It still has to feed into the management of pension funds or global wealth funds. Or, does it? It seems that Black Rock is already investing more in real estate… Look here and here. It might well be that this happens because because the smarties at Black Rock read the work of Jorda, Knoll, Kuvshinov, Schularick and Taylor, who gathered data on ‘‘The Rate of Return on Everything, 1870–2015”, including the rate of return on ‘houses’ (better: the rate of return on ‘land underlying houses’), for quite a period and a whole number of countries. We now know more, much more, about rates of return on, well, ‘everything’ than ever before. Macro can finally be Macro. But: what is a “rate of return”? And why is this important? Source: Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov,

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

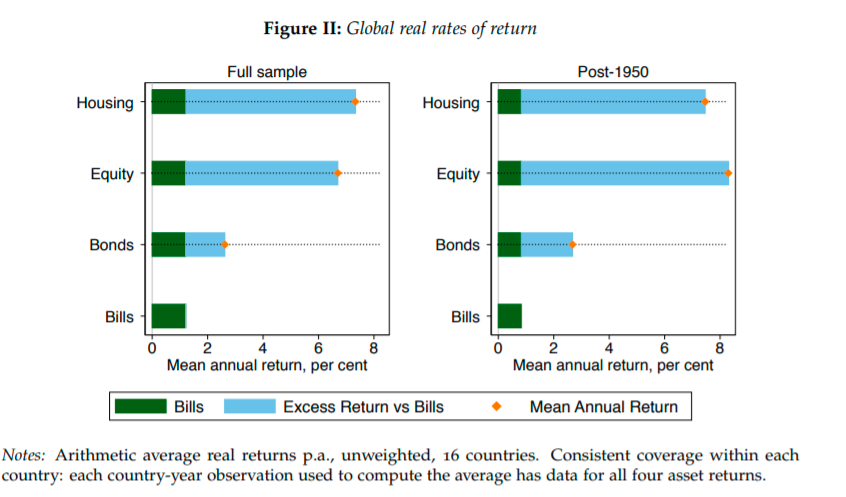

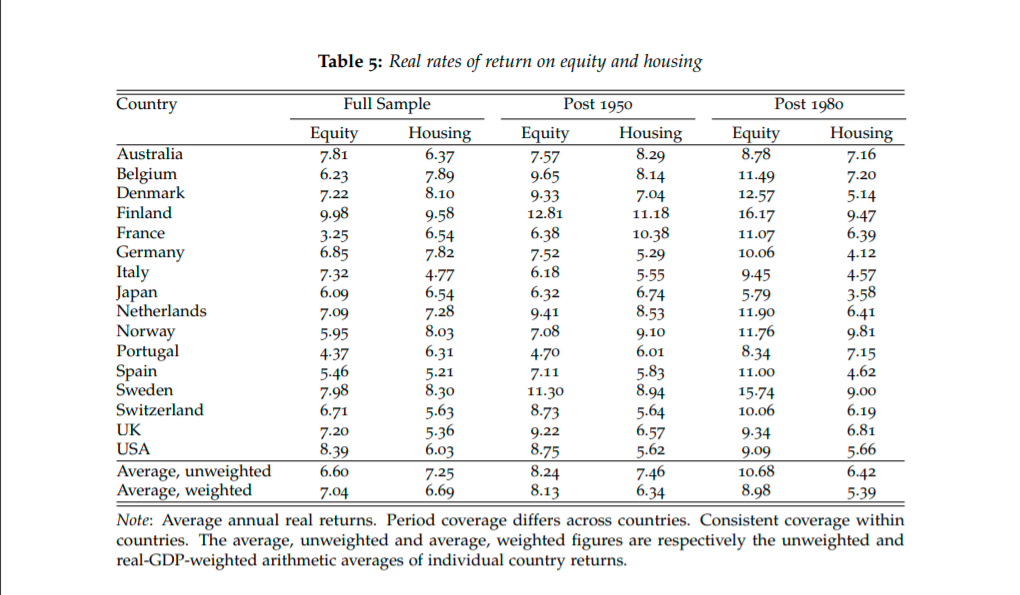

It still has to feed into the management of pension funds or global wealth funds. Or, does it? It seems that Black Rock is already investing more in real estate… Look here and here. It might well be that this happens because because the smarties at Black Rock read the work of Jorda, Knoll, Kuvshinov, Schularick and Taylor, who gathered data on ‘‘The Rate of Return on Everything, 1870–2015”, including the rate of return on ‘houses’ (better: the rate of return on ‘land underlying houses’), for quite a period and a whole number of countries. We now know more, much more, about rates of return on, well, ‘everything’ than ever before. Macro can finally be Macro. But: what is a “rate of return”? And why is this important?

Source: Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan M. Taylor. 2017. “The

Rate of Return on Everything, 1870–2015” Federal Reserve Bank of San Francisco Working

Paper 2017-25. https://doi.org/10.24148/wp2017-25 p. 13.

The authors basically define a “rate of return” as the extent to which an owner of an asset increases his or her ‘real’ wealth because of the combination of the appreciation of the assumed value of an asset plus the yield of an asset, defined as the nominal yield (rent, dividend, interest) divided by its assumed nominal value, divided by a price index to take account of inflation. As we can see there are quite some differences between asset classes. Which, in the case of houses, is remarkable. Even when the buildings certainly are a risky asset, because of wear and tear, technological changes, earthquakes, war and changes in consumer demand the long term value of ‘land underlying houses’ is much less prone to risk – London, Berlin, Tokyo and Hiroshima being only a part of the examples. But I’m taking the analysis a step further than the authors do, let’s first stick to their work, which has a much needed international side, too

Source: Jorda e.a. (2017) p. 22

