From David Ruccio The United States, as I have shown over the past week (e.g., here, here, and here), has an obscenely unequal distribution of wealth. How do we put that grotesque level of inequality into perspective? One way is by taking a historical perspective; the other is by looking across the world today. As it turns out, Nature (unfortunately behind a paywall) has just published a study in which the authors attempt to estimate the degree of wealth inequality in ancient societies for which we do not have written records.* What they did is collect data from 63 archaeological sites or groups of sites, used the distribution of house sizes as a proxy for wealth, and assigned Gini coefficients to each society.** What they are able to show is that wealth disparities generally

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

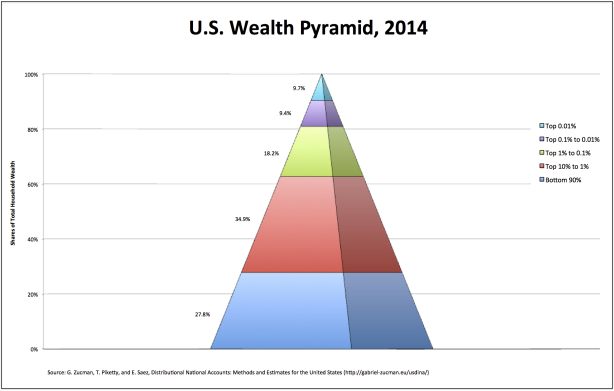

The United States, as I have shown over the past week (e.g., here, here, and here), has an obscenely unequal distribution of wealth.

How do we put that grotesque level of inequality into perspective? One way is by taking a historical perspective; the other is by looking across the world today.

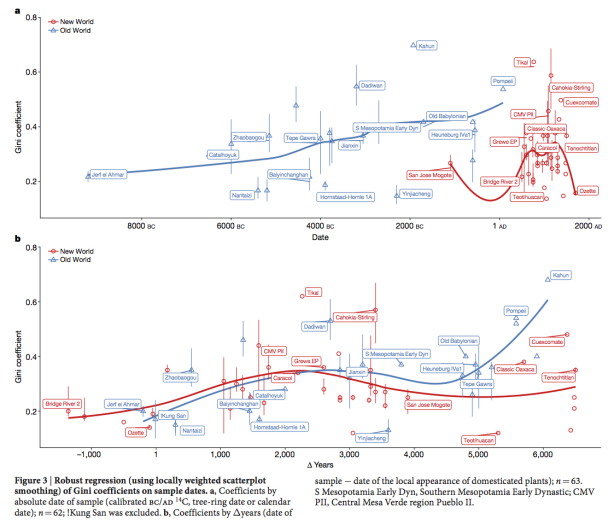

As it turns out, Nature (unfortunately behind a paywall) has just published a study in which the authors attempt to estimate the degree of wealth inequality in ancient societies for which we do not have written records.* What they did is collect data from 63 archaeological sites or groups of sites, used the distribution of house sizes as a proxy for wealth, and assigned Gini coefficients to each society.**

What they are able to show is that wealth disparities generally increased with the domestication of plants and animals and with increased sociopolitical scale. The basic idea is that wealth disparities cannot accumulate within lineages until mechanisms for the transmission of wealth across generations become common, as is much more likely within sedentary societies. Thus, less wealth is typically transmitted across generations in hunter-gatherer and horticultural societies than in agricultural or pastoral societies.

As is clear from the chart above, there were huge differences in the responses of societies to these factors in the New World (North America and Mesoamerica) and the Old World (Euroasia) after the end of the Neolithic period. Much to the researchers’ surprise, inequality kept rising in the Old World while it hit a plateau in the New World. They argue that the generally higher wealth disparities identified in post-Neolithic Eurasia were initially due to the greater availability of large mammals that could be domesticated, because they allowed more productive agricultural extensification, and also eventually led to the development of a mounted warrior elite able to expand polities to sizes that were not possible in North America and Mesoamerica before the arrival of Europeans.

These processes increased inequality by operating on both ends of the wealth distribution, increasing the holdings of the rich while decreasing those of the poor.

The authors note that the highest modeled wealth Gini coefficients in their Old World sample (0.48 at around ad 1, 0.60 at around ∆6,000 in the chart above) are similar to contemporary values for the Slovak Republic (0.45) and Spain (0.58), although much lower than for China (0.73) or the United States in 2000 (0.80).

