From David Ruccio Sometimes you just have to sit back and admire capitalism’s ingenuity. It’s able to make profits twice over. First, capitalists know that, when they keep workers’ wages down—even when there’s “full employment”—they can make spectacular profits. And, second, they can make additional profits by loaning money to those same workers, who are desperate to purchase goods and services and send their children to college, thereby financing the demand for the goods and services industrial capitalists need to sell to realize their profits. Thus, as we can see in the chart at the top of the post, the amount of consumer credit is once again soaring to record highs. In relation to personal income, consumer credit fell after the Great Recession (to just under 20 percent in December

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Sometimes you just have to sit back and admire capitalism’s ingenuity.

It’s able to make profits twice over. First, capitalists know that, when they keep workers’ wages down—even when there’s “full employment”—they can make spectacular profits. And, second, they can make additional profits by loaning money to those same workers, who are desperate to purchase goods and services and send their children to college, thereby financing the demand for the goods and services industrial capitalists need to sell to realize their profits.

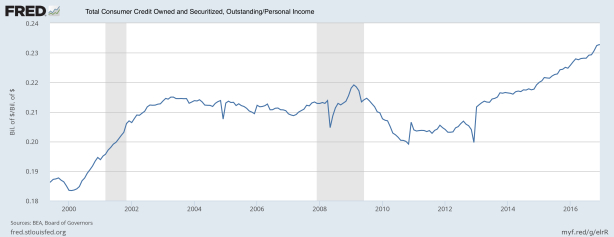

Thus, as we can see in the chart at the top of the post, the amount of consumer credit is once again soaring to record highs. In relation to personal income, consumer credit fell after the Great Recession (to just under 20 percent in December 2012)—as households “deleveraged”—and then it began to rise once again, reaching 23.3 percent four years later.

Is there any wonder bank stocks are expected to show profit growth of 6 percent when the sector kicks off second-quarter earnings season later this week?

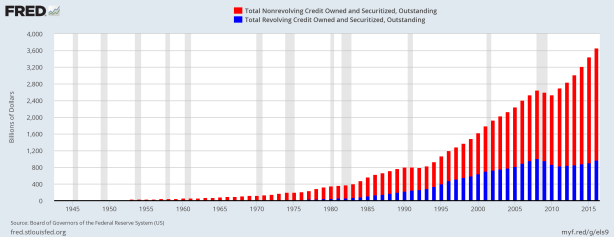

Total consumer credit outstanding (which excludes loans secured by real estate, such as mortgages) can be divided into two categories: revolving and nonrevolving credit. Revolving credit (the blue parts of the bars in the chart above) consists of credit card credit and balances outstanding on unsecured revolving lines of credit, while nonrevolving credit (the red portion) comprises secured and unsecured credit for automobiles, durable goods, and higher education.

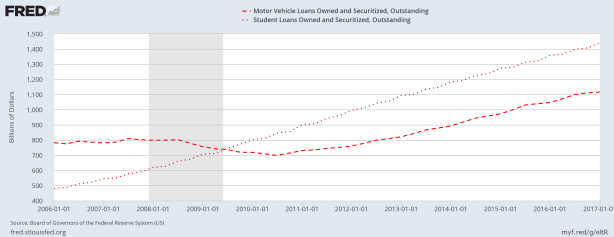

Clearly, as workers’ wages have stagnated, both loans on cars and trucks (the dashed line in the chart) and student loans (the dotted line) have been rising dramatically, which have in turn fueled new vehicle sales and increases in tuition at colleges and universities.

As I say, capitalism is an ingenious system—until, of course, the house of cards comes tumbling down.