I do not have ‘physics envy‘. I do not want economics to look too much like physics. But I do have chemistry envy. I want economics to have something like the magnificent periodic table of elements, for prices. Input prices, output prices, mark up prices, shadow prices, market prices, administered prices, government prices, expenditure prices, asset prices, monopoly prices, monopsony prices – all of these and many more neatly ordered in a relatively simple table. Somebody still has to write the book about it but there sure are elements available. One can think of the work on prices by Frederic Lee. Or about the work of Gyun Cheol Gu, who provides us with this extremely useful overview of ideas about pricing (PK means: Post Keynesian): Interestingly, the ‘Post Keynesian’

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

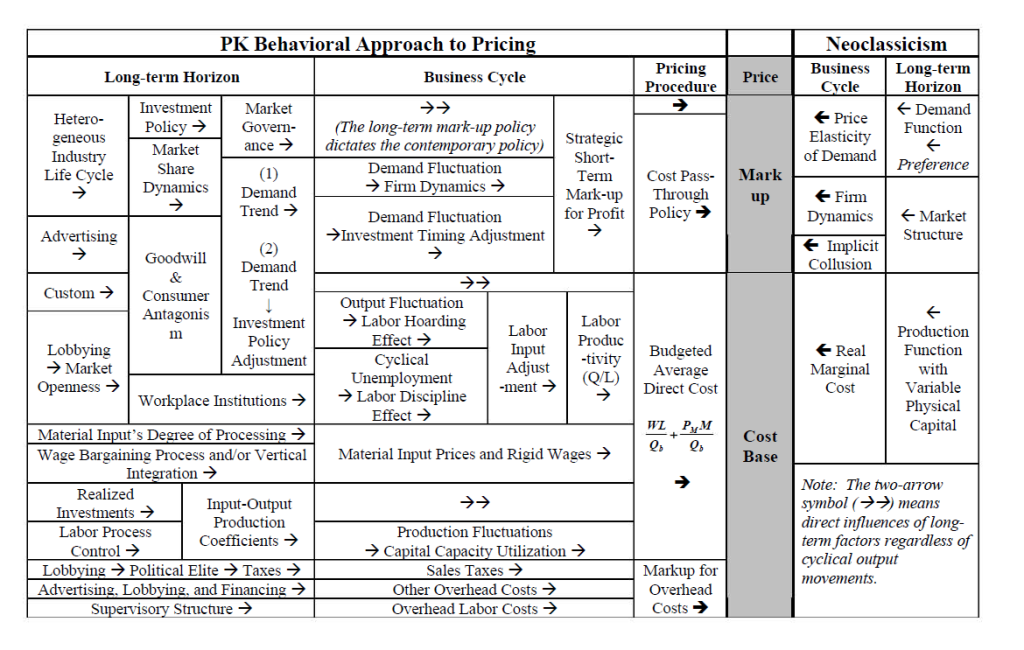

I do not have ‘physics envy‘. I do not want economics to look too much like physics. But I do have chemistry envy. I want economics to have something like the magnificent periodic table of elements, for prices. Input prices, output prices, mark up prices, shadow prices, market prices, administered prices, government prices, expenditure prices, asset prices, monopoly prices, monopsony prices – all of these and many more neatly ordered in a relatively simple table. Somebody still has to write the book about it but there sure are elements available. One can think of the work on prices by Frederic Lee. Or about the work of Gyun Cheol Gu, who provides us with this extremely useful overview of ideas about pricing (PK means: Post Keynesian):

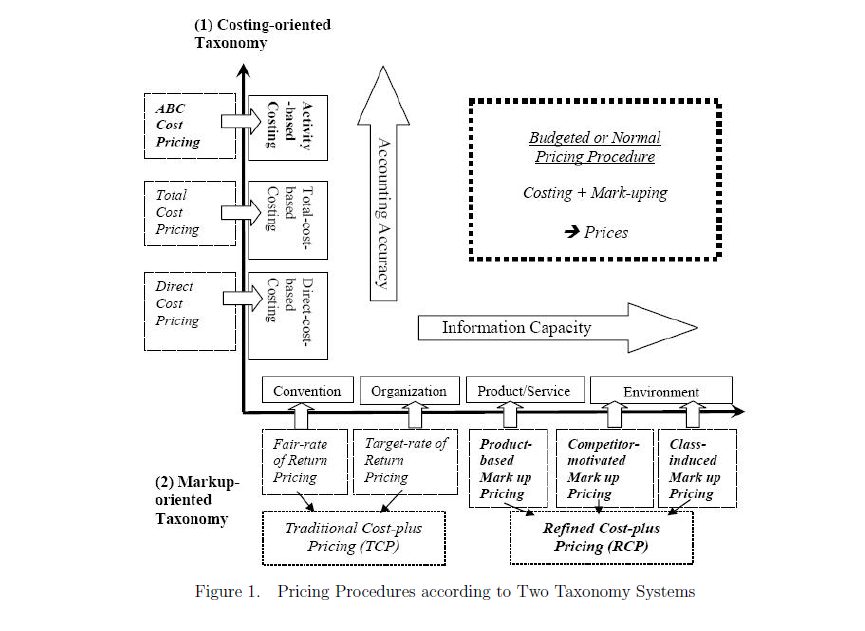

Interestingly, the ‘Post Keynesian’ approaches to pricing are fully consistent with business economics (see the overview below, also by Gyun cheol Gu).

Of course, these methods have changed over time, leading to different prices – economics itself has become an agent of change when it comes to pricing. Why is this important? As Nathan Tankus argues, the present inflation can’t be understood without having a good grip on the nature of prices and pricing. I agree. Somebody gains from present day inflation, without knowing the cost structure or retail prices it’s difficult to find out who. There sure are struggles going on about wages and profit shares – which in the end show up as a particular structure of prices, as showed by people like Dean Baker. Also, economists sometimes seem to attach a kind of mythical value to prices – but looking at them from the angle of cost calculation shows that they are just monetary constructs. Shadow prices do not exist – but they do. They are invented and calculated by economists and sometimes enter economic policies, making these dreamed up prices real tools of power, The analysis of such situations becomes, I think, easier when we have the periodic table of prices. The elements are there, steps have been made, but we’re not there, yet.