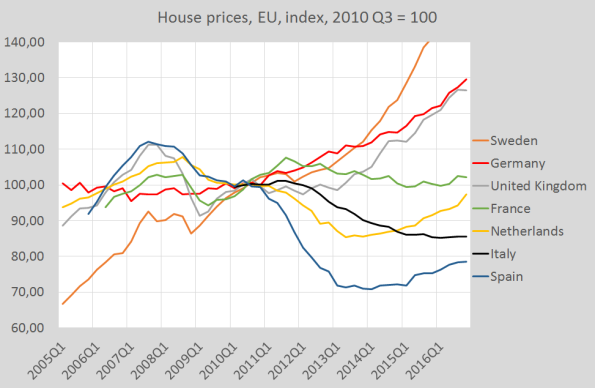

House price developments in the EU show large differences in development – which makes the task for monetary and fiscal policy even more difficult. One of the beneficial consequences of the Great Financial Crisis is that economic statisticians at for instance Eurostat or the Bank for International Settlements spend more effort on assembling house prices , though The Economist deserves praise as it led the way about 15 years ago. What do these data tell us? Low interest rates are criticized by some economists as these should encourage asset price bubbles. Houses are our most important asset. Are house prices in the EU at this moment increasing too fast? Not yet in Southern Europe. Spanish prices show a considerable increase but the level in Spain is still low. And prices in France and

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

House price developments in the EU show large differences in development – which makes the task for monetary and fiscal policy even more difficult.

One of the beneficial consequences of the Great Financial Crisis is that economic statisticians at for instance Eurostat or the Bank for International Settlements spend more effort on assembling house prices , though The Economist deserves praise as it led the way about 15 years ago. What do these data tell us? Low interest rates are criticized by some economists as these should encourage asset price bubbles. Houses are our most important asset. Are house prices in the EU at this moment increasing too fast?

Not yet in Southern Europe. Spanish prices show a considerable increase but the level in Spain is still low. And prices in France and Italy do not show any meaningful increase, while Italian levels are low.

However… Swedish prices are of the chart. Dutch prices are rapidly increasing (and continued to do so during the first six months of 2017). German prices have, by now, increased with a third (house ownership in Germany is less common than in many other countries but the increase means that there will, quite soon, be a push to sell houses to renters – who of course have to borrow from the big banks). yes, there is a northern European bubble. And it is rapidly inflating: during the last six months (not in the graph) prices have continued to increase.

The house price bubble has not exactly the same characteristics as the previous one. The previous bubble was financed by credit and money creation. The money created was to a considerable extent stacked away by the sellers (who often inherited these houses) in long-term deposits and is now used again to finance new house purchases. In selected cities, like Amsterdam, house prices are exploding (+21% in one year, I read somewhere) which is to an extent influenced by Airbnb. Nevertheless – house prices show continued increases which are way higher than the increases of nominal income of households, even including Airbnb income. Actions have to be taken: a gradual increase (with clear forward guidance) of land value taxes (the money raised has to be used to lower VAT on labor), a gradual decrease of Loan to Value ratio’s (with clear forward guidance) and a gradual banishment of tax deductions of interest paid (with clear forward guidance).

It won’t happen.