From David Ruccio The timing could not have been better, at least for me. It just so happens I’m teaching Thorsten Veblen’s Theory of the Leisure Class this week. It should become quickly obvious to students that, as I have argued before on this blog, we’re now in the midst of a Second Gilded Age. This is confirmed in a new report by UBS/PwC, according to which, after a brief pause in 2015, the expansion in billionaire wealth around the world has resumed. Thus, billionaire wealth rose 17 percent in 2016 (up from .1 trillion to trillion), far more than the 5.8-percent nominal GDP growth figure and double the rate of the MSCI AC World Index.** There was also a 10-percent rise in the number of billionaires globally to 1,542. Despite a period of heightened geopolitical uncertainty,

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

The timing could not have been better, at least for me. It just so happens I’m teaching Thorsten Veblen’s Theory of the Leisure Class this week. It should become quickly obvious to students that, as I have argued before on this blog, we’re now in the midst of a Second Gilded Age.

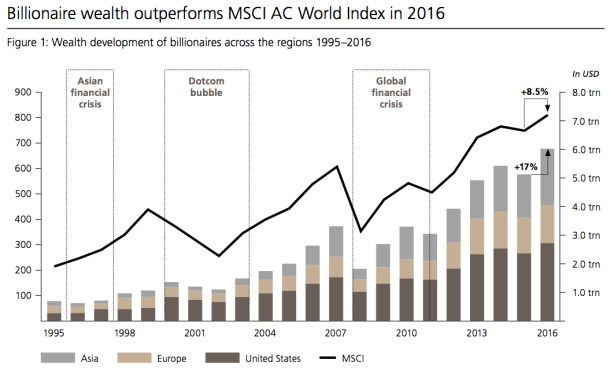

This is confirmed in a new report by UBS/PwC, according to which, after a brief pause in 2015, the expansion in billionaire wealth around the world has resumed.

Thus, billionaire wealth rose 17 percent in 2016 (up from $5.1 trillion to $6 trillion), far more than the 5.8-percent nominal GDP growth figure and double the rate of the MSCI AC World Index.** There was also a 10-percent rise in the number of billionaires globally to 1,542. Despite a period of heightened geopolitical uncertainty, the world’s ultrawealthy are flourishing.

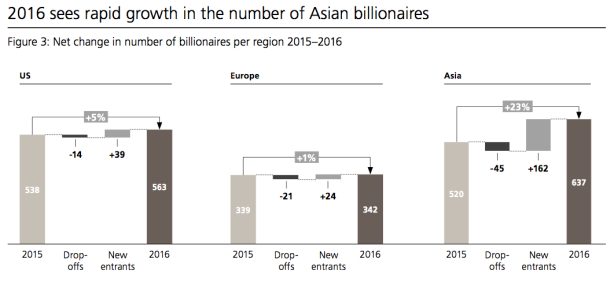

The United States still has the world’s largest concentration of billionaire wealth. It grew by 15 percent from $2.4 trillion to $2.8 trillion as billionaires prospered, far outstripping the MSCI AC World Index. Thirty-nine Americans entered the billion-dollar plus wealth band and 14 dropped off.

Europe’s billionaire population was static in 2016. Twenty-four entered this wealth band, while 21 dropped off.*** There were 342 European billionaires at the end of 2016.

The biggest jump occurred in Asia. Three quarters of the newly minted billionaires are from the region’s two biggest economies—China and India. China had by far the highest number, adding a net 67 to total 318. India’s billionaire population climbed 16 to 100. Taken together, the wealth of Asian billionaires grew by almost a third (31 percent) in 2016, up from $1.5 trillion to $2 trillion.

So, what do the world’s billionaires do with their vast wealth? Most of it is used to capture even more income and wealth. Thus, the 1,542 billionaires in the UBS/PwC database own or partly own companies that directly employ at least 27.7 million people worldwide—roughly the same as the UK’s working population. And, via an array of financial instruments and “club deals,” they manage to siphon off a large part of the surplus created by the rest of the global working-class.****

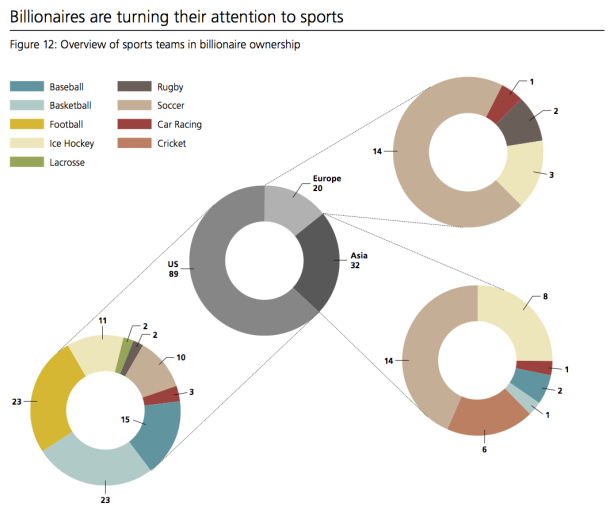

Apparently, the world’s billionaires are also becoming major patrons of sports, such as football (both global and American), hockey, baseball, and basketball. According to the report, more than 140 of the top sports clubs globally are owned by just 109 billionaires.*****

One European entrepreneur explains why he owns a sports club in the following way. “Sport is my life and my dearest hobby,” he says. “Further, the publicity you get from the broadcasting is global. The business works according to the theme ‘you win on Sunday and sell on Monday.’ People always identify themselves with winners. A er all, I not only sponsor, whatever I do in this eld must be sustainable and needs to make commercial sense.”

It should come as no surprise that Veblen held a quite different view:

Addiction to athletic sports, not only in the way of direct participation, but also in the way of sentiment and moral support, is, in a more or less pronounced degree, a characteristic of the leisure class; and it is a trait which that class shares with the lower-class delinquents, and with such atavistic elements throughout the body of the community as are endowed with a dominant predaceous trend.

Clearly, the Gilded Age today shares with its historical predecessor a “dominant predaceous trend” that enables the world’s billionaires to accumulate more and more wealth and leaves the rest of us behind.

*The title of this post is from the collection of short stories by Mark Twain and Charles Dudley Warner, published in 1873. Apparently, the name chosen by Twain and Warner was inspired by William Shakespeare’s The Life and Death of King John (Act 4, Scene 2):

Therefore, to be possess’d with double pomp,

To guard a title that was rich before,

To gild refined gold, to paint the lily,

To throw a perfume on the violet,

To smooth the ice, or add another hue

Unto the rainbow, or with taper-light

To seek the beauteous eye of heaven to garnish,

Is wasteful and ridiculous excess.

**The MSCI AC World Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. It is maintained by Morgan Stanley Capital International, and is comprised of stocks from both developed and emerging markets.

***Germany, Europe’s largest economy, also has the most billionaires, at 117. The United Kingdom comes a distant second, at 55, followed by Italy (42), France (39) and Switzerland (35).

****One high-profile example of clubbing together occurred when Warren Buffett’s Berkshire Hathaway group backed the ill-fated Kraft Heinz $143-billion bid for Unilever in February 2017. Buffett has a record of helping the 3G private equity vehicle behind the bid to nance its deals. 3G is controlled by Jorge Paolo Lemann, Brazil’s richest man, and his partners. Buffett has added his financial fiepower to 3G’s acquisitions of doughnut chain Tim Hortons as well as Kraft Heinz.

*****The Glazer family, worth an estimated $4.7 billion in 2015, controls 83 percent of my own favorite sports team.