From David Ruccio Emmanuel Saez and Gabriel Zucman begin their new book, The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay, with the moment in 2016 during the first presidential election debate between Donald Trump and Hillary Clinton when the former Secretary of State challenged the reality-show celebrity about how little he had paid in federal income taxes over the years. Trump proudly admitted it: “That makes me smart.” And Clinton, for all her carefully crafted technocratic proposals to fix the tax code, failed to effectively respond to Trump. Jump ahead three years, and the issue of wealth inequality in America has risen to the top of the political agenda. Clinton lost the election, Trump is probably not worth what he has claimed, but the nation’s wealth

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Emmanuel Saez and Gabriel Zucman begin their new book, The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay, with the moment in 2016 during the first presidential election debate between Donald Trump and Hillary Clinton when the former Secretary of State challenged the reality-show celebrity about how little he had paid in federal income taxes over the years. Trump proudly admitted it: “That makes me smart.” And Clinton, for all her carefully crafted technocratic proposals to fix the tax code, failed to effectively respond to Trump.

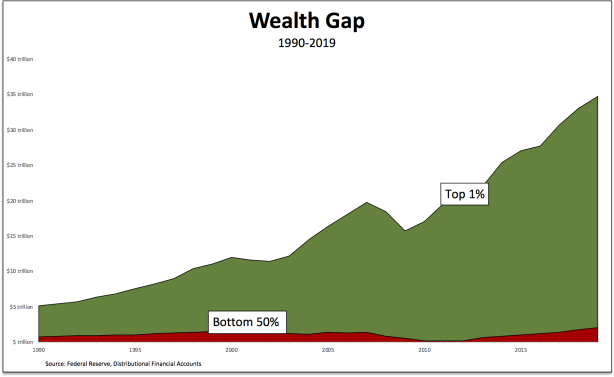

Jump ahead three years, and the issue of wealth inequality in America has risen to the top of the political agenda. Clinton lost the election, Trump is probably not worth what he has claimed, but the nation’s wealth is even more unequally distributed today—much worse even than the obscene inequalities in the distribution of income.

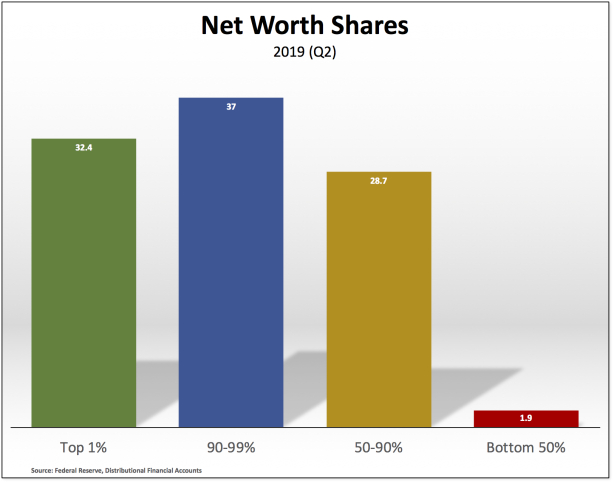

In fact, according to the Federal Reserve’s Distributional Financial Accounts, the share of total net worth of the top 1 percent of American households (32.4 percent) now exceeds that of the so-called middle-class, households in the 50-90-percent bracket (28.7 percent).

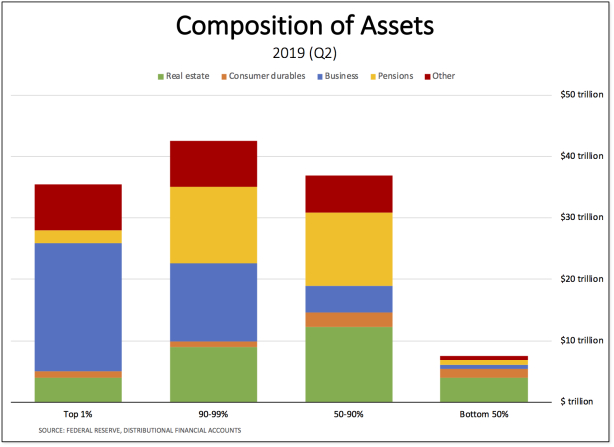

Moreover, we know that the lion’s share of the assets owned by the top 1 percent ($35.4 trillion) stems from business ($20.8 trillion)—as against the real estate holdings, consumer durables, pensions, and other assets that make up the bulk of the wealth owned by others, especially those in the bottom 90 percent.**

