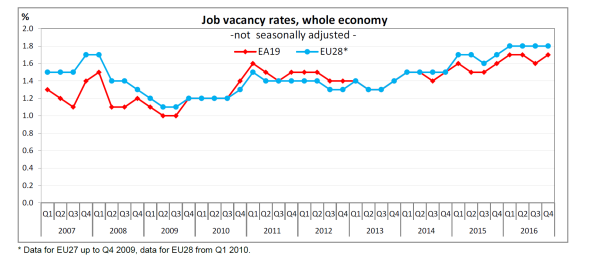

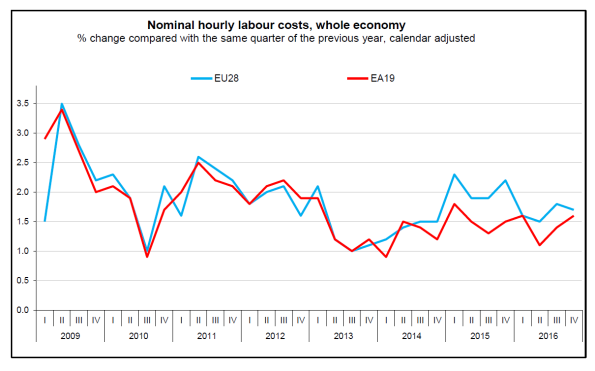

Via Eurostat (look here and here) information about the labour market: vacancy rates and wages. Vacancies are up, wages are rising at a very moderate rate (and in many countries, like Spain, not at all). These are wage costs and not wages, but at this moment the difference is small, notice that wages increase less than the 2$ inflation target of the ECB. Vacancies have developed favorably. About this: during the last year there have been tailwinds: (much) lower prices for energy, translating into lower consumer price inflation, less austerity, ever lower interest rates for households and companies (especially in southern Europe), QE and a lowish exchange rate. If there had not been an upswing – we might have had to apply real solutions to the European economy, like writing down debts. At this moment, headwinds are increasing in strength and consumper price inflation is, due to higher energy costs, increasing. As energy is largely imported, higher inflation does not warrant higher interest rates but it does warrant higher wages.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Via Eurostat (look here and here) information about the labour market: vacancy rates and wages. Vacancies are up, wages are rising at a very moderate rate (and in many countries, like Spain, not at all). These are wage costs and not wages, but at this moment the difference is small, notice that wages increase less than the 2$ inflation target of the ECB.

Vacancies have developed favorably. About this: during the last year there have been tailwinds: (much) lower prices for energy, translating into lower consumer price inflation, less austerity, ever lower interest rates for households and companies (especially in southern Europe), QE and a lowish exchange rate. If there had not been an upswing – we might have had to apply real solutions to the European economy, like writing down debts. At this moment, headwinds are increasing in strength and consumper price inflation is, due to higher energy costs, increasing. As energy is largely imported, higher inflation does not warrant higher interest rates but it does warrant higher wages.