From Lars Syll Two hundred years ago, on 19 April 1817, David Ricardo’s Principles was published. In it he presented a theory that was meant to explain why countries trade and, based on the concept of opportunity cost, how the pattern of export and import is ruled by countries exporting goods in which they have comparative advantage and importing goods in which they have a comparative disadvantage. Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however, didn’t explain why the comparative advantage was the way it was. In the beginning of the 20th century, two Swedish economists — Eli Heckscher and Bertil Ohlin — presented a theory/model/theorem according to which the comparative advantages arose from differences in factor endowments between countries.

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

Two hundred years ago, on 19 April 1817, David Ricardo’s Principles was published. In it he presented a theory that was meant to explain why countries trade and, based on the concept of opportunity cost, how the pattern of export and import is ruled by countries exporting goods in which they have comparative advantage and importing goods in which they have a comparative disadvantage.

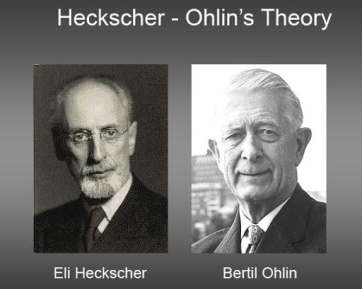

Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however, didn’t explain why the comparative advantage was the way it was. In the beginning of the 20th century, two Swedish economists — Eli Heckscher and Bertil Ohlin — presented a theory/model/theorem according to which the comparative advantages arose from differences in factor endowments between countries. Countries have a comparative advantages in producing goods that use up production factors that are most abundant in the different countries. Countries would mostly export goods that used the abundant factors of production and import goods that mostly used factors of productions that were scarce.

Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however, didn’t explain why the comparative advantage was the way it was. In the beginning of the 20th century, two Swedish economists — Eli Heckscher and Bertil Ohlin — presented a theory/model/theorem according to which the comparative advantages arose from differences in factor endowments between countries. Countries have a comparative advantages in producing goods that use up production factors that are most abundant in the different countries. Countries would mostly export goods that used the abundant factors of production and import goods that mostly used factors of productions that were scarce.

The Heckscher-Ohlin theorem — as do the elaborations on in it by e.g. Vanek, Stolper and Samuelson — builds on a series of restrictive and unrealistic assumptions. The most critically important — beside the standard market clearing equilibrium assumptions — are

(1) Countries use identical production technologies.

(2) Production takes place with a constant returns to scale technology.

(3) Within countries the factor substitutability is more or less infinite.

(4) Factor-prices are equalised (the Stolper-Samuelson extension of the theorem).

These assumptions are, as almost all empirical testing of the theorem has shown, totally unrealistic. That is, they are empirically false.

That said, one could indeed wonder why on earth anyone should be interested in applying this theorem to real world situations. As so many other mainstream mathematical models taught to economics students today, this theorem has very little to do with the real world.

Using false assumptions, mainstream modelers can derive whatever conclusions they want. Wanting to show that ‘free trade is great’ just e.g. assume ‘all economists from Chicago are right’ and ‘all economists from Chicago consider free trade to be great’ The conclusions follows by deduction — but is of course factually totally wrong. Models and theories building on that kind of reasoning is nothing but a pointless waste of time.

What mainstream economics took over from Ricardo was not only the theory of comparative advantage. The whole deductive-axiomatic approach to economics that is still at the core of mainstream methodology was taken over from Ricardo. Nothing has been more detrimental to the development of economics than going down that barren path.

Ricardo shunted the car of economic science on to the wrong track. Mainstream economics is still on that track. It’s high time to get on the right track and make economics a realist and relevant science.

This having been said, I think the most powerful argument against the Ricardian paradigm is that what counts to day is not comparative advantage, but absolute advantage.

What has changed since Ricardo’s days is that the assumption of internationally immobile factors of production has been made totally untenable in our globalised world. When our modern corporations maximize their profits they do it by moving capital and technologies to where it is cheapest to produce. So we’re actually in a situation today where absolute — not comparative — advantages rules the roost when it comes to free trade.

What has changed since Ricardo’s days is that the assumption of internationally immobile factors of production has been made totally untenable in our globalised world. When our modern corporations maximize their profits they do it by moving capital and technologies to where it is cheapest to produce. So we’re actually in a situation today where absolute — not comparative — advantages rules the roost when it comes to free trade.

And in that world, what is good for corporations is not nec