Thus, the authors conclude,

Even given the possibility that the Gini coefficients constructed here may underestimate true household wealth disparities, it is safe to say that the degree of wealth inequality experienced by many households today is considerably higher than has been the norm over the last ten millennia.

How right they are!

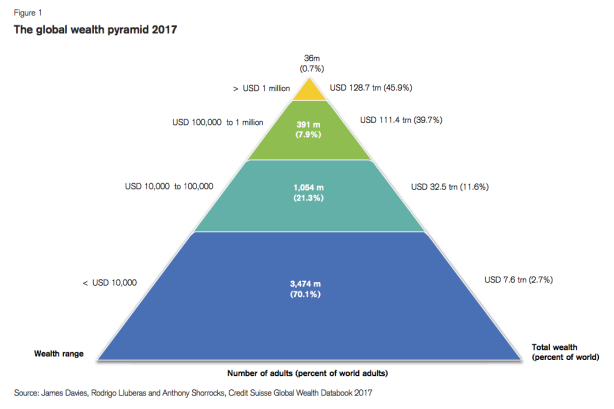

According to the latest Credit Suisse Research Institute’s Global Wealth Report, the members of the global top 1 percent now own more than half (50.1 percent) of all household wealth in the world.

In terms of wealth bands, the United States has by far the greatest number of millionaires: 15.4 million, an increase of 1.1 million adults over 2016. For 2017, that amounts to 43 percent of the world total. (Japan holds second place, with only 7 percent of the world’s millionaires, a decline of 338 from 2016 to 2017.)

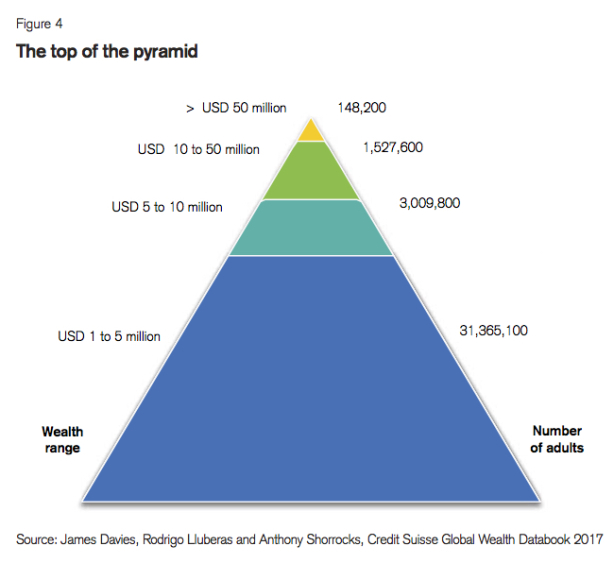

Much the same degree of concentration also occurs at the top of the pyramid. According to the Credit Suisse calculations, 148,200 adults worldwide can be classed as ultra-high net worth individuals, with a net worth above US$50 million—an increase of 13 percent (19,600 adults) during the past year.

Once again, the United States dominates the regional rankings, with 75,000 ultra-high net worth residents (51 percent), with China occupying second place with 18,100 ultra-high net worth individuals (up 3,000 on the year).

The authors of the report are clear: since the crash of 2007-08, top wealth holders benefited in particular and, across all regions, wealth inequality has risen, as median wealth declined. And their projections for 2022 suggest “more pessimistic scenarios for the immediate years ahead.”

Yes, indeed, the arc of recent capitalist history appears to be following that of millenia of prehistory, which bends toward greater inequality.

*The archaeological contexts sampled from the Old World range from around 11,000 to about 2,000 years ago (plus one recent set of !Kung San encampments), and in the Americas, from around 3,000 to about 300 years ago.

**The Gini coefficient (named after the Italian statistician Corrado Gini) is a measure of statistical dispersion intended to represent the distribution of income or wealth among the members of a group (e.g., a nation). Inequality on the Gini scale is measured between 0, where everybody is equal, and 1, where all the income or wealth is captured by a single person. I have expressed my own reservations about comparing Gini coefficients across countries or regions here.