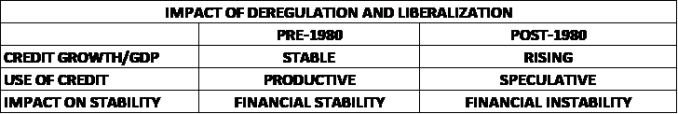

From John Balder and the current issue of RWER In addition to the explosive growth in credit, the manner in which credit was deployed also shifted toward financing transaction in housing and other assets (e.g., equities, bonds, et al). As noted above, up until the early 1980s, credit was used mostly to finance production of goods and services. Growth in credit from 1945 to 1980 was closely linked with growth in incomes. The incomes that were generated were then used to amortize and eventually extinguish the debt. This represented a healthy use of debt; it increased incomes and introduced negligible financial fragility. However, as constraints were lifted, credit creation shifted toward asset-based transactions (e.g., real estate, equities bonds, etc.). This transition was also fueled

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from John Balder and the current issue of RWER

In addition to the explosive growth in credit, the manner in which credit was deployed also shifted toward financing transaction in housing and other assets (e.g., equities, bonds, et al). As noted above, up until the early 1980s, credit was used mostly to finance production of goods and services. Growth in credit from 1945 to 1980 was closely linked with growth in incomes. The incomes that were generated were then used to amortize and eventually extinguish the debt. This represented a healthy use of debt; it increased incomes and introduced negligible financial fragility.

However, as constraints were lifted, credit creation shifted toward asset-based transactions (e.g., real estate, equities bonds, etc.). This transition was also fueled by the record-high (double-digit) interest rates in the early 1980s and the relatively low risk-adjusted returns on productive capital. The expansion of credit lifted asset prices, fueling creation of more credit. Over time, financial innovations, including securitization and derivative instruments, also contributed to the explosive growth in trading activities that accompanied asset price appreciation.

Unlike credit allocated to the production of goods and services, a decision to allocate credit to finance transactions in already existing assets (e.g., home mortgages) does not increase value-added or GDP (wealth-effects aside). As the International Currency Review stated in December 1987:

“Financial markets are quite special. They are subject to particular sources of instability that are not well understood and that have much more to do with the psychology of crowd behavior than with the behavior of goods markets. This kind of latent instability does not affect product markets at all.”

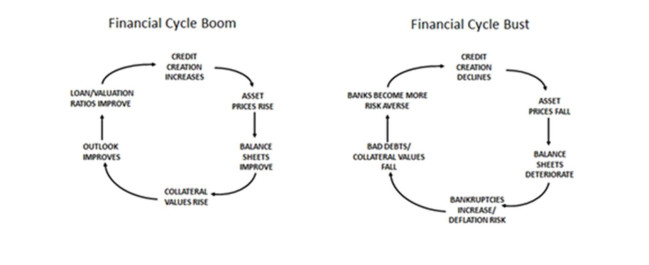

Positive feedbacks between credit growth and asset prices during the neoliberal era is illustrated in the stylized boom-bust cycle description below. The full scope of these relationships reflects the role of “crowd psychology” in unconstrained (self-regulating) financial markets. Ultimately, this process is not sustainable, as “trees do not grow to the sky.” When this process unwinds, it can trigger a severe financial crisis.

Financial deregulation and the shift to neoliberal policies spurred financial cycles that previously were dormant throughout the postwar era (1945-1980). Importantly, asset price appreciation does not result in creation of value. If the price of an asset increases, the gains to the seller are offset by the increased cost to the buyer. For example, if Susan makes a $40,000 profit on the sale of her house, the purchaser must pay the higher price. A financial transaction necessarily has both a buyer and a seller. If the price of the house rises, the seller benefits, but the buyer pays the higher price. From a wealth creation perspective, this transaction is necessarily zero-sum (negative-sum, once fees are included). In brief, wealth has been redistributed, not created. This distinction between wealth creation and wealth distribution is at the heart of financial crises, given that credit-induced asset price booms ultimately are not sustainable (though admittedly, the precise timing of the reversal is highly uncertain, given what Keynes properly described as “animal spirits.”).

From 1980 to 2007, rapid credit growth primarily fueled transactions in already existing assets (mostly real estate), not real productive growth.[1] In addition to extensive lending to households during this period, lending by financial firms to other financial firms increased from $0.5 trillion in 1980 to more than $18 trillion in 2008, or from 20% to 123% of GDP. This activity reflected the securitization process and the growth of extensive inter-connections between financial institutions that heightened systemic risk.

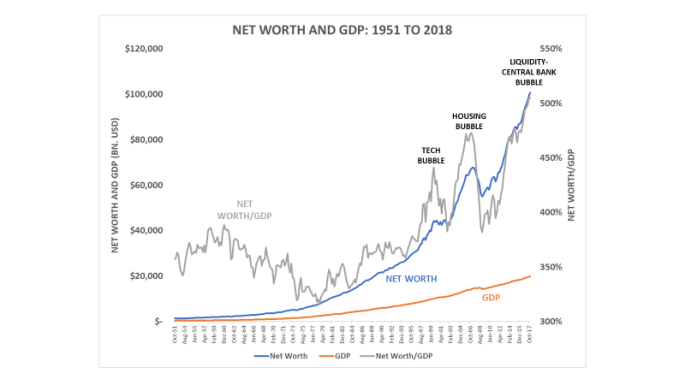

The easing of quantitative restrictions on credit creation powered positive feedbacks between credit growth and asset price appreciation that fueled serial boom-bust cycles between the late-1980s and 2007. Household net worth increased from $9 trillion (1980) to close to $68 trillion in 2007, before falling to $55 trillion during the GFC. In response to the liquidity-induced QE-bubble engineered by the Fed and other central bank since the crisis ended, US household net worth today stands at a record $101 trillion (505% of GDP).

[1] The Quantity Theory of Money implicitly assumed that credit is deployed only to support production of goods and services. However, from the early 1980 to 2007, and even more so from 2000 to 2007, most credit targeted the financial circuit, or the Finance, Real Estate and Insurance (FIRE) sector. This distinction explains the reasons for the decline in velocity that began during the 1980s. For more see Werner (2012).