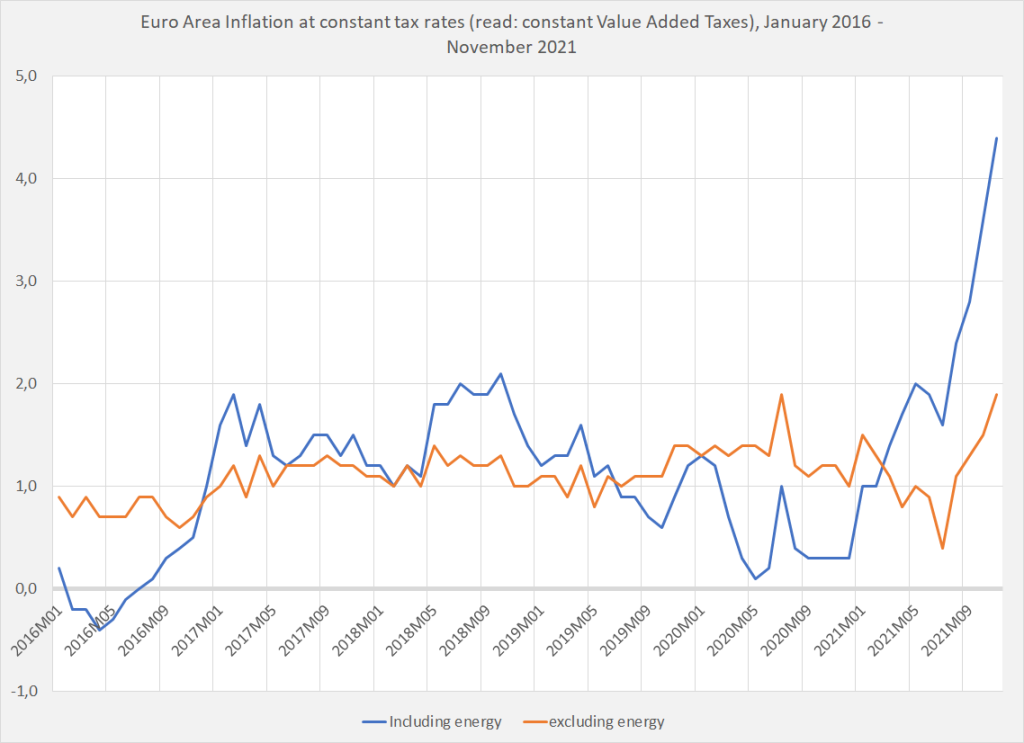

About one month ago I wroute about Euro Area inflation: “troubling but transitory“. One month more of data are in. It is even more troublesome but also more transitory. The increase of the consumer price index is dominated even more by energy prices than one month ago. As the Euro Area is a net importer of energy (among other items: natural gas from Russia.). This particular kind of inflation is, to use confusing terminology, highly deflationary… (for the non-energy sectors). Purchasing Power is transferred to Russia (and other energy exporters) and siphoned off from other sectors. The rational response: investing in energy saving (let’s commute less…) and green energy. The problem: production costs of natural gas are very low, especially labor costs. Production costs of

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

About one month ago I wroute about Euro Area inflation: “troubling but transitory“. One month more of data are in. It is even more troublesome but also more transitory. The increase of the consumer price index is dominated even more by energy prices than one month ago. As the Euro Area is a net importer of energy (among other items: natural gas from Russia.). This particular kind of inflation is, to use confusing terminology, highly deflationary… (for the non-energy sectors).

Purchasing Power is transferred to Russia (and other energy exporters) and siphoned off from other sectors. The rational response: investing in energy saving (let’s commute less…) and green energy. The problem: production costs of natural gas are very low, especially labor costs. Production costs of green energy will sometimes be higher, even when ‘saving’ often still has ridiculous high rates of return (even when time wasted on commuting is not counted as a production cost). Also, natural gas from Russia uses Russian production factors while investing in saving and green energy requires Euro Area resources. The Euro Area has plenty of these, unemployment in Southern Europe (Italy, Spain, Greece and also ‘the Balkan’) is still very high. There surely is no shortage of labor. Or sun. Or (pension)savings. Or knowledge. And we have to shift from a centralized production – decentralized use system to a decentralized production – decentralized use system. Which is quite a challenge. And it, even when there are plenty of these, will use real resources. Also: we will have to live closer to work or to work closer to home. Working from home is here to stay. But the ‘living in the countryside but working in the city’ pattern, an all time favorite of my students and colleagues alike, isn’t. Let’s move, instead of commute!