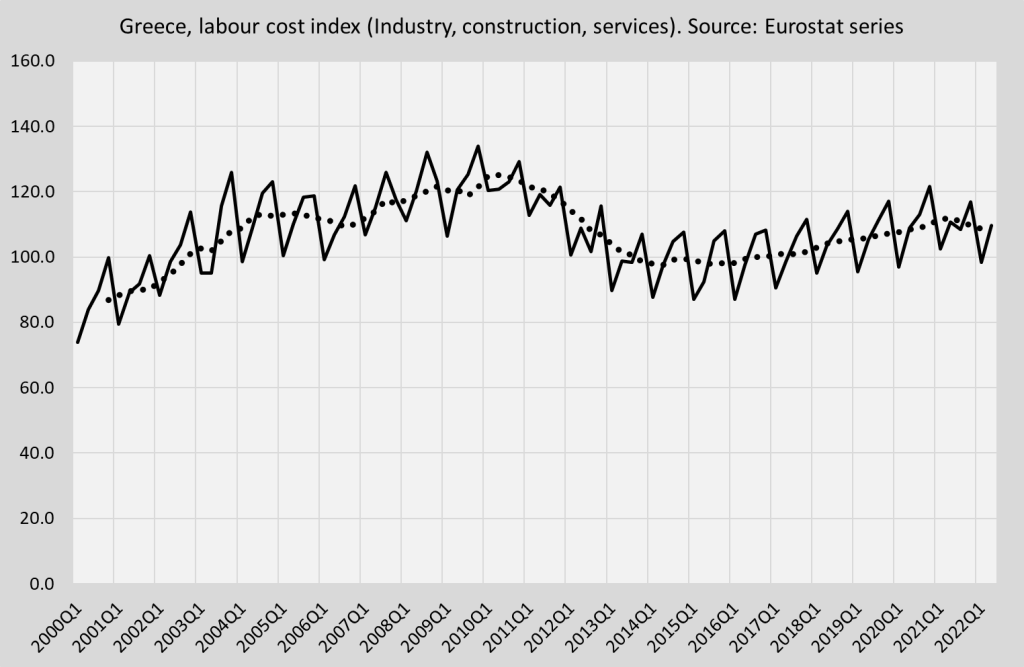

Consumer price inflation in Greece is, at the moment, 12% (graph 1). This is high and surely bankrupting quite some families. The high level of inflation is surprising, as Greek inflation was quite low and often even negative in the 2012-2022 period. The questions are: (A) what caused this sudden increase? An overheated labour market and runaway wages increases? And: (B) how can we get inflation down again? Does the ECB have to tank the economy to crush wages? Below we will investigate these questions. Graph 1. Consumer price inflation in Greece. Source: Elstat. Question A. Is the labor market overheated? Looking at graph 2 the answer is clearly: no. Unemployment is falling but still high, the number of people inside the labour market increases and there is no sign at all that

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Consumer price inflation in Greece is, at the moment, 12% (graph 1). This is high and surely bankrupting quite some families. The high level of inflation is surprising, as Greek inflation was quite low and often even negative in the 2012-2022 period. The questions are: (A) what caused this sudden increase? An overheated labour market and runaway wages increases? And: (B) how can we get inflation down again? Does the ECB have to tank the economy to crush wages? Below we will investigate these questions.

Graph 1. Consumer price inflation in Greece. Source: Elstat.

