From Asad Zaman In a previous post on “ABC’s of MMT”, I explained the basics of MMT as a preliminary to a critique of Raghuram Rajan’s article on “How Much Debt is Too Much?”. A significant part of the discussion on this post consisted of debates over words and their meanings. My use of words like assets, savings, wealth, liability, and debt was contested, and alternative usages were offered. It seems necessary to pause for a discussion of these terminological confusions, prior to going on Rajan’s article. This is because part of the critique is about the terminology used by Rajan. Standard terminology is based on false analogy between the government and the household. In a previous post on “The Power of False Names”, I have explained how the use of misleading terminology can lead to

Topics:

Asad Zaman considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Asad Zaman

In a previous post on “ABC’s of MMT”, I explained the basics of MMT as a preliminary to a critique of Raghuram Rajan’s article on “How Much Debt is Too Much?”. A significant part of the discussion on this post consisted of debates over words and their meanings. My use of words like assets, savings, wealth, liability, and debt was contested, and alternative usages were offered. It seems necessary to pause for a discussion of these terminological confusions, prior to going on Rajan’s article. This is because part of the critique is about the terminology used by Rajan. Standard terminology is based on false analogy between the government and the household. In a previous post on “The Power of False Names”, I have explained how the use of misleading terminology can lead to severe misunderstandings and wrong policies.

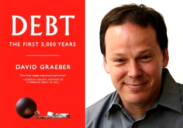

A deeper understanding of contested meanings of debt, liability, assets, savings, wealth, and related terms, emerges from the study of the history of debt in David Graeber’s “Debt: The First Five Thousand Years”. Graeber writes that “Arguments about who really owes what to whom have played a central role in shaping our basic vocabulary of right and wrong.” One of the key arguments of Graeber is that there are two kinds of debt. read more