From David Ruccio The business press is having a hard time figuring out this one: the combination of unrelenting drama in and around Donald Trump’s White House and the stability (signaled by the very low volatility) on Wall Street. As CNN-Money notes, One of the oldest sayings on Wall Street is that investors hate uncertainty. But that adage, much like other conventional wisdom, is being challenged during the Trump era. Despite enormous question marks swirling around the fate of President Trump’s economic agenda and his political future, American financial markets have remained unusually calm. What’s going on? What investors actually hate is not uncertainty but, rather, threats to profits. And corporate profits have been growing spectacularly during the recovery from the Second Great

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

The business press is having a hard time figuring out this one: the combination of unrelenting drama in and around Donald Trump’s White House and the stability (signaled by the very low volatility) on Wall Street.

As CNN-Money notes,

One of the oldest sayings on Wall Street is that investors hate uncertainty. But that adage, much like other conventional wisdom, is being challenged during the Trump era.

Despite enormous question marks swirling around the fate of President Trump’s economic agenda and his political future, American financial markets have remained unusually calm.

What’s going on?

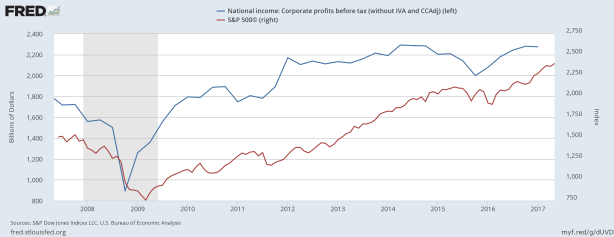

What investors actually hate is not uncertainty but, rather, threats to profits. And corporate profits have been growing spectacularly during the recovery from the Second Great Depression. Between the fourth quarter of 2008 and the first quarter of 2017, corporate profits rose more than 150 percent. Meanwhile, U.S. stocks (as measured by the Standard & Poor’s 500) increased by more than 200 percent. The rise in stock prices stems both from the growth in corporate profits and from gains in the stock market itself, which together have fueled further increases in the stock market with steadily declining levels of volatility.

As Ruchir Sharma admits,

Mr. Trump’s mercurial ways may be a source of great concern or indifference, depending on your ideological leanings. But Wall Street doesn’t seem to care one way or other.

What Wall Street cares about is not uncertainty but profits.

That’s the bottom line.