From Lars Syll The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses. So how do we get out of this unprecedented crisis? To both Keynes and Lerner, it was evident that the state has the ability to promote full employment and a stable price level — and that it should use its powers to do so. If that means that it has to take on debt and (more or less temporarily) underbalance its budget — so let it be! Public debt is neither good nor bad. It is a means to achieve two over-arching macroeconomic goals — full employment and price stability. What is sacred is not to have a balanced budget or

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

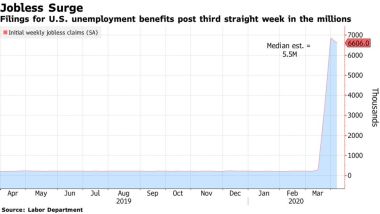

The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses.

The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses.

So how do we get out of this unprecedented crisis?

To both Keynes and Lerner, it was evident that the state has the ability to promote full employment and a stable price level — and that it should use its powers to do so. If that means that it has to take on debt and (more or less temporarily) underbalance its budget — so let it be! Public debt is neither good nor bad. It is a means to achieve two over-arching macroeconomic goals — full employment and price stability. What is sacred is not to have a balanced budget or running down public debt per se, regardless of the effects on the macroeconomic goals. If ‘sound finance,’ austerity and balanced budgets means increased unemployment and destabilizing prices, they have to be abandoned.