From David Ruccio Almost 30 thousand people joined the ranks of the global super-rich last year, as booming global stock markets and corporate profits boosted the fortunes of the already very-rich and bumped them up into the ultra-high-net-worth bracket. The global population of ultra-high-net-worth people, classed as those with more than million in assets, increased by 12.9 percent last year to a record 255,810 people, while their combined wealth surged by 16.3 percent to .5 trillion, according to a report by research firm Wealth-X. Not surprisingly, most of the gains were captured by those at the very top of the global wealthy pyramid. While all six tiers recorded double-digit growth in ultra wealthy numbers of between 13 and 15 percent, the fastest- growing tier was

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Almost 30 thousand people joined the ranks of the global super-rich last year, as booming global stock markets and corporate profits boosted the fortunes of the already very-rich and bumped them up into the ultra-high-net-worth bracket.

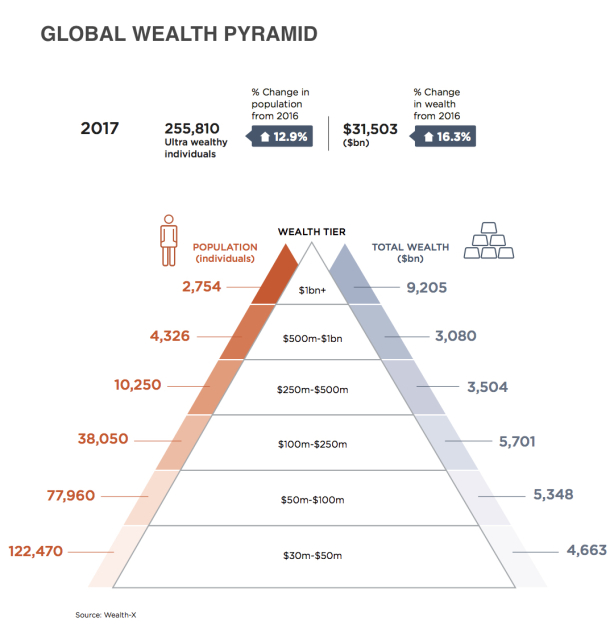

The global population of ultra-high-net-worth people, classed as those with more than $30 million in assets, increased by 12.9 percent last year to a record 255,810 people, while their combined wealth surged by 16.3 percent to $31.5 trillion, according to a report by research firm Wealth-X.

Not surprisingly, most of the gains were captured by those at the very top of the global wealthy pyramid. While all six tiers recorded double-digit growth in ultra wealthy numbers of between 13 and 15 percent, the fastest- growing tier was that of billionaires, which increased by a net 357 to a record high of 2,754 individuals. Almost half (48 percent) of the global ultra wealthy population had a net worth of between $30 million and $50 million, with the number of individuals in each tier diminishing steadily as the wealth pyramid rises. Average net worth for the approximately 122,500 ultra-high-net-worth individuals in the lower tier was $38 million, rising to $342 million for those in the $250-500-million bracket, and a substantial $3.3 billion for the elite group of billionaires. On a collective basis, only those individuals in the top two tiers of the pyramid—with a net worth of more than $500 million—experienced an increase in average net worth in 2017.

All of that makes perfect sense, given the trajectory of global capitalism during 2017. Notwithstanding the fears occasioned by surprising political events (such as the protracted negotiations for Brexit and the vagaries of Donald Trump’s presidency), the fact is last year represented a “sweet spot” for the tiny group at the top of the global economy, “supporting robust wealth gains in the financial, commodity, technology and industrial sectors.”

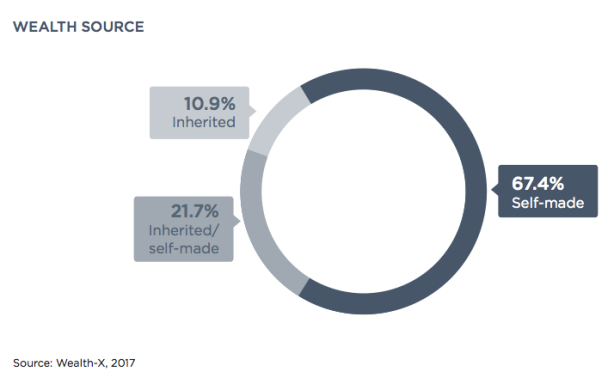

But then the folks at Wealth-X want us to believe that most of the wealth was “self-made,” based on market conditions that

were clearly supportive of personal enterprise and successful investment, driven by higher financial-sector returns, entrepreneurial wealth creation in Asia and further dynamic growth in technology-related industries.

Clearly, this is not the kind of wealth that represents the property of small artisans and peasant farmers, which in fact is being marginalized and destroyed on a daily basis by the growth of finance, manufacturing, and technology—the primary sources of the wealth of the world’s ultra-high-net-worth people.

Nor is it the property of the working-class, since the wealth they create stands opposed to them and serves as the means of extracting even more surplus from the growing army of wage-laborers across the globe—in Asia, Africa, the Pacific, Latin America and the Caribbean, the Middle East, Europe, and North America.

There’s nothing hard-won, self-acquired, or self-earned about the wealth owned by the world’s ultra-high-net-worth individuals. With their cadre of accountants, tax advisers, and financial consultants (not to mention the politicians whose campaigns they finance), they manage to capture, invest, and keep in the form of cash a large portion of the surplus created by workers toiling away in factories and offices around the planet.

Their personal property is therefore social wealth, created by the united action of all members of society. Only when it is made into common property, into the property of all members of society, will it lose its antagonistic class character.