From David Ruccio The majority of government expenditures in the United States go towards social insurance and means-tested transfers.* And the good news is, they work. According to recent report by Bruce D. Meyer and Derek Wu, Social Security cuts the poverty rate by a third—more than twice the combined effect of the five means-tested transfers. Among those transfers, the Earned-Income Tax Credit and food stamps (officially, the Supplemental Food Assistance Program) are most effective. All programs except for the tax credit sharply reduce deep poverty (below 50 percent of the poverty line), while the impact of the tax credit is more pronounced at 150 percent of the poverty line. For the elderly, Social Security single-handedly slashes poverty by 75 percent, more than 20 times the

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

The majority of government expenditures in the United States go towards social insurance and means-tested transfers.* And the good news is, they work.

According to recent report by Bruce D. Meyer and Derek Wu, Social Security cuts the poverty rate by a third—more than twice the combined effect of the five means-tested transfers. Among those transfers, the Earned-Income Tax Credit and food stamps (officially, the Supplemental Food Assistance Program) are most effective. All programs except for the tax credit sharply reduce deep poverty (below 50 percent of the poverty line), while the impact of the tax credit is more pronounced at 150 percent of the poverty line. For the elderly, Social Security single-handedly slashes poverty by 75 percent, more than 20 times the combined effect of the means-tested transfers.** Supplemental Security Income, Public Assistance, and housing assistance have the highest share of benefits going to the pre-transfer poor, while the tax credit has the lowest.***

And the bad news?

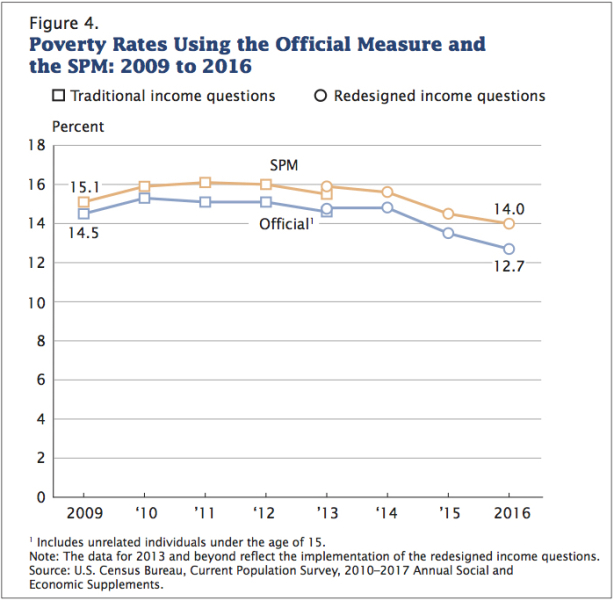

Even after all those expenditures, more than one tenth of Americans are still struggling to survive at or below the poverty line—12.7 percent according to the official poverty measure, 14 percent according to the Supplemental Poverty Measure.****

U.S. capitalism leaves such a large portion of the population in destitute circumstances that even massive public spending has not been able to solve the problem. In other words, anti-poverty programs work—but the mountain of poverty created by the American economy is simply too large to overcome.

But wait, it gets worse.

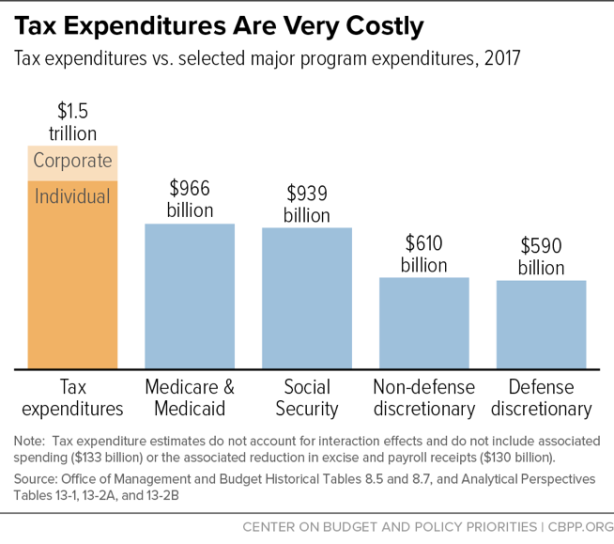

Every year, the federal government doles out billions in “tax expenditures” to corporations (especially those that allow multinational companies to delay paying U.S. taxes on their foreign profits and “accelerated depreciation,” effectively a tax subsidy for spending on machinery and equipment) and individuals (through deductions for retirement savings, employer-sponsored health plans, mortgage-interest payments and, sweetest of all, income from watching the value of your home, stock portfolio, and private-equity partnerships grow). According to the Center on Budget and Policy Priorities, the total of all federal income tax expenditures in 2017 was higher than Social Security, the combined cost of Medicare and Medicaid, or the combined cost of defense and non-defense discretionary spending.