It should come as no surprise then that major presidential candidates in the Democratic Party, especially Bernie Sanders and Elizabeth Warren, have proposed taxing the large concentrations of wealth at the top. Nor should we be astonished that billionaires have shed public tears over the proposed taxes or that the New York Times highlighted a fundamentally flawed Wharton School study showing that taxes on wealth would reduce economic growth by nearly 0.2 percent a year, over the course of a decade.**

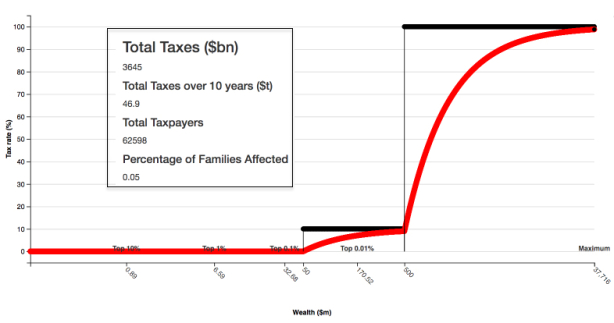

Just to illustrate the severe concentration at the top of the wealth pyramid in the United States, as well as the enormous benefit to the rest of society of using that wealth for other purposes, consider the following two-tier tax formula: a 10-percent tax on wealth over $50 million and 100 percent on wealth over $500 million. Utilizing the Wealth Tax Explorer devised by Emmanuel Saez and Gabriel Zucman, such a tax scheme would affect only 0.05 percentage of U.S. households (a total of 62,598 taxpayers) and yet it would generate in any given year a flow of revenues equal to total federal tax revenues in the United States! (And, yes, as a side benefit, it would also represent a wealth cap of $500 million.)

But that’s only one side of the story, which has been the sole focus of billionaires, mainstream economists, and political pundits. The other, perhaps even more important, side is the enormous gap between the wealth owned by the tiny group at the top and that of households who find themselves at the bottom.

Since 1990, the net wealth of the top 1 percent has soared to $35 trillion while the bottom 50 percent of Americans have been left with only $2 trillion. For those in the top 1 percent, what this means is they’ve managed to capture a large share of the surplus, which they’ve used to accumulate enormous assets (with relatively few liabilities), which in turn can be used to continue to get a cut of the surplus generated by workers in the United States and around the world (in addition to financing politicians and setting the rules of the game). And the bottom 50 percent? They get wages and salaries that allow them to continue to work but prevent them from accumulating much wealth (which consists, as we can see in the second chart above, mostly of real estate, and even then is largely offset by mortgages and other liabilities). Without wealth of their own, workers in the bottom 50 percent are thus forced to have the freedom to continue to sell their ability to work to employers in order to subsist.

So, yes, the small group of owners of American wealth might in fact be smart—because they sit on top of a system that generates enormous wealth, most of which they own, and which does not trickle down to those at the bottom, who continue to have to work for a living and aren’t even allowed to benefit from programs financed by taxes on the concentrated wealth at the top.

But all the smarts in the world can’t hide the essential injustice and unfairness of the grotesquely unequal distribution of wealth in the United States. The discussion to change the system may begin with taxes but it won’t end there. It has to be aimed at both the economic institutions that are the root cause of that inequality and the ideas that serve to justify the obscene degree of inequality in the United States and to undermine any and all attempts to reform it.

Any candidate who makes that clear will be one worth voting for.