From Lars Syll It can be said without great controversy that no other theoretical approach in this century has ever enjoyed the same level of ubiquity throughout the social sciences as the rational choice approach enjoys today. Despite this ubiquity, the success of the approach has been very tenuous. Its advance has been accompanied by an intense debate over its relative merit. The approach has been subject to the usual criticism of blatant inaccuracy given by outsiders to any would-be theoretical hegemon and to a predictable fuzzying of its assumptions as it is adapted to a wider and wider range of empirical phenomena. More notably, however, some of the most virulent mere criticisms of the rational choice approach have come from within its own ranks. Despite the absence of any

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

It can be said without great controversy that no other theoretical approach in this century has ever enjoyed the same level of ubiquity throughout the social sciences as the rational choice approach enjoys today. Despite this ubiquity, the success of the approach has been very tenuous. Its advance has been accompanied by an intense debate over its relative merit. The approach has been subject to the usual criticism of blatant inaccuracy given by outsiders to any would-be theoretical hegemon and to a predictable fuzzying of its assumptions as it is adapted to a wider and wider range of empirical phenomena. More notably, however, some of the most virulent mere criticisms of the rational choice approach have come from within its own ranks.

Despite the absence of any clear-cut resolution to this debate, there appears to be a growing consensus about the strengths and weaknesses of the approach. To put it briefly, the main strengths of the approach are that its conventional assumptions about actors are parsimonious and applicable to a very broad range of environments, generating usually falsifiable and sometimes empirically confirmed hypotheses about action across these environments. This provides conventional rational choice with a combination of generality and predictive power not found in other approaches. However, the conventional assumptions of rational choice not only lack verisimilitude in many circumstances but also fail to accurately predict a wide range of human behaviors.

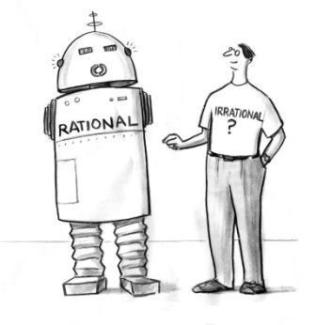

In mainstream economics — especially in microeconomics, social choice and game theory — it is taken for granted (by definition) that the actors appearing in the model world, are rational and try to satisfy given preferences. But, confronting the axiomatic model world with the real world, it usually turns out that quite a few actors are irrational.

In mainstream economics — especially in microeconomics, social choice and game theory — it is taken for granted (by definition) that the actors appearing in the model world, are rational and try to satisfy given preferences. But, confronting the axiomatic model world with the real world, it usually turns out that quite a few actors are irrational.

In a classic experiment conducted by Barbara McNeil and colleagues, it was investigated how variations in the way information were presented to patients influenced their choices between alternative therapies. Individuals — randomly assigned — were asked to imagine that they had lung cancer and to choose between two different therapies:

Different groups of respondents received input data that differed only in whether or not the treatments were identified and whether the outcomes were framed in terms of the probability of living or the probability of dying.

The experiment demonstrated that by only changing the emphasis from surviving (x) to dying (1-x) in the description of the treatment alternatives, there was a significant change in population preferences. According to ‘rational choice’ theory, the way you ‘frame’ alternatives should be totally inconsequential. Rational people do not change preferences for inconsequential reasons.

So what do we learn from this kind of experiments? This: In mainstream ‘as if’ model worlds there are only rational people and in real-life there are a lot of ‘irrational’ people.

Things are obviously not as postulated in mainstream microeconomics. The final court of appeal for models is the real world. As long as no convincing justification is put forward for how the inferential bridging is made from the model world to the real world, ‘rational choice’ models have to be considered little more than hand-waving.

Those who want to build macroeconomics on microfoundations usually maintain that the only robust policies and institutions are those based on rational expectations and representative actors. As yours truly repeatedly argued there is really no support for this conviction at all. On the contrary. If we want to have anything of interest to say on real economies, financial crisis and the decisions and choices real people make, it is high time to place macroeconomic models building on representative actors and rational expectations microfoundations in the dustbin of pseudo-science.

For if this microfounded macroeconomics has nothing to say about the real world and the economic problems out there, why should we care about it? The final court of appeal for macroeconomic models is the real world, and as long as no convincing justification is put forward for how the inferential bridging de facto is made, macroeconomic modelbuilding is little more than hand-waving that gives us a rather little warrant for making inductive inferences from models to real-world target systems. If substantive questions about the real world are being posed, it is the formalistic-mathematical representations utilized to analyze them that have to match reality, not the other way around.

The real macroeconomic challenge is to accept uncertainty and still try to explain why economic transactions take place — instead of simply conjuring the problem away by assuming rational expectations and treating uncertainty as if it was possible to reduce it to stochastic risk. That is scientific cheating. And it has been going on for too long now.