From C. P. Chandrasekhar and Jayati Ghosh We are nearing the tenth anniversary of the collapse of Lehman Brothers in the United States that sparked a Global Financial Crisis,affecting every economy in significant ways. That crisis generated extraordinary monetary policy responses in the advanced economies, with low interest rates and unprecedented expansion of liquidity, in an effort largely driven by central banks to keep their economies afloat. By contrast, expansionary fiscal policy was barely used after the first initial stimulus. In the event, even with these incredibly loose monetary policies, the advanced economies have generally spluttered along, with periodic hopes of recovery dashed by repeated slowdowns – even as asset market bubbles have emerged once again. But the

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from C. P. Chandrasekhar and Jayati Ghosh

We are nearing the tenth anniversary of the collapse of Lehman Brothers in the United States that sparked a Global Financial Crisis,affecting every economy in significant ways. That crisis generated extraordinary monetary policy responses in the advanced economies, with low interest rates and unprecedented expansion of liquidity, in an effort largely driven by central banks to keep their economies afloat. By contrast, expansionary fiscal policy was barely used after the first initial stimulus. In the event, even with these incredibly loose monetary policies, the advanced economies have generally spluttered along, with periodic hopes of recovery dashed by repeated slowdowns – even as asset market bubbles have emerged once again.

But the developing world was supposed to be different;its economies were supposedly more able to continue expanding because of the “catching up” propensities assumed by mainstream theorists. There was much talk of the “decoupling” of developing and advanced economies, with China and some other countries emerging as alternative growth poles – but this proved to be wrong.

It is certainly true that China, generally following more heterodox policies with substantial state direction of the economy, continued to show rapid (but decelerated) growth; and India also continued to grow reasonably fast, although much of that growth reflected increases in finance and public administration. However, overall the developing world turned out to be much more dependent upon growth in the advanced economies, and over the past decade, their economic expansion also slowed.

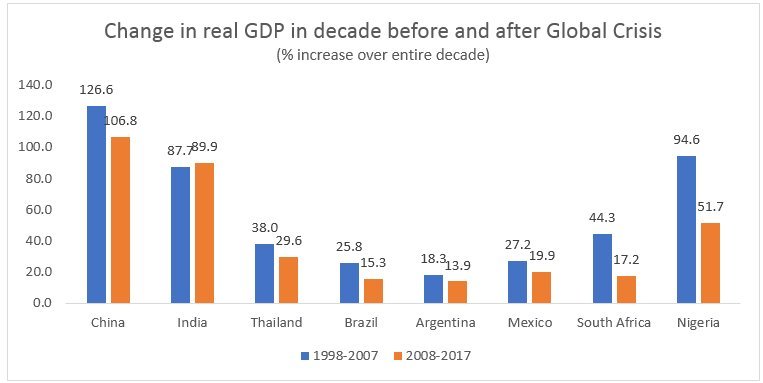

Figure 1: Major developing countries had lower growth in the decade after the crisis

Source for all figures: World Bank World Development Indicators online

Figure 1 describes aggregate real economic output growth in the decade leading up to the global crisis and the decade thereafter in some major developing economies/emerging markets. (It is worth remembering that the first period also included a global recession, in 2001-02.) Other than India, where there was a slight increase, all the other economies had less expansion than in the previous decade, in some cases very substantially so.

