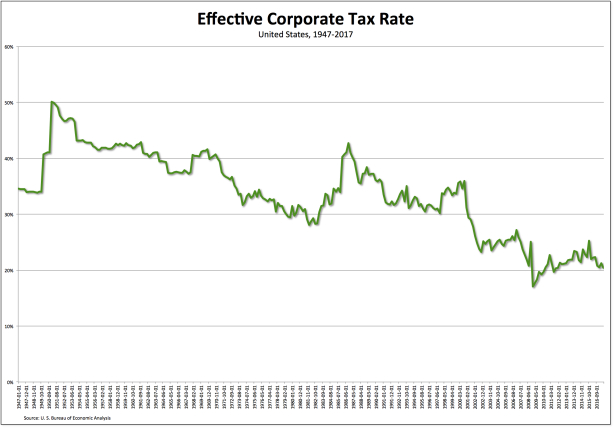

From David Ruccio One of the rationales for the great Republican tax heist of 2017 is that American corporations desperately need tax relief. However, as is clear from the chart above, the current corporate tax rate is already very low—not absolutely (since it was in fact lower in 2009, when corporate profits fell during the Great Recession), but certainly in comparison to the rest of the postwar period.* Today, the effective corporate tax rate in the United States is only 20.4 percent, lower almost by half than the much-ballyhooed statutory rate of 38.91 rate. One can only imagine, then, how low the effective rate will be if and when the statutory rate is reduced according to the tax bills passed through the U.S. House of Representatives and the Senate. They both cut it 20 percent,

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

One of the rationales for the great Republican tax heist of 2017 is that American corporations desperately need tax relief.

However, as is clear from the chart above, the current corporate tax rate is already very low—not absolutely (since it was in fact lower in 2009, when corporate profits fell during the Great Recession), but certainly in comparison to the rest of the postwar period.*

Today, the effective corporate tax rate in the United States is only 20.4 percent, lower almost by half than the much-ballyhooed statutory rate of 38.91 rate.

One can only imagine, then, how low the effective rate will be if and when the statutory rate is reduced according to the tax bills passed through the U.S. House of Representatives and the Senate. They both cut it 20 percent, on a permanent basis—which is the biggest one-time drop in the business tax rate ever.

*The effective corporate tax rate is defined here as the percentage difference between corporate profits before and after tax (both calculated without IVA and CCAdj adjustments), according to statistics from the U.S. Bureau of Economic Analysis.