From Dean Baker That’s the question millions are asking, even if economic reporters are not. The classic story of a wage price spiral is that workers demand higher pay, employers are then forced to pass on higher wages in higher prices, which then leads workers to demand higher pay, repeat. We are seeing many stories telling us that this is the world we now face. A big problem with that story is the profit share of GDP has actually risen sharply in the last two quarters from already high levels. The 12.4 percent profit share we saw in the second quarter is above the 12.2 percent peak share we saw in the 00s, and far above the 10.4 percent peak share in the 1990s. In other words, it hardly seems as though businesses are being forced by costs to push up prices. It instead looks like

Topics:

Dean Baker considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Dean Baker

That’s the question millions are asking, even if economic reporters are not. The classic story of a wage price spiral is that workers demand higher pay, employers are then forced to pass on higher wages in higher prices, which then leads workers to demand higher pay, repeat.

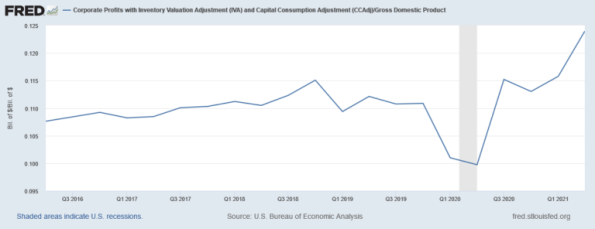

We are seeing many stories telling us that this is the world we now face. A big problem with that story is the profit share of GDP has actually risen sharply in the last two quarters from already high levels.

The 12.4 percent profit share we saw in the second quarter is above the 12.2 percent peak share we saw in the 00s, and far above the 10.4 percent peak share in the 1990s. In other words, it hardly seems as though businesses are being forced by costs to push up prices. It instead looks like they are taking advantage of presumably temporary shortages to increase their profit margins.

This doesn’t mean that some businesses are not in fact being squeezed. We are seeing rapidly rising wages for low-paid workers. That is putting a strain on many restaurants and other businesses that pay low wage.

That is unfortunate for them, but this is the way capitalism works. The reason we don’t still have half our population working on farms is that workers had the opportunity to work at higher paying jobs in manufacturing. If workers now have the option to work at better paying jobs, the restaurants that can adapt to higher pay will stay in business, but some obviously will not.