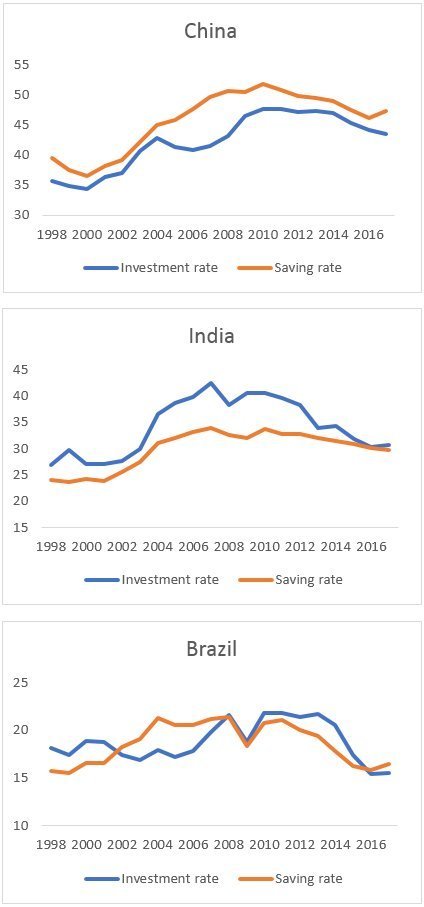

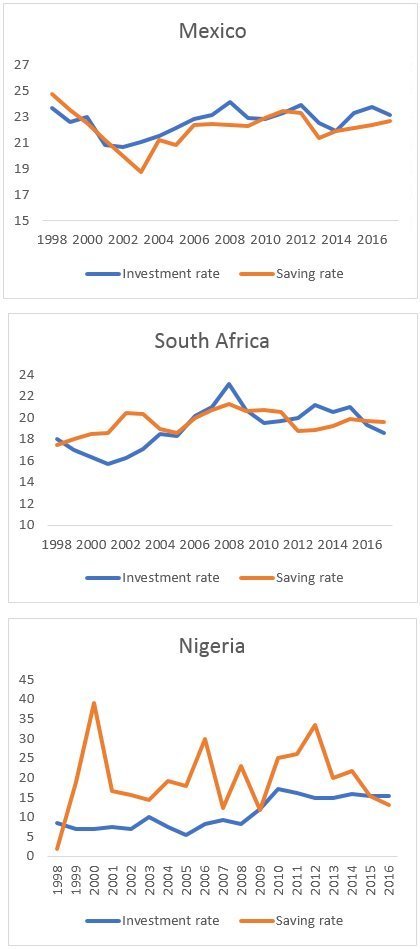

This deceleration reflected another feature, which surprisingly many countries of the developing world also had in common – a reduction in aggregate investment rates, typically accompanied by falling savings rates as well. Figure 2 shows investment and savings rates (gross capital formation and gross savings as proportion of GDP) in six major developing countries – the two largest in each developing region.

In four of these countries, investment rates showed declining trends – in some cases very sharp falls – after 2010. (The exceptions, Mexico and Nigeria, simply showed stagnation around relatively low levels.) China had exceptionally high rates of investment that crossed half of GDP in 2010, and reducing such very high levels has been very much part of the Chinese government’s efforts to rebalance the Chinese economy towards domestic consumption demand. But for the other five countries low investment rates are involuntary and undesired: they still need to increase their investment levels if their development project is to continue.

In India, for example, the falling investment rates have been a major source of policy concern for several years now, but various efforts to revive it have not been successful. In Brazil the steep decline in investment rates has been associated with near crisis and political turmoil. In South Africa and Argentina this decline has fed into other significant problems such as poor employment generation and lack of diversification.

Figure 2: Investment and savings rates (per cent of GDP)

Obviously, the factors behind falling and low investment rates (and to a lesser extent, savings rates) would be specific to each economy. But nevertheless, the broad common pattern is striking. It is true that this relates to only six countries, but they constitute the largest economies in three very distinct developing regions, and there is no immediately evident reason why they should all share this common feature.

So what is it about the global economy that is creating conditions for such a generalised decline in investment rates? The Chinese experience should be treated differently for reasons mentioned earlier, and also because even with the recent decline, China’s investment rate remains excessively high. But the experience of the other economies points to the limitations of accepting the now-standard neoliberal approach to economic policy.

The prevailing macroeconomic policy model focusses on fiscal consolidation whatever the circumstances, and on more regressive tax strategies that privilege the rich; relies on export demand as the main engine of growth; and therefore suppresses wage incomes and domestic demand. These together generate outcomes that do not allow domestic markets to expand as they could, which obviously acts as a disincentive to investment. If many or even most countries rely on this strategy, global demand is further inhibited,

And in the prevailing uncertain global climate, when trade itself has become another battleground, such concerns become magnified for potential investors, who prefer to take easy pickings in the financial markets rather than engage in productive investment with unknown consequences.Real investment therefore suffers, and further impacts on output.

As long as developing countries remain tethered to the advanced economies – not just in terms of market integration but also, perhaps even more tellingly, in terms of approach to policy making – these problems will continue and may get much worse.

(This article was originally published in the Business Line on July 16, 2018)