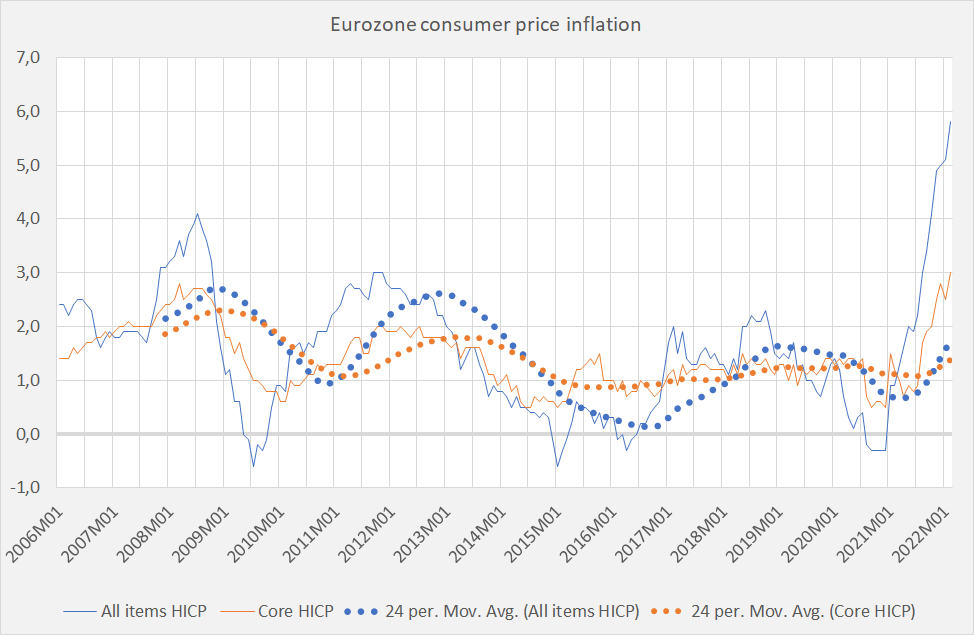

Headline as well as ‘core’ consumer price inflation in the EU has increased (graph 1). How to rate these increases? Do we have to jack up interest rates and to restrict spending? Below, I’ll argue that when we try to understand present inflation using a non-neoclassical frame of analyses we do have to take into consideration that: Not all increases are created equalWe should not just look at expenditure prices (consumption, investments) but also at factor prices and cost prices (wages, wage costs)We have to look at the short term (purchasing power of household income) but at the medium term, too (prices go up but, for some articles, down too)But Europe is in a full scale war and Wars are InflationaryWhat to do? At this moment the EU economy is not ‘overheated’ and inflation as

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Headline as well as ‘core’ consumer price inflation in the EU has increased (graph 1). How to rate these increases? Do we have to jack up interest rates and to restrict spending? Below, I’ll argue that when we try to understand present inflation using a non-neoclassical frame of analyses we do have to take into consideration that:

- Not all increases are created equal

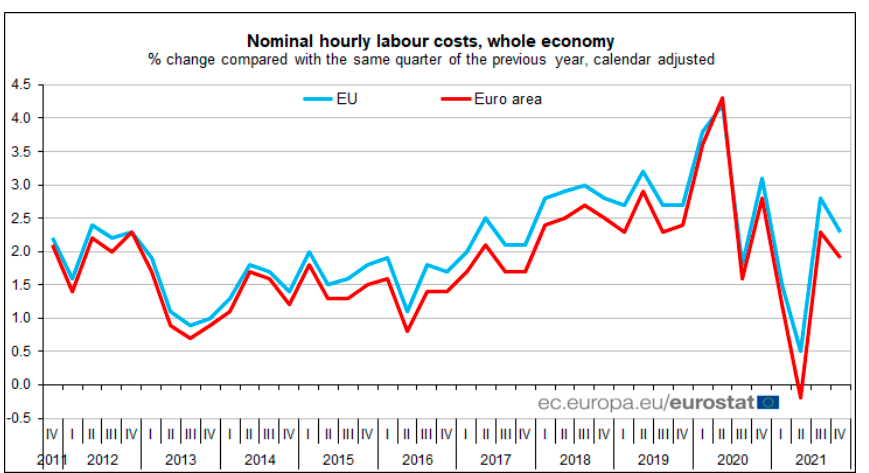

- We should not just look at expenditure prices (consumption, investments) but also at factor prices and cost prices (wages, wage costs)

- We have to look at the short term (purchasing power of household income) but at the medium term, too (prices go up but, for some articles, down too)

- But Europe is in a full scale war and Wars are Inflationary

What to do? At this moment the EU economy is not ‘overheated’ and inflation as shown in the graph must be rated to be transitory. The War in Europe will however lead, for a number of reasons, to additional inflationary pressures – which can only be countered by civilian investments in food and energy production.

