Does the switch to Green Energy mean that energy will be cheaper? To answer this question we’ll have to answer several sub-questionsfirst: is there a switch to Green Energy? Is capacity used efficiently? And is Green Energy cheap? As I will argue below, looking at the sub questions the answer to the lead question is: yes. But this answer leads to a related question: above, we’re talking about cost prices, which are down. You might have noticed that consumer prices of energy are up. Who’s getting rich?! The answer to sub question 1 is clear. There is a serious shift to Green Energy. Total installed capacity of solar alone is 160.000 Megawatt in the EU, which is close to the around 230.000 megawatt capacity of coal power plants in the United States or India (graph 1). Not bad.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Does the switch to Green Energy mean that energy will be cheaper? To answer this question we’ll have to answer several sub-questionsfirst: is there a switch to Green Energy? Is capacity used efficiently? And is Green Energy cheap? As I will argue below, looking at the sub questions the answer to the lead question is: yes. But this answer leads to a related question: above, we’re talking about cost prices, which are down. You might have noticed that consumer prices of energy are up. Who’s getting rich?!

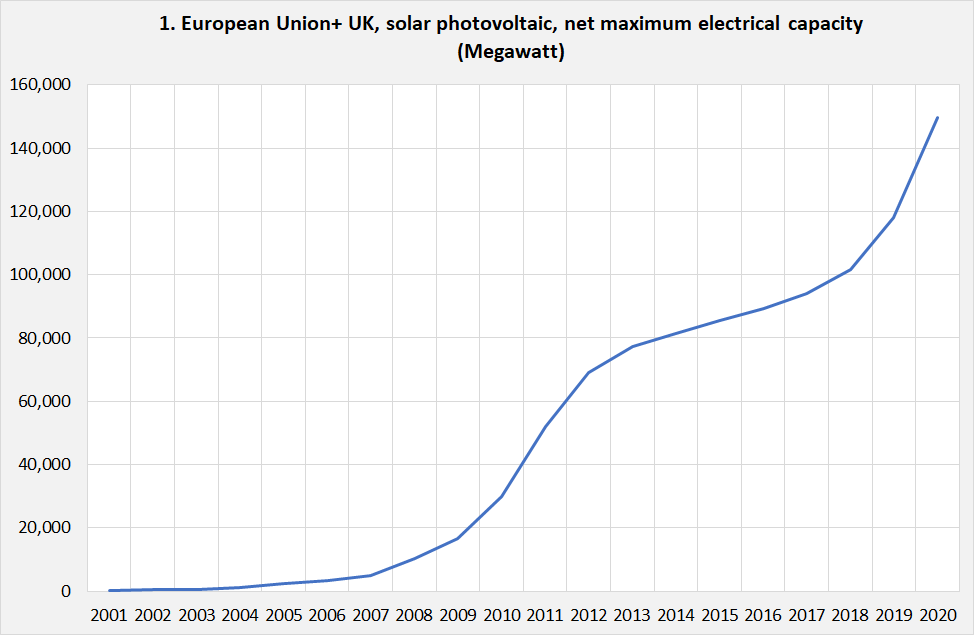

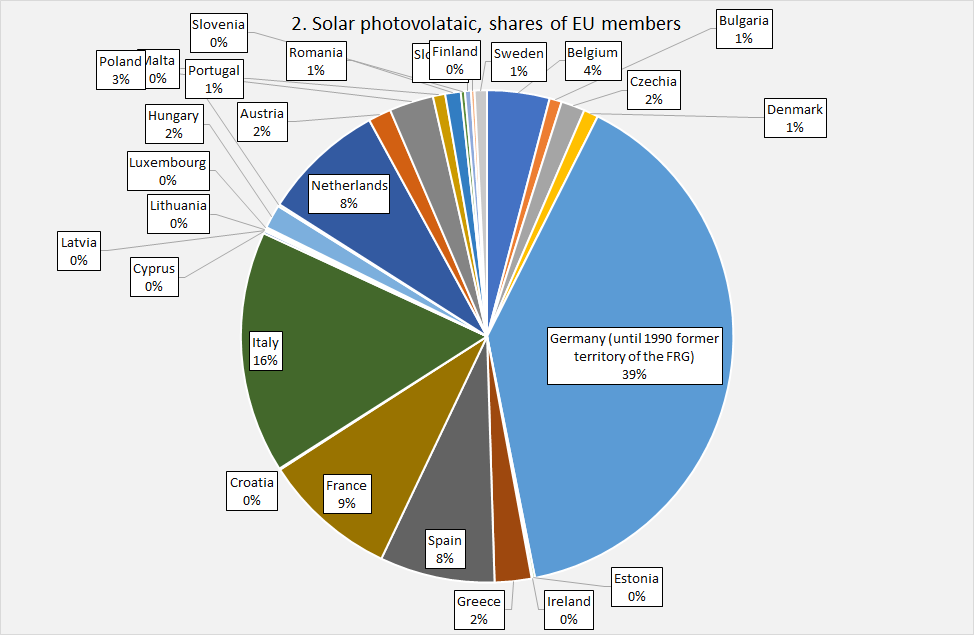

The answer to sub question 1 is clear. There is a serious shift to Green Energy. Total installed capacity of solar alone is 160.000 Megawatt in the EU, which is close to the around 230.000 megawatt capacity of coal power plants in the United States or India (graph 1). Not bad. But as the sun does not always shine this capacity has to quintuple or so. Fast. The answer to the second sub question is clear, too (graph 2). It is clear that 1 solar panel in Greece or Spain will produce more energy than the same panel in foggy Germany. However – until we reach ‘peak solar’ it does not matter too much where a panel is located. Any place is better than no place. The answer to the second question is hence: for the time being: yes! New investments in Spain and Greece and Albania and Monte Negro and comparable sunny countries are, however, warranted as production will be higher while, on top of this, installation of panels will be cheaper because of lower wages. I