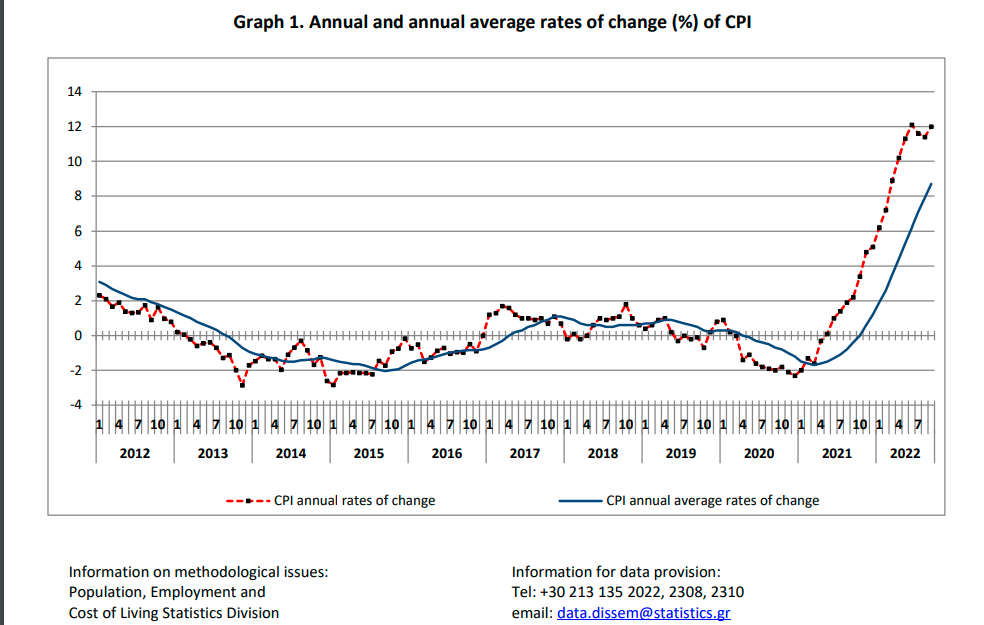

Question A. Is the labor market overheated? Looking at graph 2 the answer is clearly: no. Unemployment is falling but still high, the number of people inside the labour market increases and there is no sign at all that any kind of labor shortage prevents the Greek economy to provide the same number of jobs as 13 years ago. Mind that, in special circumstances like those of the Covid shock, we have to look beyond the unemployment data. There is no sign, at least not when we look at employment, of an overheated economy leading to domestically induced inflation.

Graph 2. Estimates of employed, unemployed and persons outside the labour force in Greece. Source: Elstat.

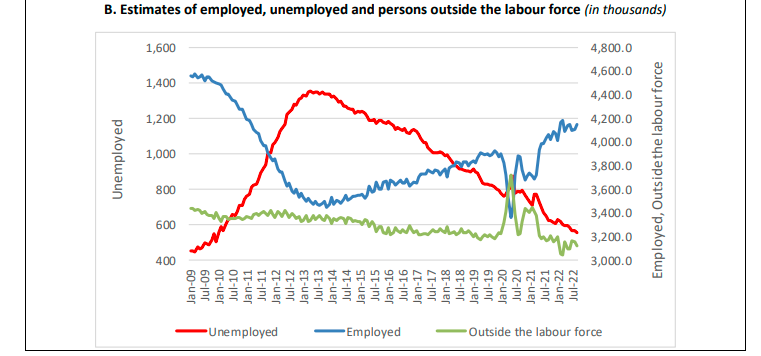

Which brings us to question B. Maybe wages are, despite considerable slack on the labor market, rising rapidly because of insider-outsider effects or whatever, meaning that they do contribute to the sudden increase of inflation. No. Graph 3 shows that nominal wages are, after a piecemeal increase in the actually going down and are still a lot lower than in 2010. Inflation is going up despite lower wages. It has to go down, of course. But investing in food and energy bottlenecks, seems the way ahead. Crushing the economy will only prolongue this bout of inflation as it will postpone badly needed investments in solar, wind, natural gas (replacing coal by natural gas is a wise thing to do, in the short and medium run), insulation (the future is hot) and irrigation. This time, we can lower inflation by a targeted increase of spending, not by decreasing it or by increasing already double digit unemployment (note: youth unemployment is the EU is already on the rise, again). I admit: interest rates were ridiculously low. But this is the wrong time to increase them. Aside: this idea that interest rates have been remarkably low and other macro economic policies should have been pursued is shared by progressive people like Varoufakis (in 2016 already) and Mason, even when Mason shows that low rates did contribute a lot to a decline of indebtedness in the USA. But that’s the point. the Central Bank interest rate is one of the most important prices in the economy – but it might not always be the best tool for macro managing the economy. Now, it surely isn’t.

Graph 3. Nominal labour costs in Greece, Industry, construction and services. Source: Eurostat.