- Not all increases of the consumer price index have the same ultimate cause. The consumer price level is an average, based upon prices of many goods and services. An increase of this average of, say, 1% can be caused by the increased of a limited number of prices or by a more general increase of many prices. Borio e.a. argue that a more general increase of prices shows that price increases have a ‘common component’. Which might spell trouble for macro economic stability. While the same increase caused by increases of a limited number of prices (say: energy) is less troublesome and also warrants another policy, One can technological change (electronics) or changes in the markets (drugs in the USA). As we can see in the graph total consumer price inflation is quite high. ‘Core’ inflation, or inflation without energy prices, is however much lower. In the Eurozone, there does not seem to be a problem with ‘common component’ inflation. No inflation problem. Yes, an energy prices problem.

- Wage increases in the EU are limited and do not contribute to inflation. At odds with neoclassical economics national accounting teaches us that it makes sense to look at the economy in a multidimensional, disaggregated way. Next to expenditure prices we also have ‘factor’ or ‘income’ prices, like wages. Looking at these it shows that there are quite some differences between economic sectors and, especially, countries. As a rule, at this moment wages in eastern EU increase a lot faster than wages in Western Europe (second graph, source ). The source also shows that there are differences between sectors (‘health’ and ‘arts’ do well). But the general pattern is clear. Wages increases are, at this moment (Q4 2021) and in the EU as a whole, rather low. Mind: this graph shows wage costs, including net taxes and subsidies. Looking just at wages, the increase is even lower. Looking at the medium term (2 to five years) the same pattern shows. Remarkably, even in rich low unemployment countries like Germany and the Netherlands, increases are limited (average for the whole year, due to Corona effects quarterly data in the Netherlands even show a decline, year on year). No inflation problem. Yes, a household purchasing power problem.

3. Even when energy prices stay high (say, oil prices at $ 120,– a barrel) energy price inflation will subside. This is a short term problem for household purchasing power. And a medium term opportunity for (1) investments in saving energy (work from home, bicycle, insulation, better regulation of temperature in buildings, a sweater at work, not going to a conference by plain – it really is that simple) and (2) investments in sustainable energy. Which means that ‘headline inflation’ which includes energy prices will come down to ‘core’ inflation (see graph 1). See, for the an overview of the advantages of the Fed policy (and the original ECB policy) of looking at the medium term, this recent article by Eggertsson e.a. No inflation problem. Yes, an investment opportunity (buy that sweater!).

4. But ‘we’ (NATO) are, at this moment, in a war. Yes, ‘we’ are (I’m living in the Netherlands, so I’m part of ‘we’) . Wars are inflationary. How to deal with this? Some of the best work of Keynes is about this: ‘How to pay for the war‘ (not just new analysis but new analysis combined with apt new measurements of the new concepts introduced in the analysis!). A central argument of Keynes: ‘inflation has distributional consequences, depending on who profits from the increase of prices’. When consumer prices increase but wages don’t consumers are getting poorer but somebody is getting rich because of higher prices. In this case these are energy producers and the owners of ‘land’ and natural resources. Read: Putin, Gazprom and Shell (I increasingly see Putin and his clique as the owners of Russia). Maybe, just maybe, we should add the companies producing military equipment to this list…. Part of the answer of Keynes was to restrict non-military spending. Is this at this moment the answer, too? Quite some countries have at this moment made solemn promises to increase military spending. At the same time the war is rapidly damaging production capacity (houses, people, factories) and, even more important than in the times of Keynes, disrupting (food) supply chains. Do we have to decrease non-military spending? Hmmm… A ‘windfall profit’ tax might be necessary. As well as additional investments in energy saving and a change of the composition of agricultural production. At this moment, corn is used to produce ethanol which is used to produce energy – solar panels are, per square meter, at least a magnitude more efficient while wheat is in short supply! But this requires a lot of thinking and goes beyond this blog. The point here is the idea that at this moment we do not have to restrict production to fight inflation but that we have to increase and redirect (food) production and to increase energy savings, to counter the consequences of the destruction of productive capacity and the disruption of supply chains. Keep capacity high.