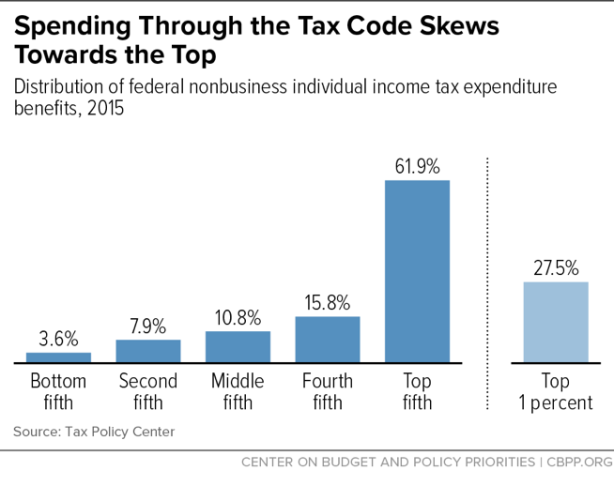

The bulk of each year’s spending on individual tax expenditures is delivered in the form of deductions, exemptions, or exclusions. The value of these tax breaks increases as household income rises: the higher one’s tax bracket, the greater the tax benefit for each dollar that is deducted, exempted, or excluded. As a result, these tax expenditures provide their largest subsidies to high-income people (27.5 percent to the top 1 percent in 2015), even though they are the individuals least likely to need financial incentives to engage in the activities that tax expenditures are generally designed to promote, such as buying a home, sending a child to college, or saving for retirement. Meanwhile, moderate- and low-income families receive considerably smaller tax-expenditure benefits for engaging in these activities (only 22.3 percent for the bottom 60 percent of American taxpayers).

Eliminating those welfare programs for the rich would go a long way toward improving and expanding the anti-poverty programs for the nation’s poor.

Alternatively, the American economy could be reorganized so that it doesn’t generate such obscene levels of poverty in the first place, thereby eliminating the need for the endless debates about the size and nature of government programs to help the poor.

*Social insurance programs are available to all individuals who have experienced unfortunate circumstances or are aged. These programs include Social Security retirement and disability insurance, unemployment insurance, and Medicare. Means-tested transfers provide cash or in-kind assistance to only those with the lowest incomes. These programs include the Supplementary Nutrition Assistance Program (formerly, food stamps), Supplemental Security Income, and Public Assistance, as well as certain tax credits, housing assistance, and Medicaid. All told, according to my calculations (based on the historical tables from the White House Office on Management and Budget), these programs constituted 60 percent of all federal outlays in 2015, in addition to a large share of state and local spending.

**Another consequence of Social Security, as noted by Christina Gibson-Davis and Christine Percheski, is that the net wealth across the range of elderly households grew from 1989 to 2013 since “With stable income, fewer older people dipped into savings to pay their bills, and they had more money to invest”—in contrast to households with children most of whose wealth declined during that same period.

***The Supplemental Security Income program is a federal cash-assistance program specifically targeting individuals with low incomes and who are also aged (65 or over), blind, or disabled. Public Assistance broadly refers to benefits (often in the form of cash welfare) offered by state and local governments to needy families and individuals. An especially prominent program is the Temporary Assistance for Needy Families program, which is federally funded but run by states and targeted to low-income families with children. The Earned-Income Tax Credit is given to individuals and couples with positive earnings, especially those with qualifying children. Federal agencies as well as states and localities offer a wide variety of housing assistance programs, including rental houses or apartments that are managed by local housing agencies and funded by the Department of Housing and Urban Development and vouchers to tenants who are free to choose any housing that meets minimum health and safety standards.

****The supplemental measure extends the official poverty measure by taking account of many of the government programs designed to assist low-income families and individuals that are not included in the official poverty measure.