From Lars Syll Keynes’s insights have enormous practical importance, according to Lance Taylor and Duncan Foley … But isn’t Keynes now mainstream? No, say Foley and Taylor. The mainstream still sees economies as inherently moving to an optimal equilibrium … It still says demand causes short-run fluctuations, but only supply factors, such as the capital stock and technology, can affect long-run growth. EVEN PAUL KRUGMAN, a self-described Keynesian, Nobel laureate, and New York Times columnist, writes in the 2012 edition of his textbook: “In the long run the economy is self-correcting: shocks to aggregate demand affect aggregate output in the short run but not in the long run” … Krugman does point to one exception: If interest rates are nearly zero, as during the financial crisis,

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

Keynes’s insights have enormous practical importance, according to Lance Taylor and Duncan Foley …

But isn’t Keynes now mainstream? No, say Foley and Taylor. The mainstream still sees economies as inherently moving to an optimal equilibrium … It still says demand causes short-run fluctuations, but only supply factors, such as the capital stock and technology, can affect long-run growth.

EVEN PAUL KRUGMAN, a self-described Keynesian, Nobel laureate, and New York Times columnist, writes in the 2012 edition of his textbook: “In the long run the economy is self-correcting: shocks to aggregate demand affect aggregate output in the short run but not in the long run” …

Krugman does point to one exception: If interest rates are nearly zero, as during the financial crisis, markets lose restorative force. But, Taylor asks, what’s the logic?

Keynes saw capitalism’s general state as allowing almost arbitrary unemployment: hence his “General Theory.” Full employment was a lucky exception.

To Taylor, calling full employment the general state and allowing one unlucky exception turns Keynes upside down.

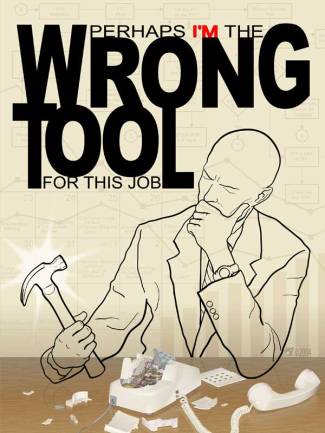

Iy is difficult not to agree with Taylor and Foley. To a large degree one does get the impression that Krugman thinks he is a Keynesian because he is a stout believer in John Hicks IS-LM interpretation of Keynes.

In a post on his blog, self-proclaimed “proud neoclassicist” Paul Krugman has argued that Keynesian macroeconomics more than anything else “made economics the model-oriented field it has become.” In Krugman’s eyes, Keynes was a “pretty klutzy modeler,” and it was only thanks to Samuelson’s famous 45-degree diagram and Hicks’s IS-LM that things got into place. Although admitting that economists have a tendency to use ”excessive math” and “equate hard math with quality” he still vehemently defends — and always have — the mathematization of economics:

I’ve seen quite a lot of what economics without math and models looks like — and it’s not good.

However, being a student of Hyman Minsky, yours truly very much doubt that IS-LM is an adequate reflection of the width and depth of Keynes’s insights on the workings of modern market economies.

Almost nothing in the post-General Theory writings of Keynes suggests him considering Hicks’s IS-LM anywhere near a faithful rendering of his thought. In Keynes’s canonical statement of the essence of his theory — in the 1937 Quarterly Journal of Economics article — there is nothing to even suggest that Keynes would have thought the existence of a Keynes-Hicks-IS-LM-theory anything but pure nonsense. John Hicks, the man who invented IS-LM in his 1937 Econometrica review of Keynes’ General Theory — “Mr. Keynes and the ‘Classics’. A Suggested Interpretation” — returned to it in an article in 1980 — “IS-LM: an explanation” — in Journal of Post Keynesian Economics. Self-critically he wrote that ”the only way in which IS-LM analysis usefully survives — as anything more than a classroom gadget, to be superseded, later on, by something better — is in application to a particular kind of causal analysis, where the use of equilibrium methods, even a drastic use of equilibrium methods, is not inappropriate.”

Sure, “New Keynesian” economists like Krugman — and their forerunners, “Keynesian” economists like Paul Samuelson and (young) John Hicks — certainly have contributed to making economics more mathematical and “model-oriented.”

But if these math-is-the-message-modelers aren’t able to show that the mechanisms or causes that they isolate and handle in their mathematically formalized macromodels are stable in the sense that they do not change when we “export” them to our “target systems,” these mathematical models do only hold under ceteris paribus conditions and are consequently of limited value to our understandings, explanations or predictions of real economic systems. Outside man-made mathematical-statistical nomological machines, economic “laws” are rare, or even non-existant. Unfortunately that also makes most of contemporary mainstream neoclassical endeavours of mathematical economic modeling rather useless. And that also goes for Krugman.

But if these math-is-the-message-modelers aren’t able to show that the mechanisms or causes that they isolate and handle in their mathematically formalized macromodels are stable in the sense that they do not change when we “export” them to our “target systems,” these mathematical models do only hold under ceteris paribus conditions and are consequently of limited value to our understandings, explanations or predictions of real economic systems. Outside man-made mathematical-statistical nomological machines, economic “laws” are rare, or even non-existant. Unfortunately that also makes most of contemporary mainstream neoclassical endeavours of mathematical economic modeling rather useless. And that also goes for Krugman.

In recent blogposts Paul Krugman has come back to his idea that it would be great if the Fed stimulated inflationary expectations so that investments would increase. I don’t have any problem with this idea per se, but I don’t think it’s of the stature that Krugman seems to think. But although I have written extensively on Knut Wicksell and consider him the greatest Swedish economist ever, I definitely — since Krugman portrays himself as “sorta-kinda Keynesian” — have to question his invocation of Knut Wicksell for his ideas on the “natural” rate of interest. Krugman writes (emphasis added):

There is nothing “artificial” or “unnatural” about low interest rates; they’re low because demand is low, and the Fed is responding appropriately. If anything, the “unnatural” situation is that rates are too high, because they’re constrained by the zero lower bound (rates can’t go below zero, except for some minor technical bobbles, because people can always just hold cash).

Second, the Fed’s inability to get rates as low as they should be justifies a search for policies that can fill this policy gap. Fiscal stimulus is one such policy; unconventional monetary policies of various kinds are another. Actually, the natural policy — natural in a Wicksellian sense, and also the one that in terms of standard economics should produce the least distortion — would be a credible commitment to higher inflation.

Now consider what Keynes himself wrote in General Theory:

I am now no longer of the opinion that the [Wicksellian] concept of a ‘natural’ rate of interest, which previously seemed to me a most promising idea, has anything very useful or significant to contribute to our analysis. It is merely the rate of interest which will preserve the status quo; and, in general, we have no predominant interest in the status quo as such.

Paul Krugman has on his blog tried to explain why we should still use the neoclassical hobby horse Aggregate Supply-Aggregate Demand model:

So why do AS-AD? … We do want, somewhere along the way, to get across the notion of the self-correcting economy, the notion that in the long run, we may all be dead, but that we also have a tendency to return to full employment via price flexibility. Or to put it differently, you do want somehow to make clear the notion (which even fairly Keynesian guys like me share) that money is neutral in the long run.

Actually, this is the same unsubstantiated stuff you find in the “fairly Keynesian” Greg Mankiw’s textbooks.

Well, this “fairly Keynesian” guy is not impressed. And I doubt that Keynes himself would have been impressed by having his theory being characterized with catchwords like “tendency to return to full employment” and “money is neutral in the long run.”

As Taylor and Foley convincingly argue — Krugman is no real Keynesian.