From David Ruccio Capitalism’s crises are clearly becoming deeper and more severe. After the crash of 2007-08, the United States (and much of the rest of the world) was subjected to the Second Great Depression, the worst economic downturn since the depression of the 1930s. Now, in the midst of the novel coronavirus pandemic, business activity has ground to a halt and unemployment has soared to levels reminiscent of the first Great Depression. Not surprisingly, both Main Street and Wall Street firms have once again turned to the U.S. government to be bailed out through a series of programs that dwarf anything the world has seen before. The Federal Reserve and the Treasury Department have stepped in with a broad array of actions to keep capitalist enterprises afloat, including up to

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Capitalism’s crises are clearly becoming deeper and more severe. After the crash of 2007-08, the United States (and much of the rest of the world) was subjected to the Second Great Depression, the worst economic downturn since the depression of the 1930s. Now, in the midst of the novel coronavirus pandemic, business activity has ground to a halt and unemployment has soared to levels reminiscent of the first Great Depression.

Not surprisingly, both Main Street and Wall Street firms have once again turned to the U.S. government to be bailed out through a series of programs that dwarf anything the world has seen before.

The Federal Reserve and the Treasury Department have stepped in with a broad array of actions to keep capitalist enterprises afloat, including up to $2.3 trillion in direct lending to support employers and financial markets (including loans to 24 large financial institutions known as primary dealers), lower interest-rates (along with a promise to keep them low for the foreseeable future), a resumption of the purchasing of massive amounts of securities, relaxing regulatory requirements on financial institutions, direct lending to banks (to encourage them to lend to their corporate clients), and the list goes on. They’ve also supported direct payments to workers, through so-called stimulus checks to households and extra payments to unemployed workers, so they’ll be available to employers when business activity resumes.

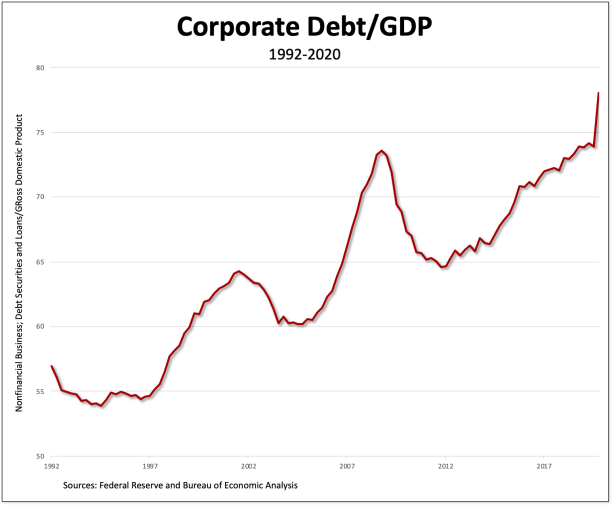

The result has been an explosion of the debt (securities plus loans) owed by nonfinancial corporations, which is now close to 80 percent of Gross Domestic Product. That debt (which has been subsidized and encouraged by the federal bailout) has become the mainstay of economic activity in the United States. It’s what’s keeping American businesses—including Apple, Walmart, AT&T, Disney, Nike, and Berkshire Hathaway—afloat.

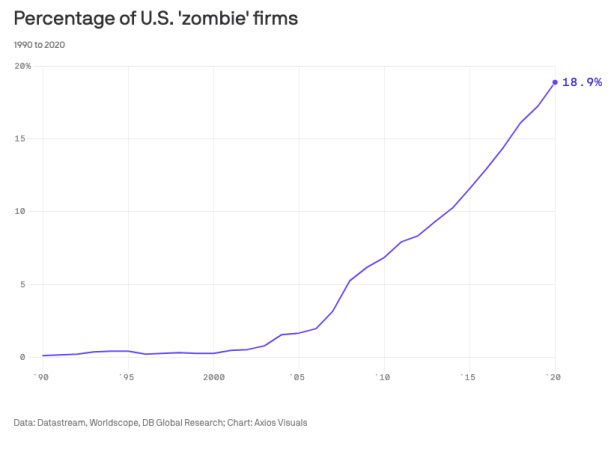

And, as businesses take on increasing amounts of debt, the percentage of “zombie firms“—corporations whose debt servicing costs are higher than their profits but are kept alive by relentless borrowing—is now close to 20 percent.

This growth of zombie capitalism is not new. Capitalism’s most ruthless critic saw the trend emerging already in the middle of the nineteenth century:

The last illusion of the capitalist system, that capital is the fruit of one’s own labour and savings, is thereby destroyed. Not only does profit consist in the appropriation of other people’s labour, but the capital, with which this labour of others is set in motion and exploited, consists of other people’s property, which the money-capitalist places at the disposal of the industrial capitalists, and for which he in turn exploits the latter.

As it turns out, the Wall Street Journal is well aware that the combination of massive government bailouts and widespread corporate indebtedness has cast doubt on contemporary capitalism, since

easy money has juiced up the value of stocks, bonds and other financial assets, which benefits mainly the rich, inflaming social resentment over growing inequalities in income and wealth. It should not be surprising that millennials and Gen Z are growing disillusioned with this distorted form of capitalism and say that they prefer socialism. The irony is that the rising culture of government dependence is, in fact, a form of socialism—for the rich and powerful.

It should come as no surprise that the Journal sees this as a “distorted” form of capitalism, which has the effect of “creating more zombies and monopolies, widening inequality, undermining productivity and slowing growth”—thereby undermining the premise and promise of “just deserts” and an expanding economic pie. To which their only response is, if only U.S. capitalism could return to the natural law of “economic risk and loss”. . .

But zombie capitalism is real capitalism. Corporations and banks, supported by their political and media representatives, presume that in both good times and bad they are entitled to turn to assistance from a shifting combination of public and private entities, which will allow them to continue and expand their operations, even as the legitimacy of their enterprise as a whole is called into question. They’re only worried about their own profits (or at least their own less-then-profitable survival), confident that the risks and losses will be successfully passed on to others.

A time when capitalism did not involve the shifting of costs from capital onto others is a pure illusion, a fairytale that is trotted out when corporations and banks appear to violate the natural laws of economics and to increasingly call for and rely on cheap money and government bailouts.

The problem is, capital is the one that has kept the zombie story alive, since it has long treated its workers as will-less and speechless bodies, interested only in shirking effort and relying on handouts. That’s why now employers want to cut back on unemployment efforts, to force them back to work.

But capital itself has become the real zombie, a set of corpses that are only reanimated by the supernatural efforts of governments and banks. So, as befitting the genre (according to Simon Pegg), they have become increasingly “slow and steady in their approach, weak, clumsy, often absurd” in their activities.

The Journal clearly wants to eliminate the association of contemporary capitalism with death, preferring a world populated by entities that obey the laws of economic risk and loss. But, as we all know, that world is animated by another undead creature, the vampire, which “lives only by sucking living labor, and lives the more, the more labor it sucks.”

Contemporary zombies or a return to vampires—that’s the only choice offered by those who defend capitalism in the midst of the current pandemic. Better, it seems to me, to protect our brains and life-blood from all the undead creatures that haunt the capitalist imaginary and devise a radically different way of organizing economic and social life.