mean, does anybody seriously question the skills and productivity of Spanish or Greek ‘panel fitters’ compared with German ‘panel fitters’? (On the internet I did not find a name for people installing solar panels but I did find ‘gas fitter’). I know: stressing the importance of investments in solar is not revolutionary. But considering the recent enthusiasm for spending more money on military stuff, I had to stress this, again. We need solar and right now anywhere is better than nowhere.

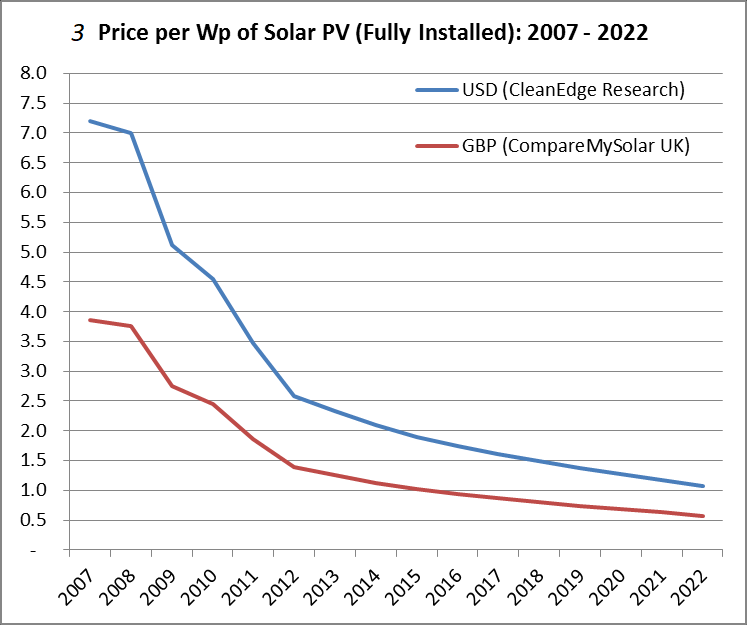

Returning to the third sub question: solar is getting cheaper and cheaper and cheaper, even in nominal terms (taking account of inflation the decline in ‘real’ costs is even larger!). At this moment it is even the cheapest kind of (electric) energy! Mind: costs are location, age and scale dependent! But even then developments are spectacular. I always considered myself to be a solar optimist but it turned out that I was a pessimist!

As solar gets cheaper (cost price) and ever more energy is produced by solar, energy is getting cheaper and will be even cheaper in the future as prime solar locations still abound. This, however, leads to a follow up question: when cost prices go down and consumer prices go up, who is winning? The answer to this is clear, too. People who invested in solar are winning, but so are oil, gas and coal producing countries (cost prices of oil, gas and coal won’t change to much when consumer prices are going up) while owners of oil, coal and gas will also have HUGE windfall profits. The free Cash Flow of Shell alone increased from $ 0.9 billion in Q4 2020 to, ahem, $ 10,7 billion in Q4 2021. As this is free cash flow, all of this money could have been invested in the cheapest kind of energy available: solar! Instead of this, Shell is buying back shares and divesting… The investments of Shell are clearly not very efficient.(wonkish note: the Shell press release is an unorderly mess, still using fuzzy indicators like EBITDA and the like). But the point: consumers pay the price while average costs have stayed more or less the same… Let me be clear: I do not mind high fuel prices (high prices for heating and electricity at home are another issue). But let these be high because of taxes, not because of windfall profits. Shell uses the profits to buy back shares… A less future oriented business strategy is hard to imagine.