The ECB rightly wants to pay more attention to costs of ‘owner occupied houses’ (OOH) when it comes to inflation. Statisticians often use ‘imputed rents’ to do this. The ECB shouldn’t do this but should look at actual costs of owners of houses. Rents and monetary costs of OOH do not develop in the same way. Also, rented houses are not inhabited by the same social and demographic groups as owner occupied houses. Which means that using rents to gauge the costs of OOH, as happens in many countries, is not the right method. Other yardsticks have to be found. And maybe, in increasingly fragmented societies the time for only one consumer price index is over, especially because of demographic and labor market developments in connection with the increasing importance of housing costs in

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The ECB rightly wants to pay more attention to costs of ‘owner occupied houses’ (OOH) when it comes to inflation. Statisticians often use ‘imputed rents’ to do this. The ECB shouldn’t do this but should look at actual costs of owners of houses.

Rents and monetary costs of OOH do not develop in the same way. Also, rented houses are not inhabited by the same social and demographic groups as owner occupied houses. Which means that using rents to gauge the costs of OOH, as happens in many countries, is not the right method. Other yardsticks have to be found. And maybe, in increasingly fragmented societies the time for only one consumer price index is over, especially because of demographic and labor market developments in connection with the increasing importance of housing costs in budgets.

One of the defining aspects of the Eurozone ‘HICP’ consumer price metric is that it is (as far as I know: thanks to conservative ordo-liberal Otto Issing) a monetary metric. Unlike many other consumer price indexes housing costs of owner occupied houses are not gauged by imputing a rent based on information on rented houses. Which is good. The idea behind these imputations is neoclassical. Which is bad: it assumes that renters as well as owners derive utility from their homes, it assumes that monetary rents are an apt measurement of the amount of utility derived from these homes and it assumes that there are no differences between renters and owners, meaning that these rents can be used to gauge the utility derived from the homes of house owners (‘the representative consumer’). But: neoclassical ‘utility’ is a bogus concept, it can’t be measured and differences between socio-economic groups do exist in our societies. Imputing rents should hence not be used as a method to construct consumer price indexes.

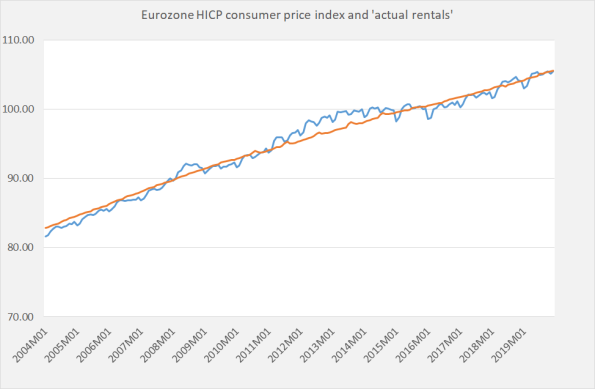

Even then, such an imputation would not be too bad if differences between the development of rents and costs of OOH would be negligible. They aren’t as I will show below. Rents are increasing, mortgage costs have declined. Mind that I do not write: mortgage interest levels. This leads to the next questions:

- Are these differences large enough to warrant a separate estimation of OOH costs, independent of rents, and to include this in the consumer price index?

- If so, how should such an estimation look like?

- Are social and economic differences between people renting houses and people owning houses nowadays thus large that one consumer price index to estimate the purchasing power of income is not a valid economic variable anymore (mind that price indexes are not constructed to estimate the purchasing power of money but the purchasing power of monetary income or, to be even more precise, of the income and net borrowing used to finance consumer expenditure).

As the graph above shows, Eurozone rents increased about as much as the consumer price level (I do not use national data as the ECB, rightly or wrongly, looks at Eurozone averages). And we all know that, especially after 2009, interest rates decreased quite a bit. Case closed, it seems. But: are interest rates the right price to include in the consumer price index? No. Many households have fixed rate mortgages which means that lower rates only feed through with a lag. And in my opinion (more precise: in my present opinion) total interest paid to the bank is the price house owners pay for their mortgage. So, we should not look at interest rates as such but at average interest paid by house owners (paying down a mortgage is part of the financial stock economy, not of the flow economy measured by the consumer price index and has to be excluded from the price index).

Calculating this for one country, the Netherlands, shows that average amount of interest paid per OOH declined from 8,2 thousand a year in 2013 to 6,4 thousand a year in 2018 (source: CBS National Accounts data and data on housing stock). Which shows that there has been quite a decline of this price (-22%) as opposed to quite an increase in rents (just like the Eurozone average house rents, rents in the Netherlands increased in this period). Renters paid more, house owners paid less. Which means that there is a strong case to include costs of OOH separately estimated in the consume price index. Aside of this price, real estate agent fees and stamp duties and the like should of course also be included. On a technical level this can easily be done. The interpretation of the data becomes, however, complicated as unlike in the case of groceries, which are bought by all households, stamp duties are on the micro level only paid by a very small share of households! We can’t use the implicit concept of the representative household anymore to understand the data and have to use more complicated concepts. The answer to the first two questions posed above is however clear: differences in developments of costs of OOH and rents are serious and costs of OOH can be included in the price index.

With regard to the third question: tons of anecdotal information as well as data on house ownership per generation now and in the past suggests that social, legal and demographic differences between renters and owners are large and have become quite a bit larger. In combination with the difference in development of the average price of a mortgage and renting this means that there is a serious case for calculating and publishing a number of price indexes instead of just one.

This, of course, complicates life for an inflation targeting central bank. But hey, financial stability, prosperity and employment and an safe and an efficient payment system are more important for central banks than inflation targeting in a increasingly fragmented and unstable capitalist society.