From Jorge Buzaglo and Leo Buzaglo Olofsgård and current RWER issue The extensive failure index defines six dimensions of economic and social malaise: socio-economic dysfunction, ecological damage, exclusion, distress, militarism, and alienation. Each of these dimensions is composed of a number of indicators of particular flaws. The (re-indexed) average of the indicators makes the index of the dimension. The (re-indexed) average of the indices for the six dimensions mentioned makes the extensive failure index. Socio-economic Dysfunction Index Our extensive list of “the outstanding faults of the economic society in which we live” includes the following components of socio-economic dysfunction. Income inequality and II) Wealth inequality: The same as in Keynes’ and Piketty’s indices,

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Jorge Buzaglo and Leo Buzaglo Olofsgård and current RWER issue

The extensive failure index defines six dimensions of economic and social malaise: socio-economic dysfunction, ecological damage, exclusion, distress, militarism, and alienation. Each of these dimensions is composed of a number of indicators of particular flaws. The (re-indexed) average of the indicators makes the index of the dimension. The (re-indexed) average of the indices for the six dimensions mentioned makes the extensive failure index.

Socio-economic Dysfunction Index

Our extensive list of “the outstanding faults of the economic society in which we live” includes the following components of socio-economic dysfunction.

- Income inequality and II) Wealth inequality: The same as in Keynes’ and Piketty’s indices, income and wealth inequality indices are included as indicators of socio-economic dysfunction. (Source: WIR22).

- Direct taxation: The share of direct taxation (taxes on income, profits, and capital gains) in total fiscal revenue reflects the degree of redistributive ambition on the income side of the public accounts (the failure indicator denotes the lack of ambition: 100 minus percent of direct taxation). (Source: World Bank).

- Corruption diminishes the quality of life and undermines the general economic, social, and political climate. The chosen indicator estimates the control of corruption; corruption is the consequence of the lack of control. (Source: World Bank/ Worldwide Governance Indicators, WGI).

- Financialization: “When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done.” (Keynes in the General Theory). Financialization, that is, overgrown financial markets, increases the risks of debt deflation and recession, and misdirect investment away from production. Rises in the price of shares and real estate resulting from financialization increase inequality. Private debt, loans, and debt securities as a percent of GDP reflect the degree of (Source: IMF).

- Tax evasion: Public revenue lost to tax evasion, in particular, evasion by transnational firms, reduces the capacities—in particular, redistributive capacities—of the public sector. The degree of tax evasion is measured as a percent of tax revenue (Source: Tax Justice Network).

- Tax havens have a deleterious effect on the international economy, fomenting capital flight, tax avoidance, and illicit financial (Source: Tax Justice Network/Corporate Tax Haven Index).

- Offshore wealth: Tax havens in VII. above are countries of destination of flight capital. Hidden capital or offshore wealth measures capital hidden by rich individuals in tax havens by country of origin as a percent of (Source: Alstadsæter et al. 2018).

- External indebtedness: The degree of external indebtedness indicates the degree of vulnerability of the A high external debt to GDP ratio increases the probability of speculative attacks and payments crises and reduces the economic policy space or policy autonomy. (Source: IMF).

- Extractivism: Lack of diversification or dependency on the production and export of one or a few raw materials (oil, minerals, staples, ) denotes extractivism. It hinders economic development, increases the vulnerability of the economy, and may be ecologically detrimental. The Herfindahl-Hirschman index measures the degree of product concentration in exports. (Source: UNDP/HDR).

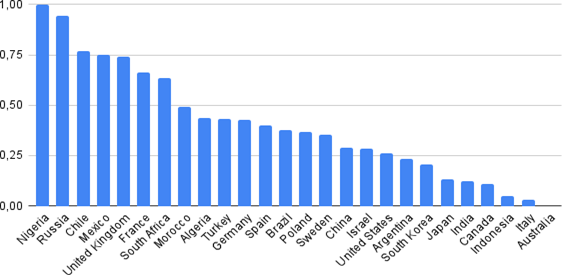

The figure shows the (re-indexed) average of the nine above-defined indices of socio-economic dysfunction for the 26 countries of the WIR22 sample. Different causes explain high socio-economic failure values for different countries. Nigeria has high values in tax evasion, corruption, and extractivism. Russia tops the lists on wealth held off-shore, non-direct taxation, and corruption. High wealth concentration, and financialization, are behind Chile’s high socio-economic failure rating. Countries with the lowest dysfunction rankings have relatively low indices on those accounts.

tomorrow the Ecological Damage Index

or read more now about failure indexes here