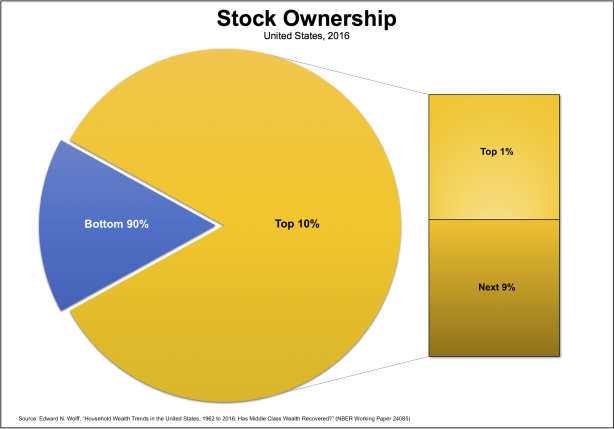

David Ruccio Ed Wolff is right: For the vast majority of Americans, fluctuations in the stock market have relatively little effect on their wealth, or well-being, for that matter. That’s because, as his research shows (and as I illustrate in the chart above), the bottom 90 percent of Americans own (either directly or indirectly) a tiny share—16 percent—of total stock value in the United States.* The rest is owned by the top 10 percent: 40.3 percent by just the top one percent (with a net worth in 2016 of ,257,000 or more) and 43.6 percent by the next nine percent (who have a net worth between ,143,200 and ,257,000). The fact is, the only real wealth owned by the vast majority of Americans is their principal residence. Otherwise, they’re forced to have the freedom to get by on

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

David Ruccio

Ed Wolff is right:

For the vast majority of Americans, fluctuations in the stock market have relatively little effect on their wealth, or well-being, for that matter.

That’s because, as his research shows (and as I illustrate in the chart above), the bottom 90 percent of Americans own (either directly or indirectly) a tiny share—16 percent—of total stock value in the United States.* The rest is owned by the top 10 percent: 40.3 percent by just the top one percent (with a net worth in 2016 of $10,257,000 or more) and 43.6 percent by the next nine percent (who have a net worth between $1,143,200 and $10,257,000).

The fact is, the only real wealth owned by the vast majority of Americans is their principal residence. Otherwise, they’re forced to have the freedom to get by on their wages and salaries—not dividends or capital gains—and, when they retire, on their meager pensions and Social Security. Those at the top are the ones who are most involved in the stock-market casino.

But that doesn’t mean the rest of us shouldn’t be worried, perhaps especially when the stock market is booming. That’s because stock prices are correlated with both corporate profits and income inequality. More surplus is being extracted and then distributed to be used—by corporations and wealthy individuals—to purchase corporate equities, thus driving up stock prices and making existing inequalities even more obscene. The rest of Americans are increasingly being left behind, subject to the dictates of their employers and the decisions made by those at the top.

And when that same group at the top decides to sell—because they’re worried about workers’ wages (which are still barely rising) or inflation (because interest rates may rise, thus making the money they borrow more expensive)—stock prices go through a “correction.”

No, the members of the bottom 90 percent are not much affected in terms of their wealth but they are buffeted by the resulting decisions taken by their employers and the small group of wealthy, stock-owning individuals—to accumulate capital or not in a particular line of business (which affects workers and their communities), to pursue changes in government policies in terms of both revenues (because they’d rather lend money to finance government deficits instead of being taxed) and expenditures (these days, to further weaken what remains of the social safety net), and so on. All of them decisions that are completely outside and beyond control of the members of the 90 percent.

So, while the stock market is a speculative casino that is driven by decisions and mostly affects the wealth of the top 10 percent, its fluctuations reverberate throughout the rest of the economy and society—both on the way up and on the way down.

That’s why everyone, especially the vast majority who don’t own much in the way of stocks, should be worried. Not of course in the same way as those who have a direct stake in the stock market, who make and lose fortunes on a daily basis. Just in the past two decades (in 2001 and then again in 2008), people have seen how there’s no clear separation or dividing line between Main Street and Wall Street. The decisions concerning the vast surplus those at the top appropriate and control are driving the current fluctuations on both streets.

What should most worry the members of the bottom 90 percent is the fact that, within capitalism, the individually rational decisions of those at the top—including the decisions or whether to buy or sell stocks—can and often do have social ramifications.

Our worries are different, which is precisely why it’s time for those at the bottom to imagine and enact a radically different set of economic and social institutions.

*Stock ownership includes direct ownership of stock shares and indirect ownership through mutual funds, trusts, and IRAs, Keogh plans, 401(k) plans, and other retirement accounts.