Not all prices are market exchange prices. I’ve been writing about administered prices (here and here) and ‘commons’ prices (here). In January, I hope to make a first small step towards a badly needed periodic table of prices. Today a new element, Gift Exchange Prices. Gifts are like the Greeks. They come in many varieties. But always, something is transferred from somebody to somebody, even when there often is no market price or even transfer of ownership. There might be a transfer of honor, prestige, and risk. Or goods like a diamond ring or services like helping somebody to move. The difference between Gift Exchange and Market Exchange is spelled out in the table below. It’s important to realize that it’s not always the giving but accepting that counts. Accepting a gift often leads

Topics:

Merijn T. Knibbe considers the following as important: auctions, Economic History, gift-exchange, periodic-table, prices, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

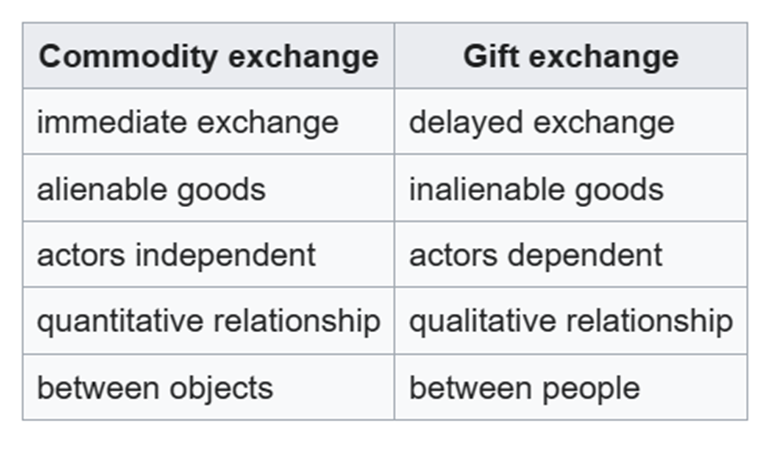

Not all prices are market exchange prices. I’ve been writing about administered prices (here and here) and ‘commons’ prices (here). In January, I hope to make a first small step towards a badly needed periodic table of prices. Today a new element, Gift Exchange Prices. Gifts are like the Greeks. They come in many varieties. But always, something is transferred from somebody to somebody, even when there often is no market price or even transfer of ownership. There might be a transfer of honor, prestige, and risk. Or goods like a diamond ring or services like helping somebody to move. The difference between Gift Exchange and Market Exchange is spelled out in the table below. It’s important to realize that it’s not always the giving but accepting that counts. Accepting a gift often leads to human bonds and expectations. Declining a gift might sometimes even destroy bonds. Gifts are not free.

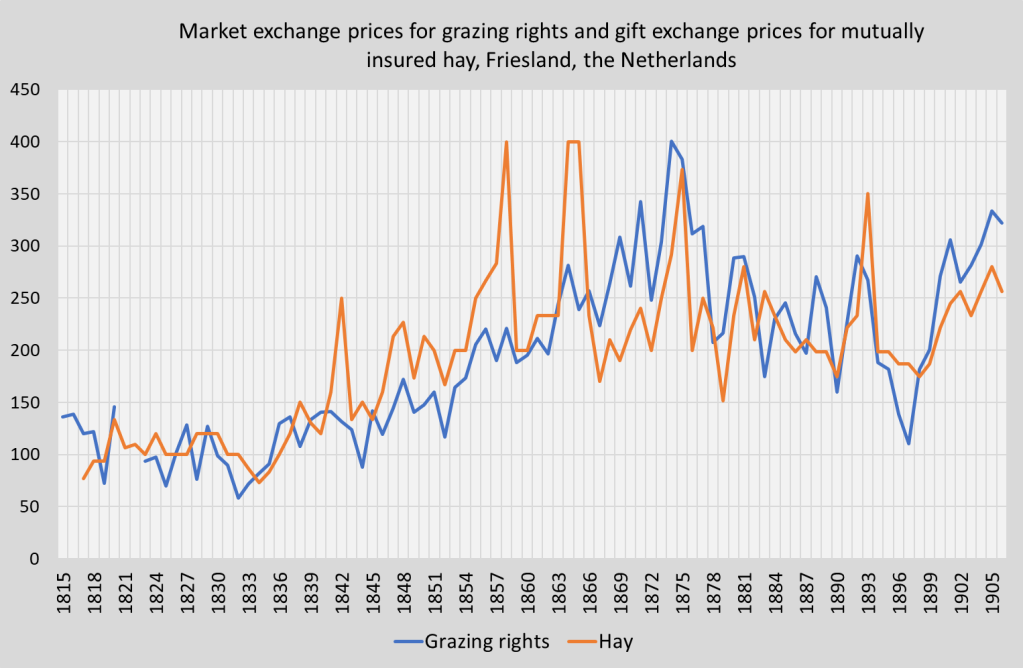

One of the situations leading to ‘gift exchange’ arises when people participate in so-called ‘mutuals’ like credit unions or mutual insurance organizations. My historical research led me to agricultural mutual insurance organizations insuring hay, cattle, and crops in the 19th century. To be able to insure these items, they had to be valued. At the beginning of August, new valuation prices were set each year. These were not market exchange prices: no exchange took place. Transfers of money only took place when, for instance, a farm of a member of the mutual burned down and the other members had voluntarily obliged themselves to compensate the victim: gifts. The amount of money to be transferred was based on assessing the damage and the valuation prices (compare with the table, it ticks all the boxes when you realize that total risk is inalienable). The costs of the organization were met by a small fee. This was, again, no market exchange price but a cost-price-based administered price, in this case, a ‘commons’ price.

It is possible to compare these gift exchange prices with pure market prices. Each year in April, another organization, the ‘Noorderleegs Buitenveld’, which owned quite some fertile grasslands, auctioned grazing rights. It is possible to compare the gift exchange prices with the market exchange prices of the auction. As we can see, the gift exchange prices (set in August) show the same pattern as the auction prices, even when the gift exchange prices were more volatile (caused by misharvests or bumper crops of hay that were not yet clear in April). But do not mistake one for the other.