From David Ruccio It’s not price gouging, corporations tell us—it’s inflation. You know, supply and demand. Not enough supply, because of forces beyond their control, and too much demand, but they’re doing the best they can to meet it. Not a word about profits, though. Not from the corporations. And not from mainstream economists and pundits (or, for that matter, from the Biden administration, which prefers to point the finger at Putin). When they do go beyond supply and demand, they blame worker shortages and rising wages. They call it the Great Resignation.* This must be what they’re referring to: As is clear in this chart, the real wages of production and nonsupervisory workers did in fact increase after the end of the Second Great Depression—by 12 percent (between the end of 2014

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

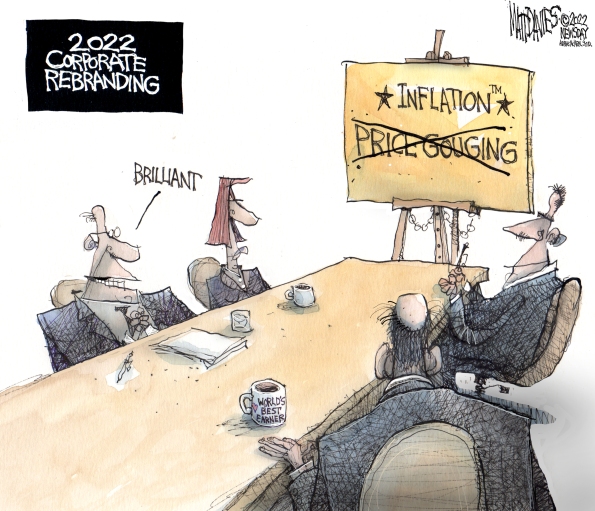

It’s not price gouging, corporations tell us—it’s inflation. You know, supply and demand. Not enough supply, because of forces beyond their control, and too much demand, but they’re doing the best they can to meet it.

Not a word about profits, though. Not from the corporations. And not from mainstream economists and pundits (or, for that matter, from the Biden administration, which prefers to point the finger at Putin). When they do go beyond supply and demand, they blame worker shortages and rising wages. They call it the Great Resignation.*

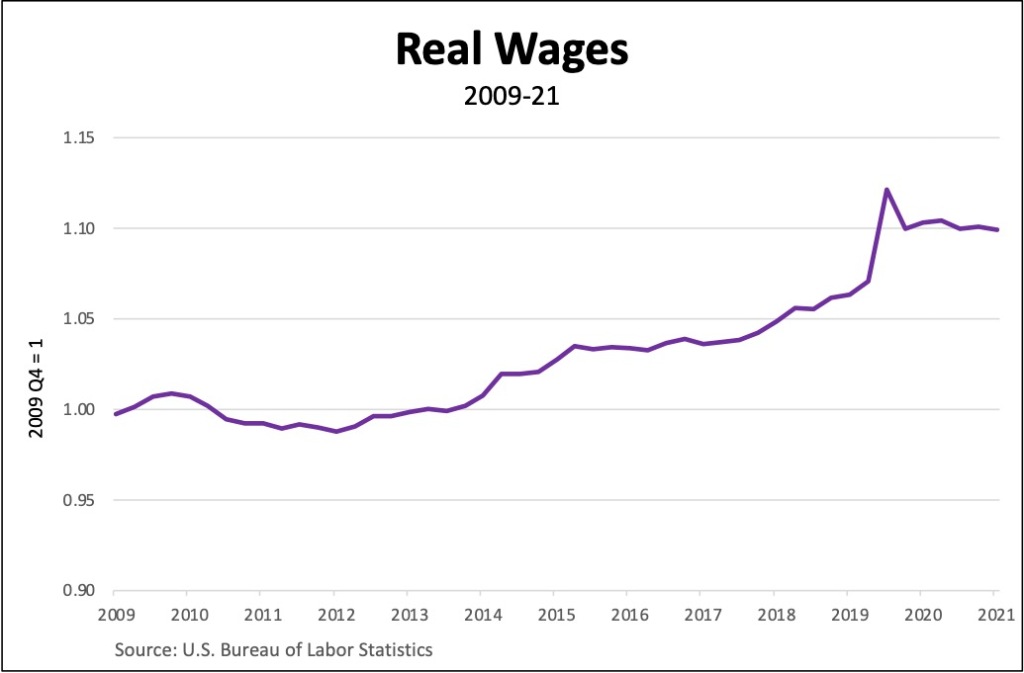

This must be what they’re referring to:

As is clear in this chart, the real wages of production and nonsupervisory workers did in fact increase after the end of the Second Great Depression—by 12 percent (between the end of 2014 and the middle of 2020). But then, they forget to mention, wages started to slide, falling back (during the rest of 2020 and through 2021). In other words, the wages of U.S. workers have recently been falling short of the inflation rate.

