From Lars Syll There is something that just does not sit very well with Oxford macroeconomist Simon Wren-Lewis’ view of modern macroeconomics. On more than one occasion has this self-proclaimed ‘New Keynesian’ macroeconomist approvingly written about the ‘impressive’ theoretical insights New Classical economics has brought to macroeconomics. In one of his latest blog posts he once again shows how devoted he is to the Chicago übereconomists and their modelling endeavours (emphasis added): DSGE models are firmly entrenched in academic macroeconomics, and in pretty well every economist that has done a PhD, which is why the Bank of England’s core model is DSGE … Have a look at almost any macro paper in a top journal today, and compare it to a similar paper before the NCCR, and you can

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

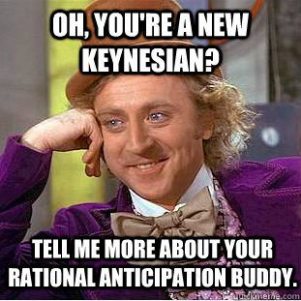

There is something that just does not sit very well with Oxford macroeconomist Simon Wren-Lewis’ view of modern macroeconomics. On more than one occasion has this self-proclaimed ‘New Keynesian’ macroeconomist approvingly written about the ‘impressive’ theoretical insights New Classical economics has brought to macroeconomics. In one of his latest blog posts he once again shows how devoted he is to the Chicago übereconomists and their modelling endeavours (emphasis added):

There is something that just does not sit very well with Oxford macroeconomist Simon Wren-Lewis’ view of modern macroeconomics. On more than one occasion has this self-proclaimed ‘New Keynesian’ macroeconomist approvingly written about the ‘impressive’ theoretical insights New Classical economics has brought to macroeconomics. In one of his latest blog posts he once again shows how devoted he is to the Chicago übereconomists and their modelling endeavours (emphasis added):

DSGE models are firmly entrenched in academic macroeconomics, and in pretty well every economist that has done a PhD, which is why the Bank of England’s core model is DSGE … Have a look at almost any macro paper in a top journal today, and compare it to a similar paper before the NCCR, and you can see we have been through a methodological revolution … If you are expecting me at this point to say that DSGE models where were macroeconomics went wrong, you will be disappointed … Moving to DSGE involved losses as well as gains. It inevitably made models less rich and moved them further away from the data in areas that were difficult but not impossible to model in a theoretically consistent way. The DSGE methodological revolution set out so clearly in Lucas and Sargent’s paper changed the focus of macroeconomics away from things we now know were of critical importance.

If moving to DSGE meant not being able to tackle things of “critical importance,” and makes economic models “less rich” and further away from real-world data, why still ultimately defend it? And does “consistency” really trump every other model consideration? You do, of course, expect that of New Classical Chicago economists. But a ‘Keynesian’ macroeconomist?

To Wren-Lewis the ‘New Keynesian’ acceptance of rational expectations, representative agents and microfounded DSGE models is, at the end of the day, something good, perhaps even a “gain.” Not all economists (yours truly included) share that view:

While one can understand that some of the elements in DSGE models seem to appeal to Keynesians at first sight, after closer examination, these models are in fundamental contradiction to Post-Keynesian and even traditional Keynesian thinking. The DSGE model is a model in which output is determined in the labour market as in New Classical models and in which aggregate demand plays only a very secondary role, even in the short run.

In addition, given the fundamental philosophical problems presented for the use of DSGE models for policy simulation, namely the fact that a number of parameters used have completely implausible magnitudes and that the degree of freedom for different parameters is so large that DSGE models with fundamentally different parametrization (and therefore different policy conclusions) equally well produce time series which fit the real-world data, it is also very hard to understand why DSGE models have reached such a prominence in economic science in general.

Neither New Classical nor ‘New Keynesian’ microfounded DSGE macro models have helped us foresee, understand or craft solutions to the problems of today’s economies.

If macroeconomic models – no matter of what ilk – assume representative actors, rational expectations, market clearing and equilibrium, and we know that real people and markets cannot be expected to obey these assumptions, the warrants for supposing that conclusions or hypothesis of causally relevant mechanisms or regularities can be bridged, are obviously non-justifiable. Macroeconomic theorists – regardless of being ‘New Monetarist’, ‘New Classical’ or ‘New Keynesian’ – ought to do some ontological reflection and heed Keynes’ warnings on using thought-models in economics

Wren-Lewis ought to be much more critical of the present state of macroeconomics — including ‘New Keynesian’ macroeconomics — than he is. Fortunately — when you’ve got tired of the kind of macroeconomic apologetics produced by ‘New Keynesian’ macroeconomists like Wren-Lewis there still are some real Keynesian macroeconomists to read. One of them — Axel Leijonhufvud — writes:

For many years now, the main alternative to Real Business Cycle Theory has been a somewhat loose cluster of models given the label of New Keynesian theory. New Keynesians adhere on the whole to the same DSGE modeling technology as RBC macroeconomists but differ in the extent to which they emphasise inflexibilities of prices or other contract terms as sources of shortterm adjustment problems in the economy. The “New Keynesian” label refers back to the “rigid wages” brand of Keynesian theory of 40 or 50 years ago. Except for this stress on inflexibilities this brand of contemporary macroeconomic theory has basically nothing Keynesian about it …

I conclude that dynamic stochastic general equilibrium theory has shown itself an intellectually bankrupt enterprise. But this does not mean that we should revert to the old Keynesian theory that preceded it (or adopt the New Keynesian theory that has tried to compete with it). What we need to learn from Keynes … are about how to view our responsibilities and how to approach our subject.

Wren-Lewis is keen on trying to give a picture of modern macroeconomics as a pluralist enterprise. But the change and diversity that gets Wren-Lewis approval only take place within the analytic-formalistic modelling strategy that makes up the core of mainstream economics. You’re free to take your analytical formalist models and apply it to whatever you want — as long as you do it with a modelling methodology that is acceptable to the mainstream. If you do not follow this particular mathematical-deductive analytical formalism you’re not even considered doing economics. If you haven’t modelled your thoughts, you’re not in the economics business. But this isn’t pluralism. It’s a methodological reductionist straightjacket.

If there really is a proliferation of macromodels nowadays, it almost exclusively takes place as a kind of axiomatic variation within the standard DSGE modelling framework. And — no matter how many thousands of models economists like Wren-Lewis come up with, as long as they are just axiomatic variations of the same old mathematical-deductive ilk, they will not take us one single inch closer to giving us relevant and usable means to further our understanding and explanation of real economies.

When it really counts, Wren-Lewis shows what he is — a mainstream economist fanatically defending the insistence of using a Chicago-style axiomatic-deductive economic modelling strategy. To yours truly, this attitude is nothing but a late confirmation of Alfred North Whitehead’s complaint that ‘the self-confidence of learned people is the comic tragedy of civilization.’