One of the tenets of Modern Monetary Theory (MMT) is that taxes are, ceteris paribus, deflationary. When prices of gasoline increase because of green taxes, people have less money left and know that their purchasing power declines. This is not consistent with neoclassical macro, at least not in its influential ‘Ricardian equivalence’ version, but that’s not interesting. The interesting thing is that MMT states that if inflation rises, taxes should increase to cool the economy. Which means that they will have to target some kind of inflation rate. Which rate? I’m not aware of any MMT-ers writing about this (but I might have missed a paragraph here or there from Bill Mitchell). But they should. The price level doesn’t only change because of an overheated economy but also because sales

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

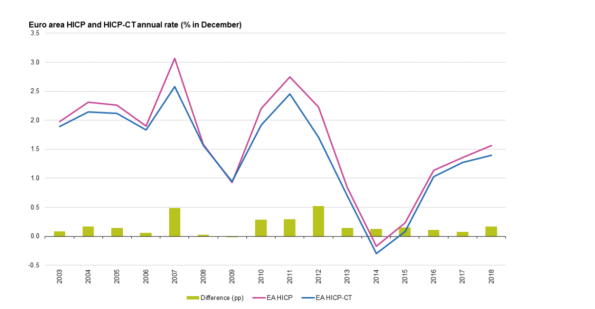

One of the tenets of Modern Monetary Theory (MMT) is that taxes are, ceteris paribus, deflationary. When prices of gasoline increase because of green taxes, people have less money left and know that their purchasing power declines. This is not consistent with neoclassical macro, at least not in its influential ‘Ricardian equivalence’ version, but that’s not interesting. The interesting thing is that MMT states that if inflation rises, taxes should increase to cool the economy. Which means that they will have to target some kind of inflation rate. Which rate? I’m not aware of any MMT-ers writing about this (but I might have missed a paragraph here or there from Bill Mitchell). But they should. The price level doesn’t only change because of an overheated economy but also because sales taxes or VAT or other indirect taxes increase. Which means that, whenever there is a spike in indirect taxes, we might mistake ‘normal’ inflation (a possible sign of an overheated economy) with a (deflationary!) increase in the price level because of tax increases. Looking at inflation including changes in tax rates leads to the risk that you want to increase taxes because inflation is high because (indirect) taxes are increased! Fortunately, the constant tax rate inflation is calculated by Eurostat. The same holds for energy prices in an economy which has a large external energy deficit: when oil prices rise this shows up as an increase in the price level but it’s not any kind of sign of an overheated economy.

In the Eurozone, constant tax prices (as well as core prices without energy) showed a lot lower increase than the official HICP rate of inflation. In Greece in 2019 this difference was over 4% (huh!) and in the entire 2010-2012 period over 6% meaning that in these three years alone the consumer price level increased with 6% because of increases in indirect taxes. Deflation in full swing!

Alas, at the time and consistent with neoclassical macro, the European Central Bank only looked at headline inflation which led to the infamous rate increases in 2008 and 2011 and misguided austerity. The ECB changed its course. But it is good to point out that there are sound, MMT consistent, why this happened. I’m not a real MMT-er. But that’s no reason not to apply their logic to the rate of inflation.