’t be mainly caused by the level of the interest rate (though it is a very good thing that many households at the moment can cheaply refinance their mortgages). It is caused by household spending (more tourism!) and business investment (more cruise ships!). Yes, interest rates are also included in business calculations, especially when cruise ships of around one billion are at stake. and yes, a sudden increase of interest rates in combination with a downturn will bust the cruise ship companies. But central bank interest policies are only one of the fiddles in the orchestra and they do not conduct the entire symphony. Though the concert may stop when they play out of tune. Like the ECB in combination with the Euro Area governments did. To get the thing going again, more is needed (in the case of the Euro Area: an increase of net exports in combination with less austerity). Low interest rates alone are not enough. For nerds: the above is basically Hardod-Domar growth theory.