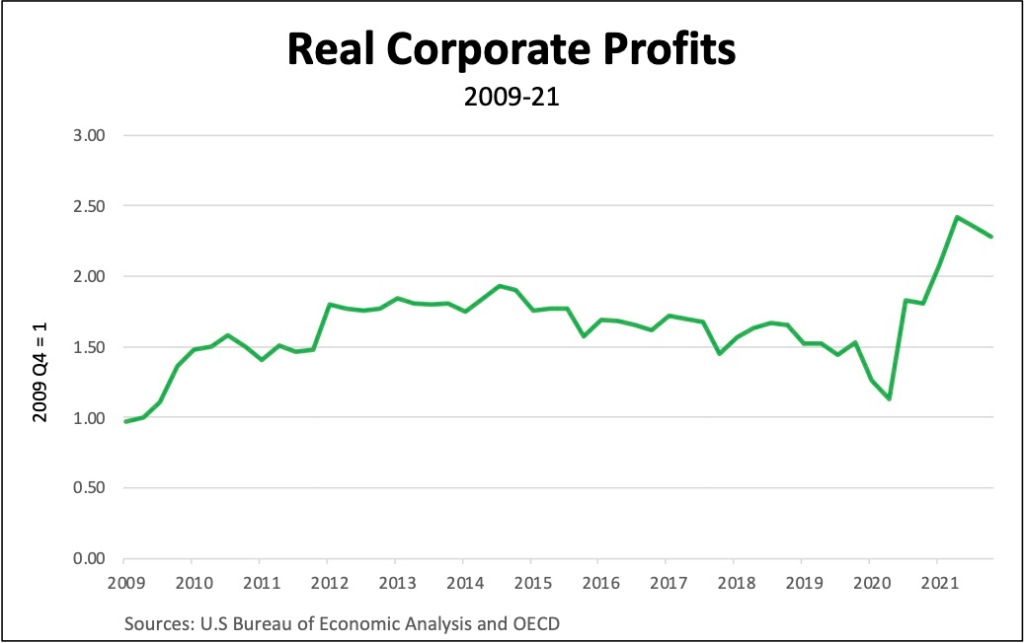

What about corporate profits?

Well, as is clear from this chart, the profits of nonfinancial corporations have soared—not just in nominal terms but even after accounting for inflation. Since 2009, they’ve more than doubled.

For all the complaining—about everything from workers’ wages to supply-chain problems—and rebranding—substituting inflation for price-gouging—it’s obvious that American corporations have been very successful in padding their bottom lines.

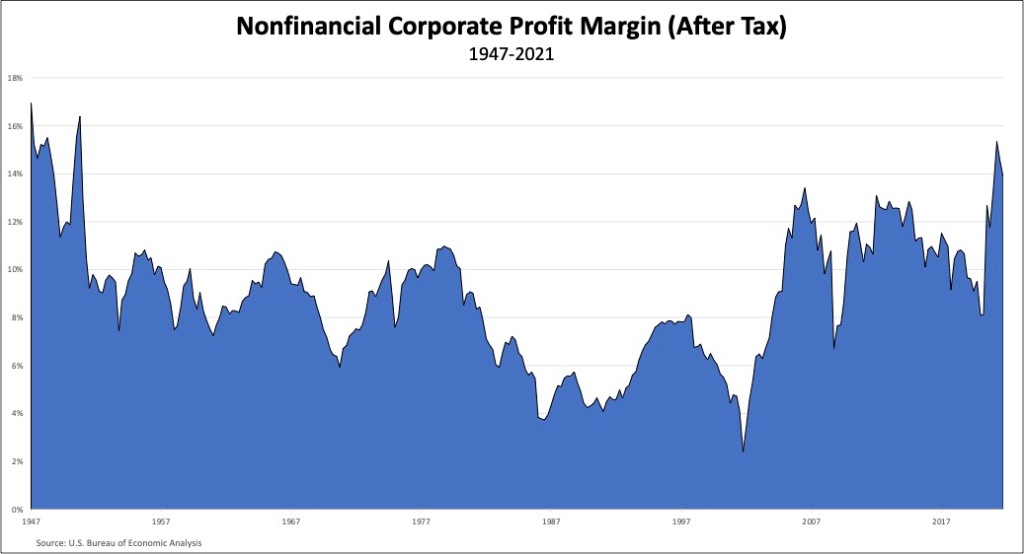

Actually, last year was the most profitable year for American corporations since 1950!**

In all four quarters of 2021, the overall profit margin stayed above 13 percent, a level reached in just one other three-month period during the past 70 years.***

Think about it: during 2021, workers’ real wages were virtually unchanged while real corporate profits increased by a whopping 27 percent.

That’s not inflation, or even price-gouging. We need to be honest and rebrand it for what it is: corporate profiteering.

———

*Even Paul Krugman has finally given up on that one.

**Bloomberg Businessweek was the first to report this extraordinary milestone in U.S. corporate profits.

***The profit margin is calculated as seasonally adjusted after-tax profits as a share of gross value of nonfinancial corporate business.