From David Ruccio According to recent news reports, Kevin Hassett, the State Farm James Q. Wilson Chair in American Politics and Culture at the American Enterprise Institute (no, I didn’t make that up), will soon be named the head of Donald Trump’s Council of Economic Advisers. Yes, that Kevin Hassett, the one who in 1999 predicted the Down Jones Industrial Average would rise to 36,000 within a few years. Except, of course, it didn’t. Not by a long shot. The average did reach a record high of 11,750.28 in January 2000, but after the bursting of the dot-com bubble, it steadily fell, reaching a low of 7,286 in October 2002. Although it recovered to a new record high of 14,164 in October 2007, it crashed back to the vicinity of 6,500 by the early months of 2009. And, even today, almost two decades later, it’s only just cracked the 20,000 barrier. But, no matter, mainstream economists and pundits—like Greg Mankiw, Noah Smith, and Tim Worstall—think Hassett is a great choice. Perhaps, in addition to his Dow book, they want to place the rest of Hassett’s writings on an altar. Like Hassett’s claim (which I discuss here) that “lowering corporate taxes is the only real cure for wage stagnation among American workers.” Or his other major claim (which I discuss here), that poverty and inequality in the United States are merely figments of our imagination.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

According to recent news reports, Kevin Hassett, the State Farm James Q. Wilson Chair in American Politics and Culture at the American Enterprise Institute (no, I didn’t make that up), will soon be named the head of Donald Trump’s Council of Economic Advisers.

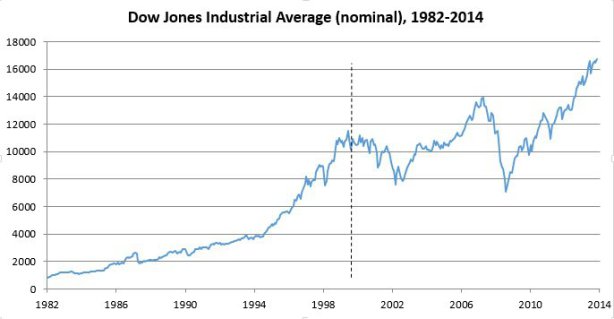

Yes, that Kevin Hassett, the one who in 1999 predicted the Down Jones Industrial Average would rise to 36,000 within a few years.

Except, of course, it didn’t. Not by a long shot. The average did reach a record high of 11,750.28 in January 2000, but after the bursting of the dot-com bubble, it steadily fell, reaching a low of 7,286 in October 2002. Although it recovered to a new record high of 14,164 in October 2007, it crashed back to the vicinity of 6,500 by the early months of 2009. And, even today, almost two decades later, it’s only just cracked the 20,000 barrier.

But, no matter, mainstream economists and pundits—like Greg Mankiw, Noah Smith, and Tim Worstall—think Hassett is a great choice.

Perhaps, in addition to his Dow book, they want to place the rest of Hassett’s writings on an altar.

Like Hassett’s claim (which I discuss here) that “lowering corporate taxes is the only real cure for wage stagnation among American workers.”

Or his other major claim (which I discuss here), that poverty and inequality in the United States are merely figments of our imagination.

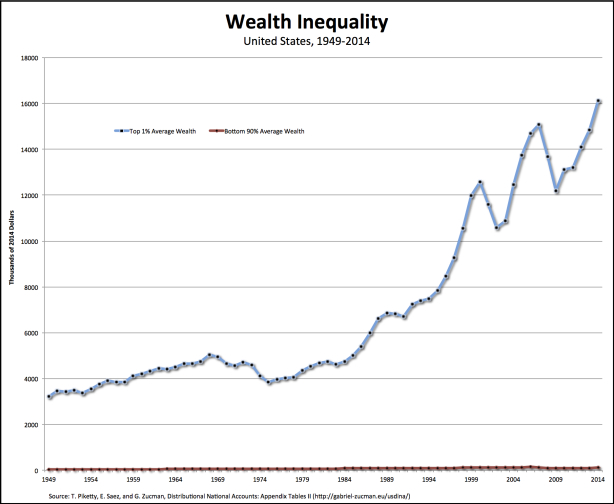

Let’s focus on that last claim. As regular readers of this blog know, income inequality—whether measured in terms of fractiles (e.g., the 1 percent versus everyone else) or classes (e.g., profits and wages)—has been increasing for decades now. But for conservative economists like Hassett (who was an economic adviser to Mitt Romney before being a candidate to join the Trump team), inequality has not been growing and poor people are actually much better off than they and the rest of us normally think. What they do then is substitute consumption for income and argue that consumption inequality has actually not been growing.

So, what’s the big problem?

But even in terms of consumption they’re wrong. As Orazio Attanasio, Erik Hurst, Luigi Pistaferri have shown, once you correct for the measurement errors in the Consumer Expenditure Survey (which Hassett and his coauthor, Aparna Mathur, don’t do), and bring in other sources of consumption information (including the well-regarded Panel Study of Income Dynamics), consumption inequality has increased substantially in recent decades—more or less at the same rate as inequality in the distribution of income.

Overall, our results suggest that there has been a substantial rise in consumption and leisure inequality within the U.S. during the last 30 years. The rise in income inequality translated to an increase in actual well-being inequality during this time period because consumption inequality also increased.

And, remember, that doesn’t take into account other forms of inequality, such as the increase in the unequal distribution of wealth, which has exploded in recent decades. The poor and pretty much everyone else—the 90 percent—are being left behind.

It’s the spectacular grab for income, consumption, and wealth by the small group at the top that Hassett and the new administration will be trying to protect.