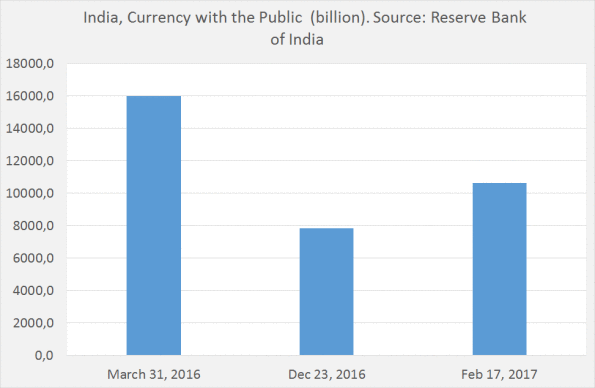

What’s happening in India? The people are clearly rolling back the recent move of the Indian government to basically abolish the cash economy: the amount of cash is, at the moment of writing this, increasing at a hyperinflation rate of 8,5% per fortnight (according to the Reservebank of India data). But the amount of cash is still way below last years’level. Bank deposits are 12% higher than last year but have been flat since December. The question is why cash was abolished. Read here, on this blog, Norbert Häring about the reasons why: it’s good for foreign fintech. And yes, it was a conspiracy. It’s not yet clear what this did to the poor and illiterate, who are living in an ad hoc cash economy (see also Alex Tabarrok about this). Alex Tabarrok also noted that the total Indian economy witnessed sturdy GDP growth in the las tquarter of 2016. Which might mean that the abolishment of cash mainly affected the ‘street economy’ of the poor. In such an economy especially transactions with people who you do not know require: cash. In depth information about (based upon the economy of the pre-war French prison system) such an economy can be found in the autobiographical novel Papillon. It’s all about relations. And trust. But cash is king. Comparable novel about India: Shantaram. The first 100 pages of Dostojevski’s Crime and Punishment also give a vivid idea of such an economy.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

What’s happening in India? The people are clearly rolling back the recent move of the Indian government to basically abolish the cash economy: the amount of cash is, at the moment of writing this, increasing at a hyperinflation rate of 8,5% per fortnight (according to the Reservebank of India data). But the amount of cash is still way below last years’level. Bank deposits are 12% higher than last year but have been flat since December.

The question is why cash was abolished. Read here, on this blog, Norbert Häring about the reasons why: it’s good for foreign fintech. And yes, it was a conspiracy. It’s not yet clear what this did to the poor and illiterate, who are living in an ad hoc cash economy (see also Alex Tabarrok about this). Alex Tabarrok also noted that the total Indian economy witnessed sturdy GDP growth in the las tquarter of 2016. Which might mean that the abolishment of cash mainly affected the ‘street economy’ of the poor. In such an economy especially transactions with people who you do not know require: cash. In depth information about (based upon the economy of the pre-war French prison system) such an economy can be found in the autobiographical novel Papillon. It’s all about relations. And trust. But cash is king. Comparable novel about India: Shantaram. The first 100 pages of Dostojevski’s Crime and Punishment also give a vivid idea of such an economy. You need relations, you have to build trust – but cash is king (though a little less so than in the French prison system and the Indian slums of Shantaram). Anyway – a lot of wealth was evaporated, by the government.