From Lars Syll Economics is perhaps more than any other social science model-oriented. There are many reasons for this — the history of the discipline, having ideals coming from the natural sciences (especially physics), the search for universality (explaining as much as possible with as little as possible), rigour, precision, etc. Mainstream economists want to explain social phenomena, structures and patterns, based on the assumption that the agents are acting in an optimizing (rational) way to satisfy given, stable and well-defined goals. The procedure is analytical. The whole is broken down into its constituent parts so as to be able to explain (reduce) the aggregate (macro) as the result of the interaction of its parts (micro). Building their economic models, modern mainstream

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

Economics is perhaps more than any other social science model-oriented. There are many reasons for this — the history of the discipline, having ideals coming from the natural sciences (especially physics), the search for universality (explaining as much as possible with as little as possible), rigour, precision, etc.

Mainstream economists want to explain social phenomena, structures and patterns, based on the assumption that the agents are acting in an optimizing (rational) way to satisfy given, stable and well-defined goals.

The procedure is analytical. The whole is broken down into its constituent parts so as to be able to explain (reduce) the aggregate (macro) as the result of the interaction of its parts (micro).

Building their economic models, modern mainstream economists ground their models on a set of core assumptions — describing the agents as ‘rational’ actors — and a set of auxiliary assumptions. Based on these two sets of assumptions, they try to explain and predict both individual (micro) and — most importantly — social phenomena (macro).

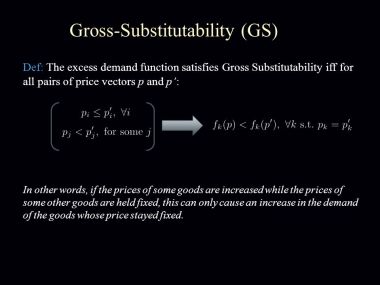

The core assumptions typically consist of complete-ness, transitivity, non-satiation, optimisation, consistency, gross substitutability, etc., etc.

The core assumptions typically consist of complete-ness, transitivity, non-satiation, optimisation, consistency, gross substitutability, etc., etc.

The auxiliary assumptions spatio-temporally specify the kind of social interaction between ‘rational actors’ that take place in the model.

So, the models basically consist of a generalspecification of what (axiomatically) constitutes optimizing rational agents and a more specific description of the kind of situations in which these rational actors act (making the auxiliary assumptions serve as a kind of specification/restriction of the intended domain of application for the set of core assumptions and its deductively derived theorems). The list of assumptions can never be complete since there will always be unspecified background assumptions and some (often) silent omissions (like closure, transaction costs, etc., regularly based on some negligibility and applicability considerations).

The hope is that the ‘thin’ list of assumptions shall be sufficient to explain and predict ‘thick’ phenomena in the real, complex, world.

Empirically it has, however, turned out that this hope is almost never fulfilled. The core — and many of the auxiliary — assumptions turn out to have preciously little to do with the real (non-model) world we happen to live in. And that goes for the gross substitution axiom as well:

The gross substitution axiom assumes that if the demand for good x goes up, its relative price will rise, inducing demand to spill over to the now relatively cheaper substitute good y. For an economist to deny this ‘universal truth’ of gross substitutability between objects of demand is revolutionary heresy – and as in the days of the Inquisition, the modern-day College of Cardinals of mainstream economics destroys all non-believers, if not by burning them at the stake, then by banishing them from the mainstream professional journals …

If the elasticity of substitution between liquid assets and the products of industry is significantly different from zero (if the gross substitution axiom is ubiquitously true), then even if savers attempt to use non-reproducible assets for storing their increments of wealth, this increase in demand will increase the price of non-producibles. This relative price rise in non-producibles will, under the gross substitution axiom, induce savers to substitute reproducible durables for non-producibles in their wealth holdings and therefore non-producibles will not be, in Hahn’s terminology, ‘ultimate resting places for savings’. The gross substitution axiom therefore restores Say’s Law and denies the logical possibility of involuntary unemployment.