From Philip George Until 1982 it was believed that stomach ulcers were caused by stress and lifestyle. That year, two Australian scientists, Robin Warren and Barry Marshall, demonstrated that most gastric and duodenal ulcers were caused by a bacterium, Heliobacter pylori. They cultivated the bacteria which they discovered in biopsies of patients suffering from ulcers, after which Marshall ingested the bacteria to prove that they caused gastric ulcers. As this example shows, it is not uncommon even in science to try and explain real-world phenomena using variables that cannot be measured, like stress. Such attempts inevitably turn out to be incorrect. In economics the most common of such fairy variables is “inflation expectations”; the other popular one is of course “rational

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Philip George

Until 1982 it was believed that stomach ulcers were caused by stress and lifestyle. That year,

two Australian scientists, Robin Warren and Barry Marshall, demonstrated that most gastric

and duodenal ulcers were caused by a bacterium, Heliobacter pylori. They cultivated the

bacteria which they discovered in biopsies of patients suffering from ulcers, after which

Marshall ingested the bacteria to prove that they caused gastric ulcers.

As this example shows, it is not uncommon even in science to try and explain real-world

phenomena using variables that cannot be measured, like stress. Such attempts inevitably turn

out to be incorrect.

In economics the most common of such fairy variables is “inflation expectations”; the other

popular one is of course “rational expectations”. Thus, when inflation falls short of the

targeted rate for a long time it is ascribed to the central bank’s failure to calibrate inflation

expectations high enough. That the cause could lie elsewhere is never considered.

An analogy would not be out of place. If someone fails to hit the top of a tree with his gun

you get him to aim higher, at the top of a skyscraper. If he still cannot hit the top of the tree

you get him to aim at the moon. When he still cannot hit his target you are forced to veer

around to the conclusion that his failure is because his gun is not powerful enough. With

inflation during the past few decades in the US, this has indeed been the case. But

economists are reluctant to accept this explanation.

Consumer price inflation in the US after the Great Recession fell below the targeted 2% for

long periods. The reason was said to be “low inflation expectations.” But a more sensible

explanation is simply that consumers did not have sufficient money to spend.

It is sometimes useful to think of the economy as a firm. If the price of a key input A

accounting for 5% of its total costs goes up by 20% then the firm has to raise the price of its

output by 1% to earn the same profit as before. If the price of the input increases by 20% each

year for five years, while the prices of other inputs remain the same, then A will eventually

account for a higher proportion of the firm’s input costs, a little less than 12%.

In a previous post (What caused the stagflation of the 1970s? Answer: Monetarism) we

showed that most of the changes in inflation since the early 1970s were due to changes in the

price of oil, ignoring second-order effects. Oil accounts for a small proportion of total costs in

the US economy but oil prices change by large amounts; in 1974, for instance, oil prices rose

by an average of 170% each month year-on-year. Since then, oil prices have fallen which

mainly explains why energy costs as a proportion of GDP have fallen from 13.1% in 1980 to

5.7% in 2019.

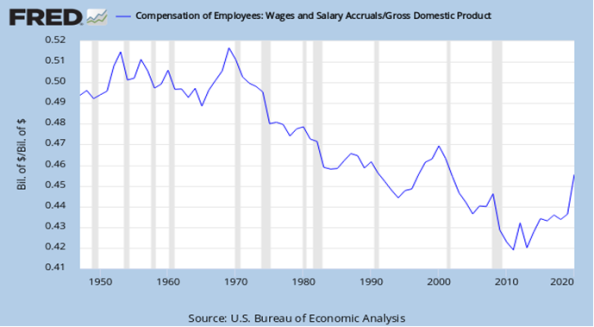

But there is one other important input that has contributed to the fall in inflation and that is

wages and salaries. Economists are right to worry about wage costs because they account for

about 45% of GDP at current prices (55% if supplements to wages and salaries are included

but those consist of contributions to pension plans and are not immediately spent). Since

wages constitute the largest component of GDP a small increase of 5% in labour

compensation will result in a 2.25% increase in prices. If the increase persists over several

years then labour compensation will eventually account for a larger proportion of GDP. In

reality, the opposite has happened. Labour compensation as a proportion of GDP has fallen

from about 52% in 1969 to 45% in 2020 though it used to be even lower after the Great

Recession.

Thus, if inflation has consistently fallen short of the target it is not because of “low inflation

expectations” but due to lower labour compensation combined with an increase in the saving

rate following the large loss of net worth in the aftermath of the Great Recession. Also, the

distribution within the labour compensation basket is skewed towards the high end with a

lower propensity to consume.

Low inflation has been achieved by squeezing wages. If higher labour compensation results

in a little higher inflation it is a welcome price to pay.