The authors did a terrific piece of work. We do not have to assume that the rate of return on government bonds is the alfa and omega of the economic universe anymore. As the work of Piketty shows, for the recent decades based on balance sheet data of the national accounts, real estate and land underlying real estate are our most important kind of capital, meaning that house owners won, during the last century. Stated otherwise: yields on assets in combination with increases in prices are of prime importance for measuring and understanding the distribution of income and wealth, questions about this distribution can be answered in a much better way. The authors also point out that serious questions related to ‘safe’ and ‘risky’ rates can not just be answered in a better way but, essentially, can finally be posed. Or as the authors state this: “equities do not outperform housing in simple risk-adjusted terms” (Jorda e.a. (2017) p. 23). Which brings us back to Black Rock. The people at Black Rock seem to have to understood the consequence of this factoid, which might have influenced their investment strategies. Buy land. As MacDonald’s understood a long time ago… Which brings us to the political economy side of the article. The article speaks, consistently, about ‘houses’ and not, unblike Piketty and the national accounts, about ‘land underlying houses’ . Which, as land regained renewed prominence in economics, is somewhat old fashioned. Clearly, ownership of land and (ownership of) value increases related to the location of land are not just an economic but to quite extent political variables. A Georgist land tax would have siphoned off quite some of the HUGE increases in the value of land, increases which often are due not to individual entrepreneurship – let alone ownership – but to government investments in combination with individual investments surrounding the location. ‘Capital’ is not just a factor of production but, as the authors show, also a factor of distribution, while the pattern of distribution is heavily influenced by government policies. Let’s hope that governments understand this and levy Georgist land value taxes on the property of Black Rock and MacDonald’s. The data of Jorda et all show how much owners have profited of owning ‘land’! An alternative title of the article could have been: “Der Teufel scheißt immer auf den größten Haufen“. Translated in economese: “historically, the development of wealth inequality can be described by a power law”.

Personal note: constructing historical house price series is very difficult, as I experienced for the City of Leeuwarden (albeit for an earlier period than the post 1870 decades of the article). For one thing, quality differences between houses inside the city walls (bricks and tiles to diminish the risk of fire) and outside the city walls (loam, wood, reed) have to be taken into account. This series alone is a triple A achievement. Also: this AER article by (part of) the authors does mention that 80% of the rise of prices is due to the increases of the prices of land.