From Lars Syll When I read in the 70s the publications of Sonnenschein, Mantel and Debreu I was deeply concerned. Up to the time I had the naive illusion that the microeconomic foundation of the GE model, which I had admired so much, does not only allow us to prove that the model and the concept of equilibrium are logically consistent (that equilibrium exists), but also allow us to show that the equilibrium is well determined (unique and stable). This illusion, or should I rather say, this hope, was destroyed, once and for all. I was tempted to repress this insight and continue to find satisfaction in proving existence of equilibrium for more general models under still weaker assumptions. However, I did not succeed in repressing the newly gained insight because I believe that a theory

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

When I read in the 70s the publications of Sonnenschein, Mantel and Debreu I was deeply concerned. Up to the

time I had the naive illusion that the microeconomic foundation of the GE model, which I had admired so much,

does not only allow us to prove that the model and the concept of equilibrium are logically consistent (that

equilibrium exists), but also allow us to show that the equilibrium is well determined (unique and stable). This

illusion, or should I rather say, this hope, was destroyed, once and for all. I was tempted to repress this insight and continue to find satisfaction in proving existence of equilibrium for more general models under still weaker assumptions. However, I did not succeed in repressing the newly gained insight because I believe that a theory of economic equilibrium is incomplete if the equilibrium is not well determined.

And so what? Why should we care about Sonnenschein-Mantel-Debreu?

Because Sonnenschein-Mantel-Debreu ultimately explains why New Classical, Real Business Cycles, Dynamic Stochastic General Equilibrium (DSGE) and New Keynesian microfounded macromodels are such bad substitutes for real macroeconomic analysis!

These models try to describe and analyze complex and heterogeneous real economies with a single rational-expectations-robot-imitation-representative-agent. That is, with something that has absolutely nothing to do with reality. And — worse still — something that is not even amenable to the kind of general equilibrium analysis that they are thought to give a foundation for, since Hugo Sonnenschein (1972), Rolf Mantel (1976) and Gerard Debreu (1974) unequivocally showed that there did not exist any condition by which assumptions on individuals would guarantee neither stability nor uniqueness of the equilibrium solution. A century and a half after Léon Walras founded neoclassical general equilibrium theory, modern mainstream economics hasn’t been able to show that markets move economies to equilibria. This if anything shows that the whole Bourbaki-Debreu project of axiomatizing economics was nothing but a delusion.

Opting for cloned representative agents that are all identical is of course not a real solution to the fallacy of composition that the Sonnenschein-Mantel-Debreu theorem points to. Representative agent models are — as I have argued at length in my On the use and misuse of theories and models in mainstream economics — rather an evasion whereby issues of distribution, coordination, heterogeneity — everything that really defines macroeconomics — are swept under the rug.

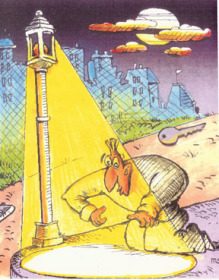

Of course, most macroeconomists know that to use a representative agent is a flagrantly illegitimate method of ignoring real aggregation issues. They keep on with their business, nevertheless, just because it significantly simplifies what they are doing. It reminds — not so little — of the drunkard who has lost his keys in some dark place and deliberately chooses to look for them under a neighbouring street light just because it is easier to see there …