From David Ruccio You know your generation’s screwed when even Monopoly is mocking you. Back in 2016, I argued that Millennials were in fact generation screwed. For example, in 2010 (when some of them were 20 to 24 years of age), their unemployment rate was 17.2 percent, much higher than the already high national average of 9.9 percent.* Partly because of the difficulty they had finding jobs, but also because they have been saddled with high student and healthcare debt, the typical Millennial family lost ground between 2010 and 2016, falling further behind the typical wealth lifecycle than any other birth cohort. According to the Federal Reserve Bank of St. Louis (pdf), a typical 32-year-old family respondent in 2016 (born in 1984) was 34 percent (,000) below the 32-year-old

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

You know your generation’s screwed when even Monopoly is mocking you.

Back in 2016, I argued that Millennials were in fact generation screwed.

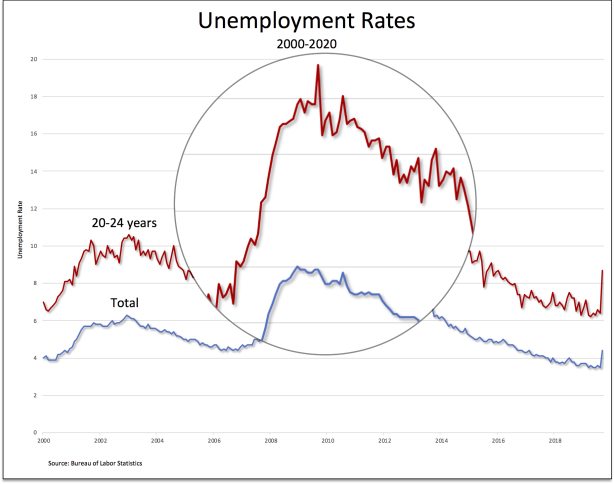

For example, in 2010 (when some of them were 20 to 24 years of age), their unemployment rate was 17.2 percent, much higher than the already high national average of 9.9 percent.*

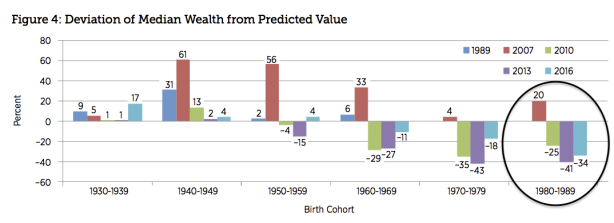

Partly because of the difficulty they had finding jobs, but also because they have been saddled with high student and healthcare debt, the typical Millennial family lost ground between 2010 and 2016, falling further behind the typical wealth lifecycle than any other birth cohort. According to the Federal Reserve Bank of St. Louis (pdf), a typical 32-year-old family respondent in 2016 (born in 1984) was 34 percent ($12,000) below the 32-year-old benchmark established by earlier generations.

No wonder Hasbro decided to lampoon their inability to purchase real estate.

Still, the authors of the report thought there were grounds for optimism, since “These families have many more years to earn, save and accumulate wealth.”

Except now, according to Vox (first in early April and now in May), Millennials have been screwed again.

As someone on the tail end of the millennial generation, I was lucky enough to still be in school when the 2008 recession hit. Yet financial anxiety has been an omnipresent part of how I see the world. It feels as though the one-time hallmarks of adulthood — buying a house, having kids, stability, even thinking about these things — are no longer milestones, but irresponsible dreams. Meanwhile, millennials older than me, many of whom are in their 30s and began their job searches in the thick of the 2008 recession, are even more financially fragile.

In fact, Millennials have every reason to be concerned, about their present and their future. They (and the next younger cohort) appear to have been most affected by furloughs, layoffs, and pay cuts in the midst of the current economic crisis. Moreover, we know that those making less money and those working in certain sectors (such as hospitality, restaurant services, and retail trade) have been more likely to be laid off than other, often older workers. And yet still Millennials have to continue to pay off their student loans and healthcare debts and make their rent payments.

The last time I analyzed the situation of Millennials, I discovered they were more inclined to identify as members of the working-class (and not, for example, as middle-class) and more critical of capitalism than previous generations.

I wonder now, when they’re being screwed a second time in their short lives, how they will identify and what economic and social arrangements they will end up criticizing.

Millennials still have plenty of time, if not to accumulate wealth, at least to change the world.

*For the sake of comparison, the difference between the two unemployment rates in 2007 was only 2.8 points.