From Jamie Morgan and the current issue of RWER What mainstream economics has become creates limits on what society can be because mainstream economics is an extremely powerful source of ideational content. This is not just a matter of what cannot be explored without models or datasets, since many things that can be explored in this way are not actually explored and some that are, are deformed. One well-known current example is inequality. This problematic was conceptually invisible within the mainstream prior to the popularity of Piketty’s Capital in the Twenty First Century (2014) despite more than two decades of growing (if variable) wealth and income inequality (within states rather than necessarily between them), and despite longstanding work by James Galbraith and others. As

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Jamie Morgan and the current issue of RWER

What mainstream economics has become creates limits on what society can be because mainstream economics is an extremely powerful source of ideational content. This is not just a matter of what cannot be explored without models or datasets, since many things that can be explored in this way are not actually explored and some that are, are deformed. One well-known current example is inequality. This problematic was conceptually invisible within the mainstream prior to the popularity of Piketty’s Capital in the Twenty First Century (2014) despite more than two decades of growing (if variable) wealth and income inequality (within states rather than necessarily between them), and despite longstanding work by James Galbraith and others. As Piketty notes, this was not accidental, it was a consequence of the dominant conceptual constructs, mindsets and lack of empirical curiosity amongst economists.

The idea that marginal productivity in competitive markets equals to its price means, from a normative point of view, that labour is paid what it is worth (naturalising social division). Trickle down assumptions lead economists to anticipate incomes are all growing and wealth diffuses (rather than power allows wealth to be captured, concentrated and protected). Given the prevalence of these kinds of ideas and assumptions, little attempt was actually made to establish or critique the relations that were assumed, and this in turn, was reinforced by a reluctance to go beyond standardised tests of readily available datasets. This highlights how the economist’s skillset can be an impediment to empirical work, since testing data is not the same as seeking out all available evidence, some of which only comes into view if one is prepared to think in terms of a range of methods and sources – for Piketty that was many different types of tax record (see Pressman, 2015). Mainstream economics has subsequently been required by circumstance to address inequality. However, its prior invisibility – and focus on incentives to individuals and firms – meant in effect that the most powerful social science discourse acted to reinforce growing inequality, since it was to economics one would look for argument and evidence regarding it as a possible problem.

And to be clear, despite new focus on it, mainstream economics has still not fully reconciled to inequality as a problem. For example, mainstream theory does not usually differentiate between different social groups in terms of the impacts of distribution, so it provides no theorisation of the real effects of inequality, including the benefits of raising wages for targeted multiplier effects or their retardation through “hysteresis” effects. Mainstream theory still tends to assume that it is education, skills and competition that determine wages, thereby presupposing a particular account of competitive markets and the market mechanism. This is despite that the value of education and skills, and the nature of competition, are dependent on the rules of bargaining domestically, and the rules of trade internationally. Changes in these provide the actual explanatory grounds for the institutional effects that create the scope for inequality to rise (Morgan, 2015).[1]

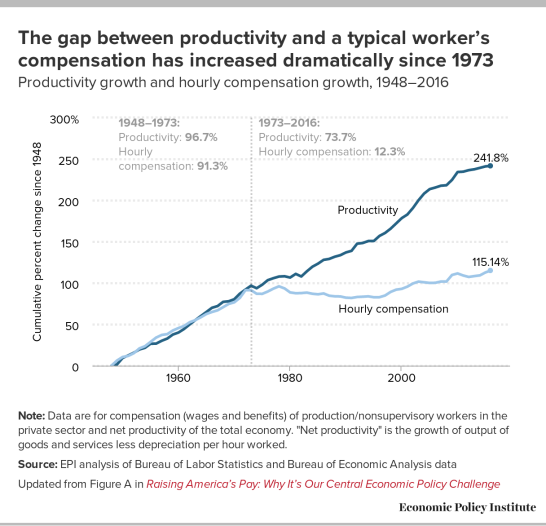

The same problem holds for the other main facet of theory, which is that the fundamental engine of income growth is productivity growth. This may well be its context, but it is one subject to distribution. In most wealthy countries productivity and wage growth have been divergent for decades, and nowhere is this more evident than in the US:

So, there is something partial in the blithe statement that if labour wants higher wages in the near future it must first deliver higher productivity in order for this to be affordable. This assumes a fixed relation between wages and productivity and a fixed line of causation for any wage effect (based on a definite relation to, for example, “human capital”). This simply ignores the role of mechanisms that affect distribution. Or perhaps more accurately, this makes it a problem to be modelled in ways restricted by mathematical expression – which has been the case in contemporary “matching” models. The existence of divergence establishes that fixed relations have not applied. Moreover, the way in which it has not been the case has had political consequences. CEO pay is nominally performance based, but has grown in ways that grossly exceed any fixed relation to metrics of corporate activity (which has not prevented attempts to justify top-layer pay, for example, Gabaix and Landier, 2008, which re-specifies Rosen’s 1981 work on “superstars”; and contrast this with Bolchover, 2010).

Populist anger has many sources, but one of them is likely the sense of injustice that is provoked by changes in the world that economics has facilitated and then failed to address. To reiterate, the invisibility of inequality has subsequently become a problem field mainstream economics has not fully reconciled to. Things that can be explored are not and in so far as they are, they are deformed. This, as should be clear from the above, has ideational content and consequence that exceeds the formal statement of theory. It involves implicit principles of what is just (paid what one is worth). Moreover, it involves theory-driven assumptions about foci for research based on what variables are important mechanisms for progress in income and wealth effects, which are manifestly misleading (the dominant picture of relevant mechanisms and processes seems thus inadequate).

Early on I noted that few mainstream economists would feel the need to respond to accusations or claims that they are neoliberal ideologues relying on positivist philosophy of science. In fact, research tends to indicate many economists (in Europe and the US) would identify as politically liberal in the US sense of the term, meaning they consider themselves socially progressive, centrist or left leaning. This is not irrelevant, but this is not the most relevant way to position mainstream economists. They may not be ideologues (some are, but that is true of any field), but economics has form and function, it has ideational content, absence and consequence.[2] The focus and practice of the profession occludes this and decentres it, since economists are not encouraged as economists to be concerned with this normativity. Its lack affects the empirical field. read more

[1] Which arguably is why much of the effect is observed – the statistical differences – within states rather than between states. Every country where common policy tenets apply may experience wealth and income concentration even as some benefit more than others from globalized relations – uneven accumulation and its wage effects may also serve to equalize the distribution of income and wealth among states.

[2] Note: this point is not intended to under-emphasize the importance of those who have had the specific intent of transforming the ideational landscape. The point addresses the vast majority of the many 1,000s of economists, not the role of Mont Pelerin, the willed construction of a Washington Consensus etc. The two are, in many ways related, but this does not speak to the self-understanding of the majority.