From C.P. Chandrasekhar and Jayati Ghosh There is no doubt that President Trump is upending global trade. He has unleashed a trade war with China as well as with some of the US’ s purported allies, using grounds of “threats to national security” to impose tariffs on many US imports. The likely retaliation will obviously affect some US exports in turn. The trajectory of world trade suddenly looks quite uncertain – and this will also depress investment across the trading world. So the Trump effect on world trade is clearly just beginning. But the naked self-interest of Trump’s moves, the “America first” orientation declared by the US President should not be interpreted only in the doom saying tones of much of the mainstream media. The truth is that this orientation is not new: US trade

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from C.P. Chandrasekhar and Jayati Ghosh

There is no doubt that President Trump is upending global trade. He has unleashed a trade war with China as well as with some of the US’ s purported allies, using grounds of “threats to national security” to impose tariffs on many US imports. The likely retaliation will obviously affect some US exports in turn. The trajectory of world trade suddenly looks quite uncertain – and this will also depress investment across the trading world.

So the Trump effect on world trade is clearly just beginning. But the naked self-interest of Trump’s moves, the “America first” orientation declared by the US President should not be interpreted only in the doom saying tones of much of the mainstream media. The truth is that this orientation is not new: US trade policy always put the US first – or at the very least, privileged the interests of US capital vis-à-vis all other players. The US strongly influenced the Uruguay Round of the GATT that introduced many new elements into trade negotiations (such as services, intellectual property provisions and trade-related investment measures) to benefit US multinationals.

Subsequently, despite the promises made in the so-called “Doha Round”, the US and other advanced countries simply ignored the genuine demands and concerns about the unfair functioning of the WTO agreements. In other bilateral and plurilateral negotiations, they have aggressively pushed for even stronger rules for intellectual property that enabled monopolies and rent-seeking by their own companies, and then sought to protect them through Investor-State Dispute Settlement mechanisms, with little concern for the impact on other economies. They have denied developing countries the right to ensure their own food security even as they have used the small print of various agreements to continue to give as many subsidies as they like themselves.

The difference is that today President Trump, as the head of the waning superpower, is no longer as interested in supporting the neoliberal order that allowed the US to retain global supremacy for so long, and is happy to declare it as being against US interests. Of course, he will still promote US capital as aggressively as was done before, but the apparently “neutral” rules of the game that were pushed by previous US Presidents are now seen as providing too many opportunities to pretenders, and therefore are sought to be overturned.

This is obviously a challenge for all US trading partners, but this also presents many developing countries with significant opportunities. Periods of global capitalist instability are generally seen as dark times, but through history they have also been periods when the established international division of labour (which tends to get cemented in more stable times) was changed, because they allowed newly industrialising countries to access markets and have some freedom in their own industrial policies.

But even before the breakout of a trade war, which seems more and more possible, how much has the Trump administration already affected US trade patterns? In the absence of clear policies over the past year, even the bellicose statements and threats made by the US President could be expected to have some impact. So let us examine the trade patterns of the US over the period of the second Obama administration and the first year of the Trump regime, to see if there was any significant change.

Chart 1 describes the quarterly shares of the US in world merchandise trade, the area in which Trump claims that the US has been “exploited” by trading partners because of its large deficits. There is of course an obvious logical fallacy here, of treating net exports as inherently more advantageous even for the holder of the world’s reserve currency. But in fact, as evident from Chart 1, US shares of both global exports and imports (which increased from 2011 to the end of 2014, began declining in the first quarter of 2015 in the middle of Obama’s second tenure. This has continued into Trump’s first year – but over this later period the US trade deficit widened after reducing for several years.

Chart 1.

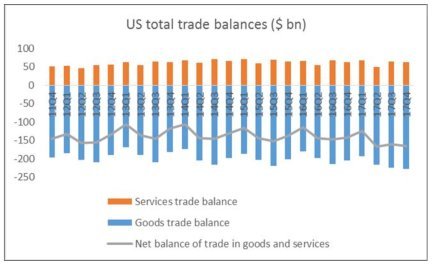

It is well known that merchandise trade represents only a part of total trade, and services trade has increased sharply in the period of globalisation. Chart 2 shows that the US has had surpluses in services trade, so that the net trade balance in both goods and services is somewhat lower. Here too, the broadly cyclical pattern of the previous four years continued into Trump’s first year. Even so, the increase in the merchandise trade deficit was so large that the services surplus could not compensate, and the net deficit has been increasing sharply after Trump came to power. It is true that the US economy grew faster last year, which would have affected imports as well. But the interesting point to note is that the services trade surplus did not increase as much as could be expected.

Chart 2.

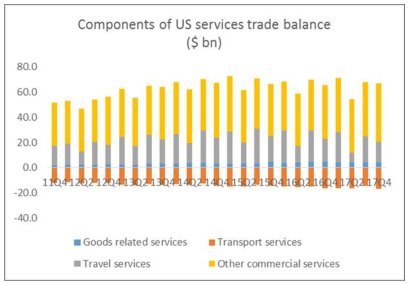

The breakdown of the US services balance, shown in Chart 3, is revealing. The US has a deficit in transport services, which tend to be related to its volume of trade. Travel services have been volatile, but the net export of such services (essentially through tourism) declined in the past year. The big story is in other commercial services, which includes the range of services in which US companies are globally competitive: construction; insurance and pension services; charges for the use of intellectual property; telecommunications, computer and information services; other business services; and personal, cultural and recreational services. The trade balance in this category increased significantly from $164 bn in the last year of the Obama administration, to $175 bn in the first year of President Trump. For whatever reason, the rents of UN MNCs from various kinds of intellectual property and market dominance in media and entertainment industries, as well as the sector so beloved of the US President, construction – have already shown even greater increases during his tenure so far.

Chart 3.

What are the implications of all this for the US’s trading partners? The obvious lessons are already well known: do not expect any concessions from the US on any front and watch your own back. But there are other less obvious lessons. Pious neoliberal multilateralism, as expressed in the rules and operations of the WTO, created a system of monstrous but legally entrenched inequalities. The implosion of that system lays bare some of its hypocrisy. Perhaps smashing the myth of benign intent will allow all countries to demand policy space to address the real concerns of their own citizens.

(This article was originally published in the Business Line on June 18, 2018)